SoFi shares rise as record revenue, member growth drive strong Q3 results

Using the Elliott Wave Principle (EWP) for the S&P 500, we found three weeks ago that:

“if the index can stay at least above SPX5880, and especially last week’s low at SPX5696, we must allow it to ideally target SPX6060, possibly as high as SPX6175 before the next correction of around 5-7% can start.”

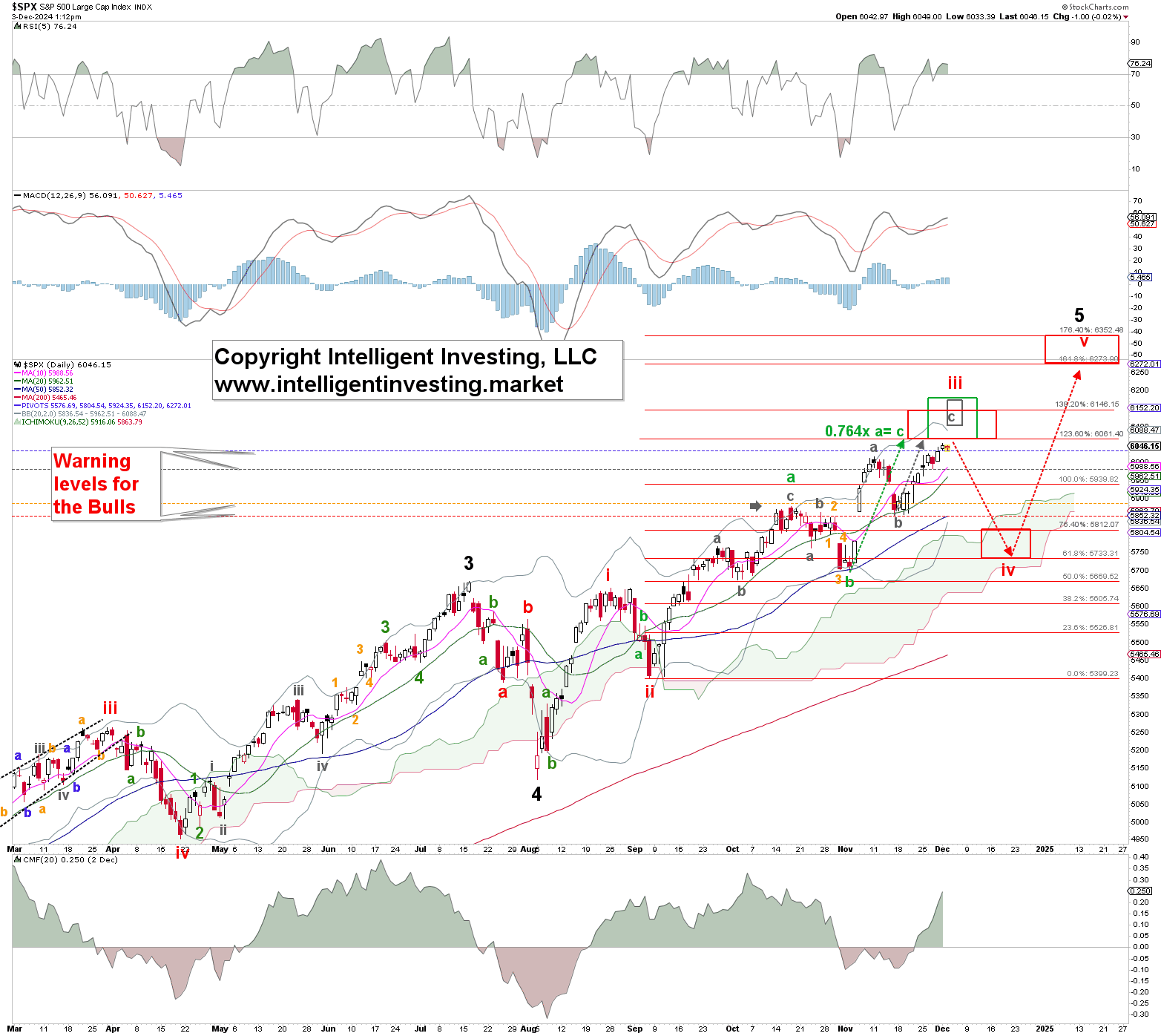

Moreover, we’ve been tracking the index's advance as an Ending Diagonal (ED) structure. As a reminder, EDs are tricky because all their waves (i-ii-iii-iv-v) comprise three waves: 3-3-3-3-3 = abc-abc-abc-abc-abc.

Besides, W-iii typically targets the 123.60% extension of W-i, measured from W-ii. The W-iv then tends to correct back to the 61.80% extension, after which the last W-v targets the 161.80% extension. In this case, we are looking at W-iii to reach at least SPX6060, W-iv should bottom around SPX5735, and W-v can reach at least SPX6275.

True to the ED’s path, the advance since our last update decided to subdivide into another set of abc, with the November 11 SPX6017 high as (grey) W-a of (green) W-c of the (red) W-iii. The November 15 SPX5915 low was the (grey) W-b, and now the grey W-c is underway. See Figure 1 below.

Thus, the Bulls held the index price above the critical SPX5880 level, allowing our premium members to stay on the right side of the trade as the red W-iii was still underway. The green W-c subdivided into another set of smaller (grey) abc.

Typical ED behavior. It can reach the typical c=a extension at SPX6175ish, but the 0.764x extension is around $6060. Moreover, the usual grey W-c target zone is $6145+/-10, but the market can also deviate from that. So, we still expect the red W-iii to reach SPX6060-6175, from where the red W-iv can materialize.

Thus, we can raise our warning levels from our last update: if the index can stay at least above SPX5984, and especially the November 21 low at SPX5887, we must allow it to ideally target SPX6060, possibly as high as SPX6175 before the next correction of around 5-7% can start.