S&P 500 falls as ongoing government shutdown, trade jitters weigh

This article was written exclusively for Investing.com

- Multi-year highs for soybeans, corn, and wheat in 2021

- Chinese demand and the soybean-corn ratio support the oilseed

- Energy prices and policy support corn

- Geopolitics support wheat

- Weather is critical, but many signs point higher for the grains and oilseeds in 2022

Agricultural commodities feed the world. The United States is the world’s leading producer and exporter of soybeans and corn and a leading exporter of wheat. Oilseeds and grains are critical ingredients in food and biofuel. Food is essential, and governments worldwide are responsible for providing security and nutrition to their citizens. When people go hungry, governments quickly lose power.

In 2021, rising inflationary pressures increased the input costs for farmers and producers that grow agricultural products. Escalating energy, fertilizer, equipment, and other input costs have pushed oilseed and grain prices higher. Moreover, weather and supply chain issues have caused prices to accelerate to the highest levels in years. As we head into 2022, input costs remain sky-high. The trend in soybean, corn, and wheat futures markets remains higher at the end of 2021.

Each year is always a new adventure for the commodities that feed people. The weather across the critical growing areas worldwide is invariably a primary factor determining the path of least resistance of prices. Meanwhile, demographics point to rising demand.

Each quarter the world adds around twenty million more mouths to feed. Therefore, food demand was higher in 2021 than 2020 and will increase in 2022. At the turn of this century, there were approximately six billion people in the world. At the end of 2021, the number stands at over 7.866 billion, an over 31% increase over the past twenty-one years. Producers must grow more crops each year to keep pace with the population growth.

I expect we will see a continuation of higher lows and higher highs in the grain and oilseed markets in 2022.

Multi-year highs for soybeans, corn, and wheat in 2021

Nearby CBOT soybean futures reached the highest price since 2012 in May 2021 before correcting.

Source: CQG

The chart shows that nearby soybean futures closed 2020 at $13.1425 per bushel, rose to a high of $16.7725 in May 2021, and were at the $13.54 level on Dec. 29. While beans corrected from the high, they were in the teens in late December and posted a slight 3% gain for 2021 with two trading days left in the year.

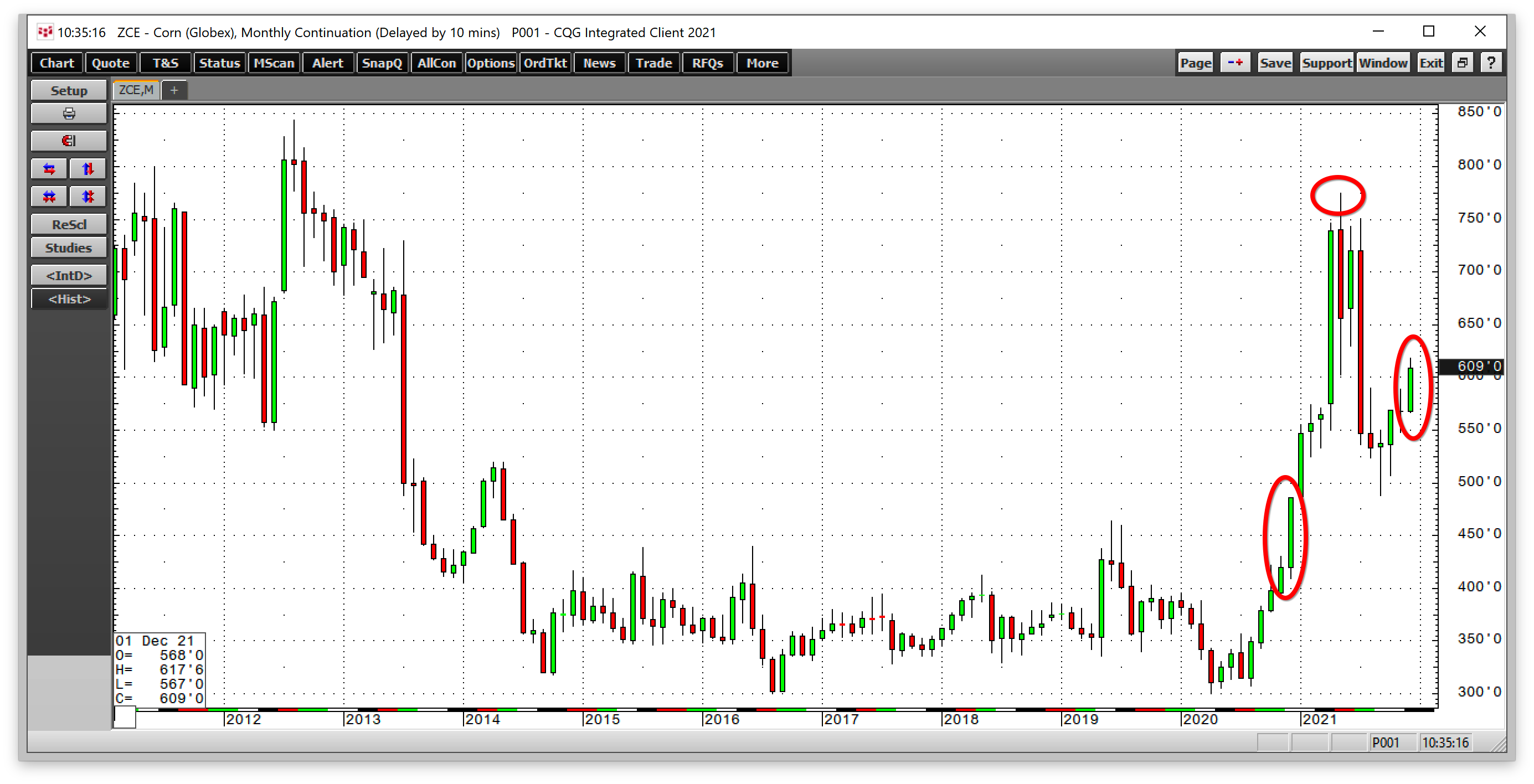

Source: CQG

The continuous CBOT corn futures contract was at $4.8575 at the end of 2020, traded to a high of $7.75 in May, and was at $6.09 on Dec. 29, 25.4% higher in 2021.

Source: CQG

Meanwhile, CBOT soft winter wheat futures were at the $6.4175 per bushel level at the end of 2020, reached a high of $8.6325 in November, and were at $7.92 on Dec. 29, 23.4% higher for the year.

All three of the leading grain futures markets posted gains in 2021 after reaching multi-year highs.

Chinese demand and the soybean-corn ratio support the oilseed

In the soybean market, aside from the weather during the crop year, Chinese demand is a primary factor that drives the price higher or lower.

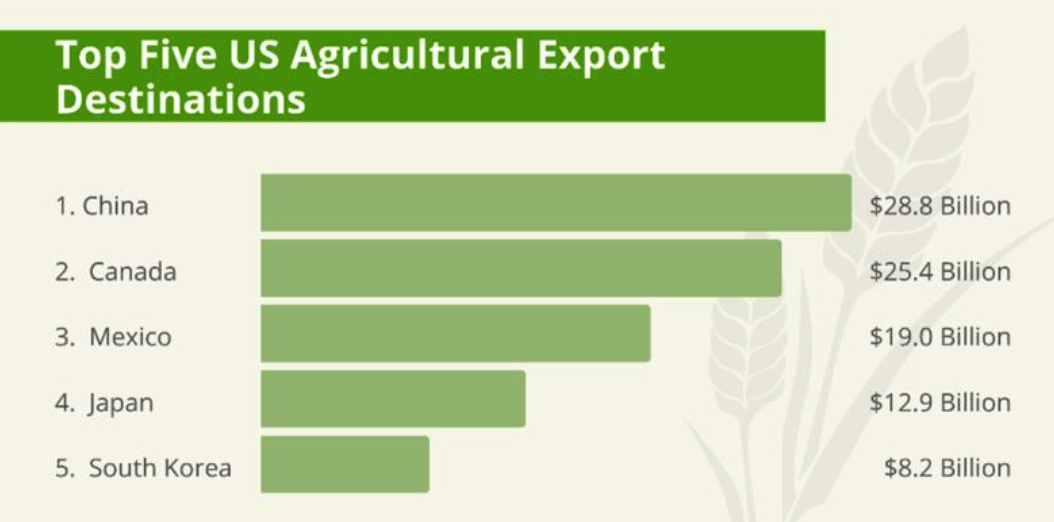

Source: commodity.com

The chart shows that China accounted for $28.8 billion in US agricultural exports in 2021, the third-highest level in history.

As we head into 2022, corn’s outperformance over soybeans could push the oilseed’s price higher over the coming months. Many US farmers choose between planting corn or beans on their acreage each crop year. They tend to pick the product that offers the most attractive economic return.

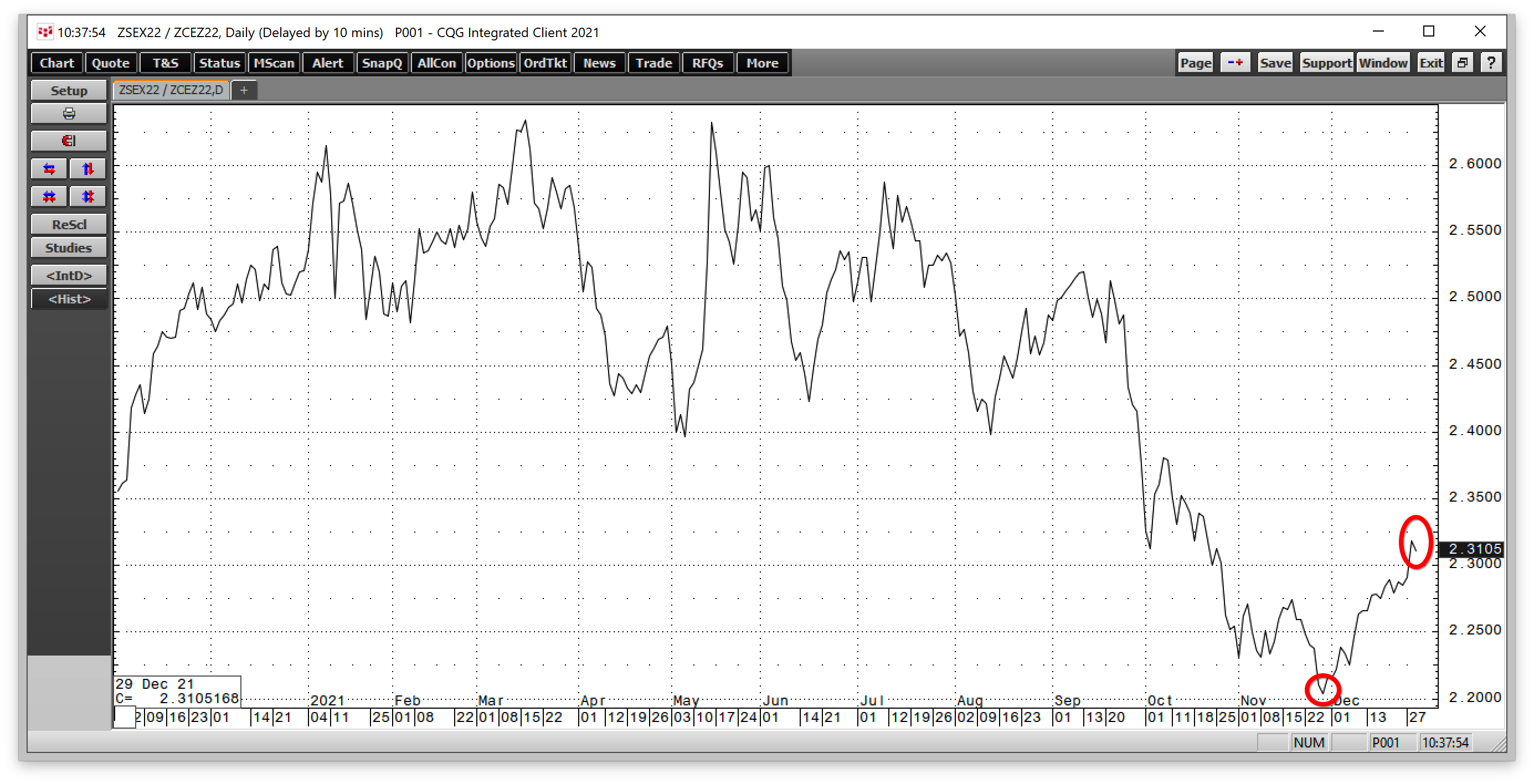

Historically, the corn-soybean ratio has traded at an average of 2.4 bushels of corn value in each bushel of soybean value. When the ratio is above the average, they tend to plant more soybeans. When it is under 2.4:1, corn provides the most attractive return.

Source: CQG

As of Dec. 29, the ratio stood at the 2.3105:1 level, favoring corn planting in spring 2022. The ratio has been rising after reaching a low of 2.2040 on Nov. 29. If the ratio remains below the long-term average, more corn planting could lead to a shortage of beans, given robust Chinese demand.

While Chinese soybean demand remains a significant factor as we move into the next crop year, corn demand remains strong.

Energy prices and policy support corn

Addressing climate change weighs on fossil fuel production and consumption, favoring alternative and renewable fuels. Corn is the primary input in US ethanol production.

Source: Barchart

The chart of Chicago ethanol swaps shows the biofuel rose to a record high in 2021 when it reached $3.45 per gallon in November. With January swaps at the $2.3000 level on Dec. 29, they were 53.3% higher than the end of 2020 when they settled at $1.50 per gallon. The rise in ethanol, prices, and bullish trends in crude oil and other fossil fuels supports corn demand for the coming year.

Geopolitics support wheat

The US is the world’s leading producer and exporter of corn and soybeans. Wheat is the primary ingredient in bread. Over the past years, Russian production has increased, making Russia the leading exporter of the essential grain.

Wheat is a highly political commodity since bread is a staple all over the world. Historically, wheat shortages and rising prices caused political upheaval.

Russia and Ukraine are substantial wheat producers, and Black Sea ports are critical logistical locations for global exports. Tensions between Russia and Ukraine and the potential for foreign involvement in any conflicts will likely increase concerns over wheat shortages in 2022.

In 2021, wheat’s price already rose to the highest level since 2012. Wheat was trading on either side of $8 per bushel at the end of December. The wheat futures market could become a geopolitical hornet’s nest in 2022, pushing the price higher on supply concerns.

Weather is critical, but many signs point higher for the grains and oilseeds in 2022

As we enter a new crop year during the coming months, the weather across key growing regions worldwide will be the primary factor impacting the path of least resistance of soybean, corn, and wheat prices. However, the grain markets that feed the world are going into 2022 with a bullish skip in their steps.

Rising inflation is causing land rents, labor, fertilizer, energy, equipment, and other input prices to rise to levels where framers will need higher crop prices to compensate for increased production costs. Meanwhile, population growth continues at a rate of around twenty million people each quarter.

In the 2022 crop year, there will be about eighty million more mouths to feed worldwide than in 2021, putting upward pressure on the demand side of the fundamental equation.

Bull markets rarely move in straight lines; corrections can be brutal. The current high price levels create the potential for corrections before corn, soybean, and wheat futures markets continue to make higher lows and higher highs.

I will be a buyer on price weakness in the leading grain and oilseed futures markets in early 2022, leaving plenty of room to add to risk positions on the downside. I am bullish on the grain sector for the coming year as the price action in 2021 established favorable price trends.

The trend is always your best friend in all markets. In the grain and oilseed arenas, the path of least resistance continues to favor the upside at the end of 2021.