Esperion stock rises after Japan approves cholesterol drug NEXLETOL

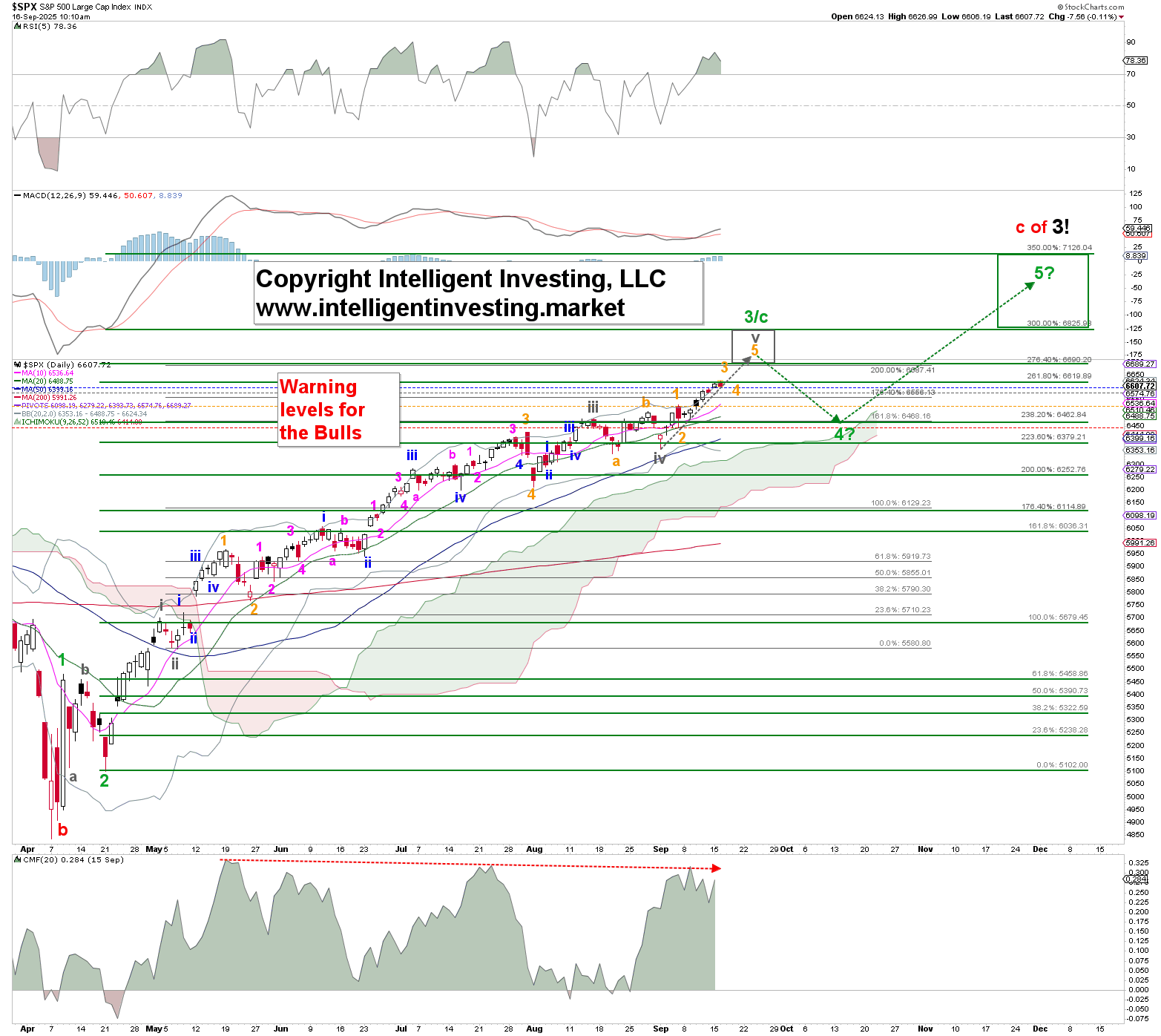

In our previous updates about the SP500 (SPX), see here, we shared our short- and long-term Elliott Wave (EW) Principle counts that explain why the index can reach as high as approximately 7120 before we should worry about a bear market like 2022, and found that

“… The ideal upside target for the current rally [gray Wave-v] is then 6690+/-10, which is where the gray 200.00% and green 276.40% extensions overlap; 6687 vs 6690, respectively. From there, a mild 4±1% pullback (green W-4?) can be expected before the green W-5 rallies the price to, ideally, the 350.0% extension at 7126.”

Back then, the index was trading around 6480, and it reached a new all-time high of 6626 today. Therefore, our assessment of a rally (gray W-v of green W-3/c) from the September 2 low was correct, and in the meantime, we adopted the alternative EW count as our primary. See Figure 1 below.

Figure 1. Our preferred short-term Elliott Wave count.

Besides, like every impulse, the gray W-v is dividing into five smaller (orange) waves: 1, 2, 3, 4, and 5. The orange W-3 could reach as high as 6730, and the W-5 as high as 6795, based on a standard impulse. However, for now, we focus on the 6690+/-10 level for the completion of this rally. Everything else is a bonus that comes with increased risk.

Besides, like every impulse, the gray W-v is dividing into five smaller (orange) waves: 1, 2, 3, 4, and 5. The orange W-3 could reach as high as 6730, and the W-5 as high as 6795, based on a standard impulse. However, for now, we focus on the 6690+/-10 level for the completion of this rally. Everything else is a bonus that comes with increased risk.

The warning levels for this wave count have been raised as the SPX moved higher and are now set at: first at 6600 (25% chance that the gray W-v is over); second at 6579 (50% chance the gray W-v is over); third at 6529 (75% chance the gray W-v is over); and fourth at 6443 (W-v is definitely over).

Therefore, as shown previously, our EW count still points to the same upside target, 7120, since the April low can now be considered over. In the meantime, 6690+/-10 remains our interim target zone, where a 4+/-1% pullback could happen with higher probability. Therefore, the FED’s rate decision is unlikely to crash the market. It moves to its own rhythm.