IonQ CRO Alameddine Rima sells $4.6m in shares

There was some concern heading into Friday that Thursday's gains were going to be clawed back, but I was surprised by the extent of the buying that did show up. The Nasdaq and S&P had the best of the action.

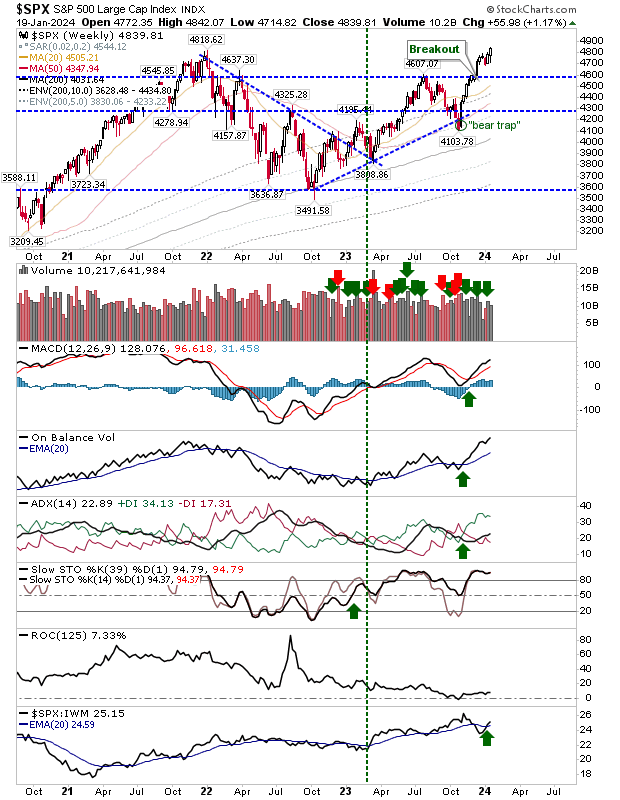

The S&P 500 made a good "clean" breakout, ending the bear market kicked off at the end of 2021. The weekly buying volume was a little below par, but it was the price action that was most welcome. Weekly technicals are very strong - note the new high in on-balance-volume. Buyers are keen to get involved, although it comes at the expense of small-cap stocks.

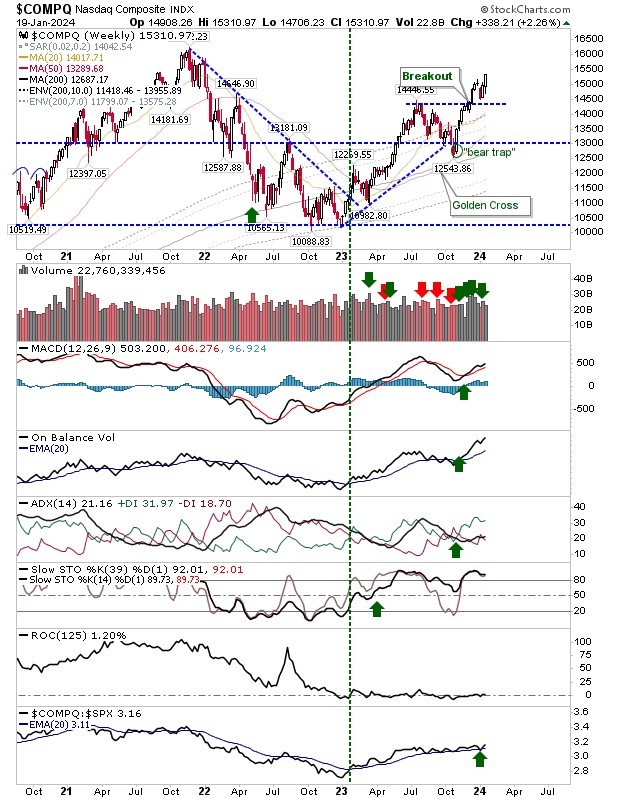

The Nasdaq hasn't made it to a new all-time high, but it continues to build the right-hand-side of its base. As with the S&P, the volume was a little light on the week but technical strength is good. The index is outperforming the S&P, which is in itself, an excellent sign given the move to all time highs in the latter index.

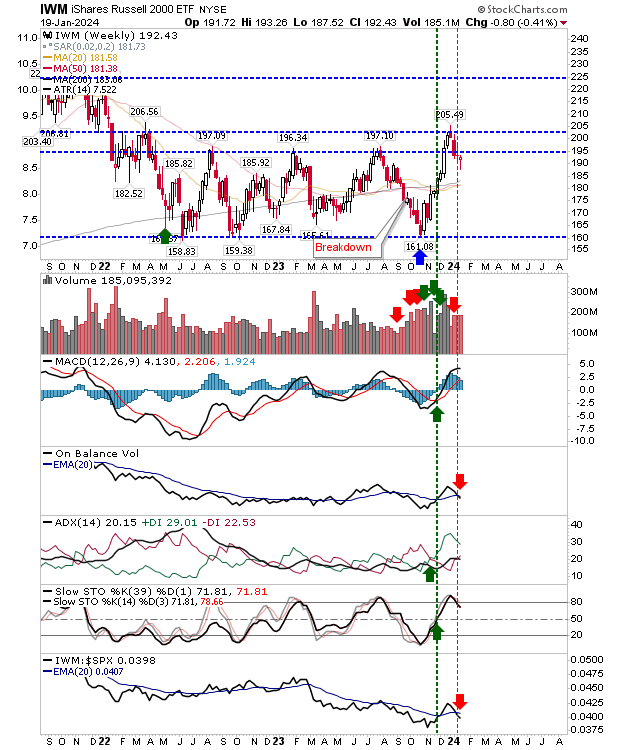

The Russell 2000 (IWM) was perhaps the only index to disappoint a little. It has the most room to mount a recovery and had successfully defended its 50-day MA on the daily time frame. The weekly chart shows a nice bullish hammer, so I would be looking for a positive week from the index, even if the weekly close was below that $196/7 support level.

For this week, we may see some early selling in the Nasdaq and S&P that could benefit the Russell 2000 ($IWM) if it's able to attract some of the proceeds of those sales. By end-of-week, I would be looking for an advance in the Russell 2000, and for the S&P and Nasdaq an end-of-week finish comparable to, or better than, Friday's close.