Janux stock plunges after hours following mCRPC trial data

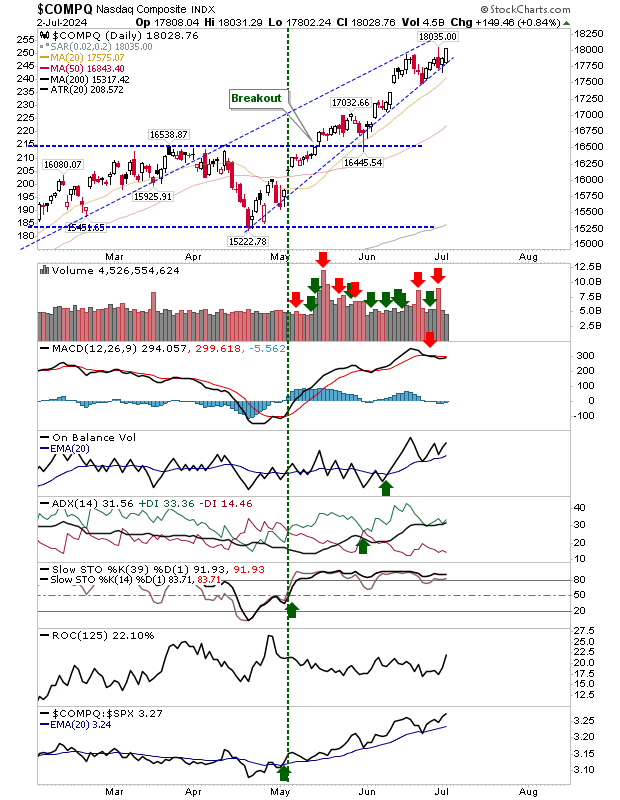

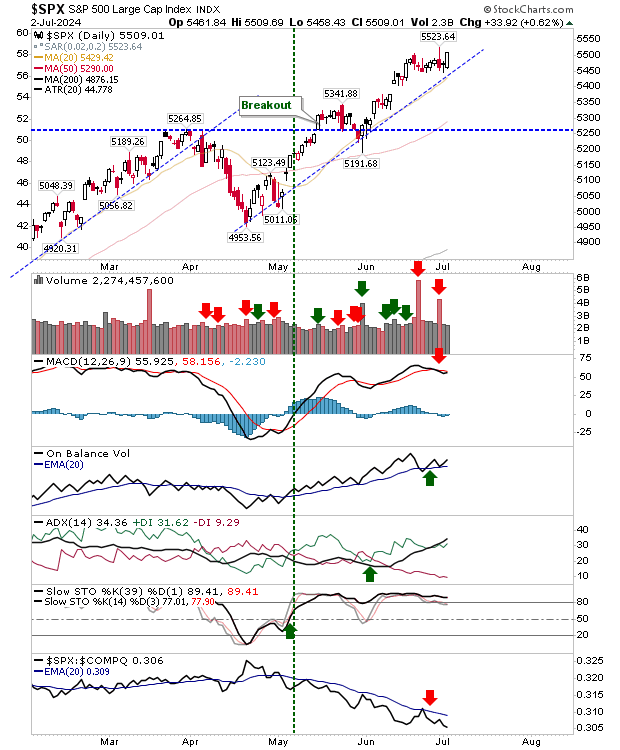

It was a good day for the S&P 500 and Nasdaq as both made attempts to clear their recent trading ranges. However, neither cleared the spike highs from Friday which continue to look like peaks for their respective rallies, although the Nasdaq has come closest to doing so. Buying volume was well down and the MACD trigger 'sell' for each index remains intact.

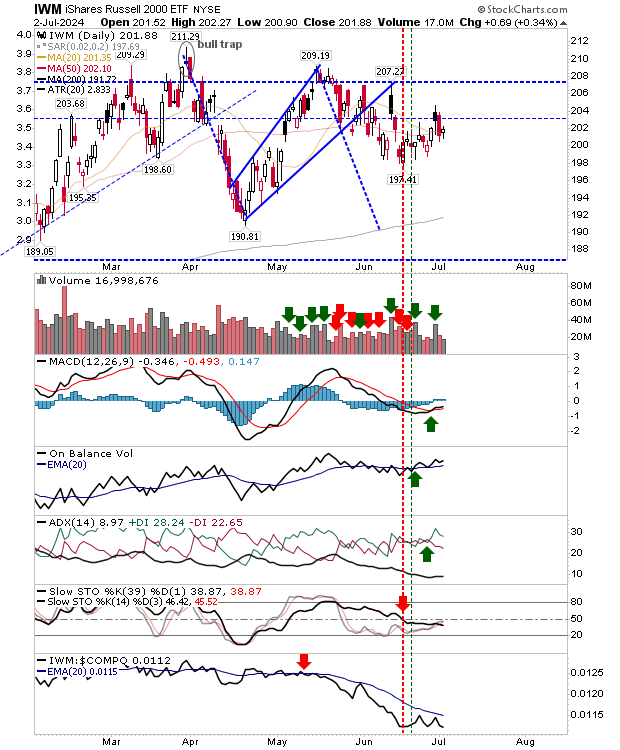

The fly in the ointment is the Russell 2000 (IWM). It barely moved the needle today as the index remained range-bound. Relative performance has struggled since it failed to break out in May, but it needs volume.

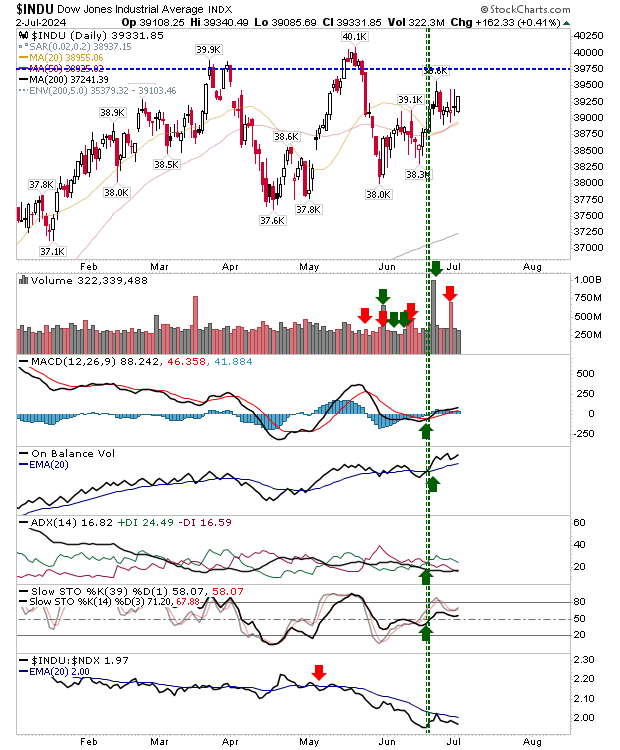

The Dow Jones Industrial Average is proving to be the odd one out. It posted a decent gain today but is range-bound like the Russell 2000 ($IWM). Unlike the S&P 500 and Nasdaq, technicals are net positive.

For today, look for the Nasdaq to take out last Friday's top-looking spike high. If it can't, or gaps are higher and start to fall, then there could be bigger problems. The narrow trading ranges that have played over the last couple of weeks in the S&P 500 and Nasdaq do suggest a more bullish outlook, but let's see what the day brings. The Russell 2000 remains too noisy to suggest a big gain or loss could offer any directional guidance.