Stifel reaffirms Buy rating on Wolverine World Wide stock amid Q3 revenue beat

Nvidia (NASDAQ:NVDA) wasn’t responsible for yesterday’s market rally. Overall, It was a solid day, with 377 stocks rising on the S&P 500 and just 124 falling. Even the S&P 500 Equal Weight ETF (NYSE:RSP) had a strong showing.

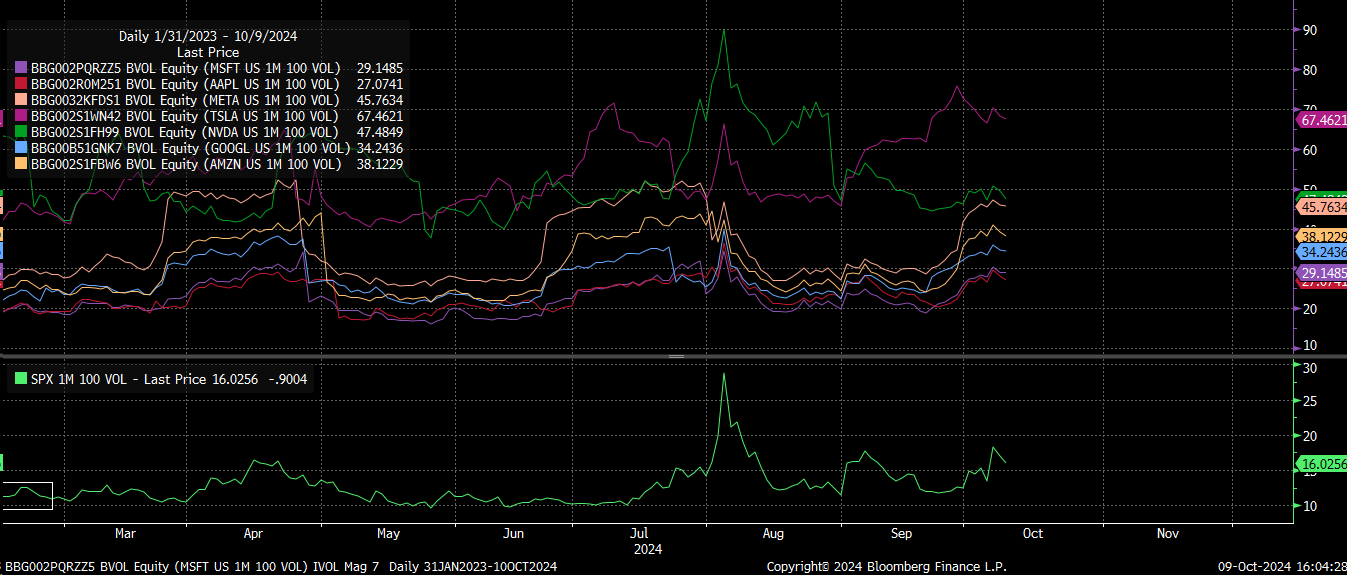

Nothing has changed in my view, mainly because we know the call wall sits around 5,800, and we’re at the tail end of volatility dispersion season, with earnings season kicking off on Friday with JPMorgan. Yesterday, we saw implied volatility across the MAG7 names decrease.

There’s nothing more frustrating than when signals that have worked so well in the past stop working when you need them to. Or, in this case, the signals are doing precisely what you’d expect, but the equity market isn’t responding as it usually does. This is the second time this has happened since mid-September, and it’s frustrating on many levels.

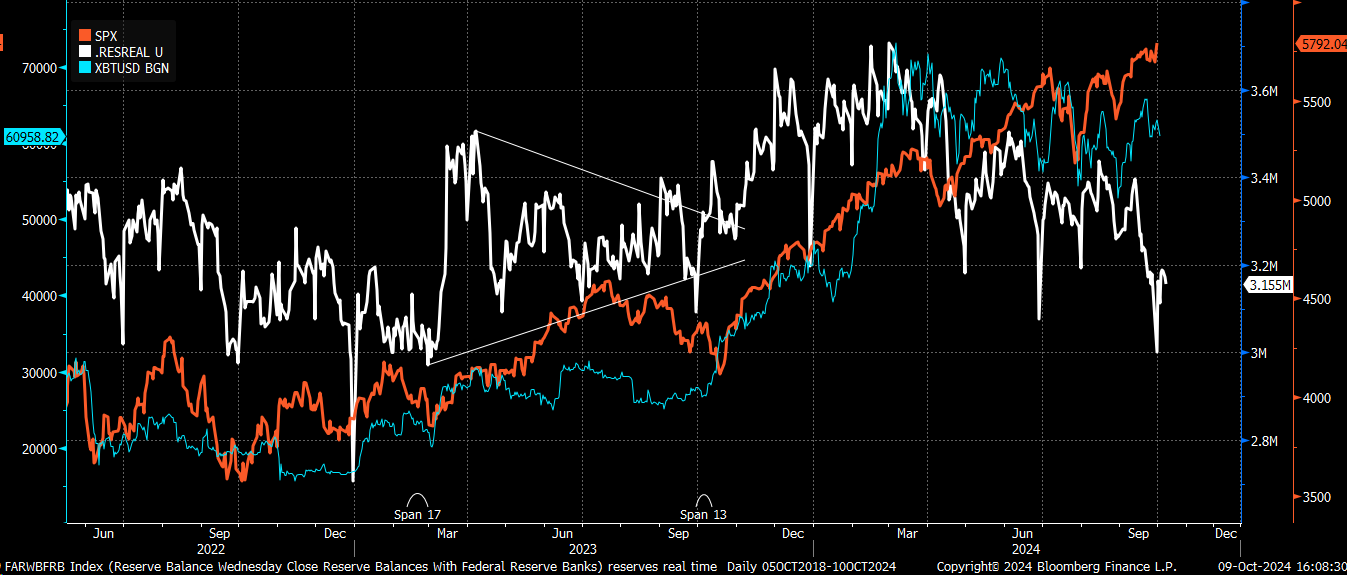

The first instance was the decline in reserve balances, which we discussed extensively in the Free Commentary section and on YouTube. The balances fell as expected, and while Bitcoin responded with a decline, the S&P 500 did not. It’s also important to note that reserve balances have not returned to previous levels yet. With the BTFP draining, it’s possible we may not see them return to those levels.

USD/CAD, USD/CHF - Reliable Indicators Disappoint

The other factor we’ve noted was that USD/CAD was likely to move higher, and it has. We’ve used this, along with implied volatility metrics, regularly to help identify the top in mid-July. But up to this point, there has been no significant reaction.

Another reliable indicator that seems off is the USD/CHF, which I often use alongside technology stocks. Inverting it to CHF/USD usually overlays very well with Apple (NASDAQ:AAPL), but it’s not working once again.

In such a strange market and during an incredibly odd time, I’ve been trying to focus more on how the market functions rather than on fundamentals or pure technicals.

For a while, starting in June, that seemed to be paying off. But it’s become extremely challenging right now, with even mechanical things that should be working not behaving as expected.

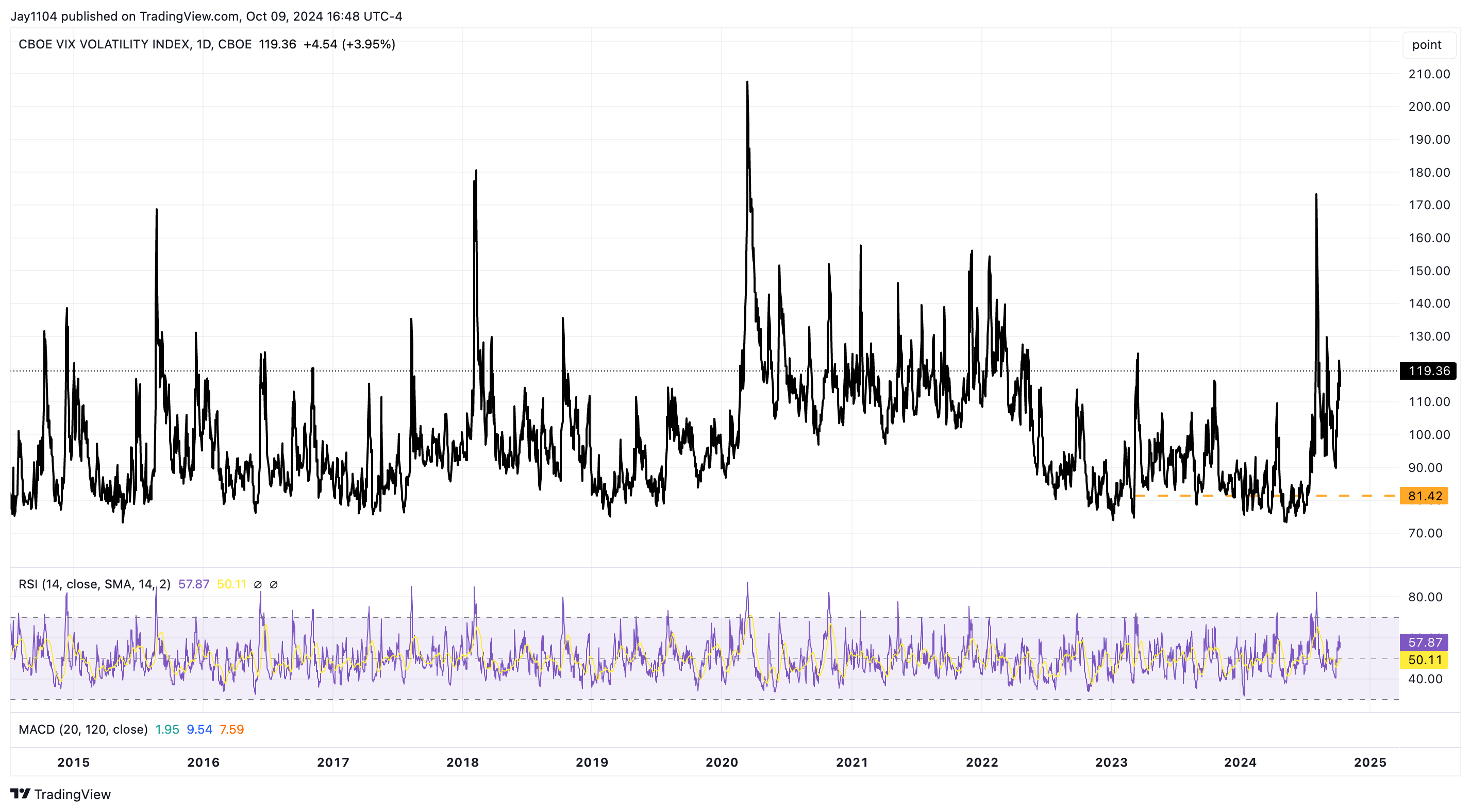

Even the VVIX, which measures the VIX’s volatility, is at 120—not exactly a low level.

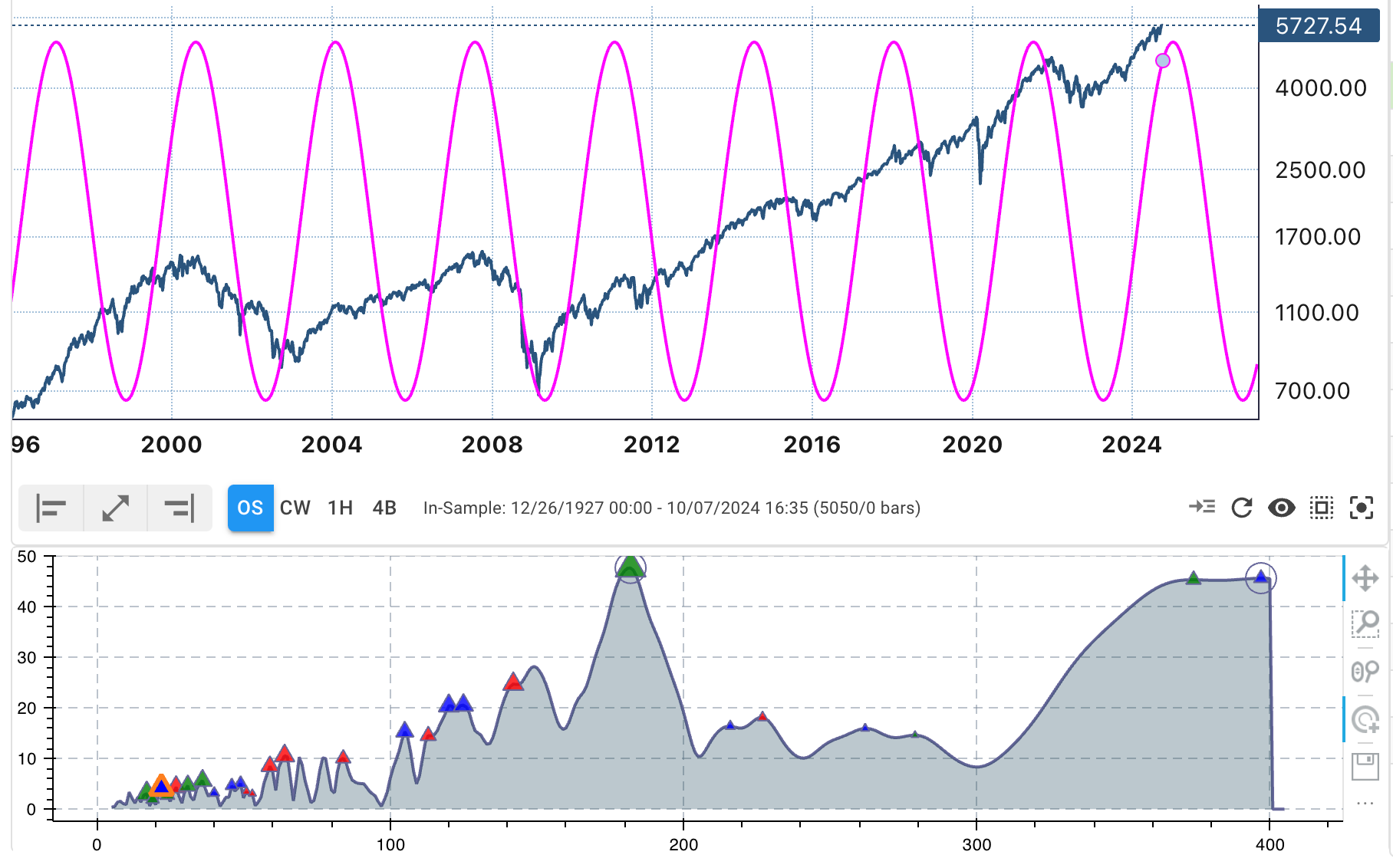

The 180-week cycle is the dominant cycle, and most people who follow cycle analysis know it’s powerful. This cycle is due to peak any week now, though these cycles are rarely perfect. It did peak early in 2022, and it bottomed late in 2023.

(CYCLES.ORG)

From studying the market’s liquidity profile and the spreads between the bid and ask, it seems everyone has disappeared. Maybe they’ve all become 0DTE day traders or traders of Nvidia weeklies—I don’t know—but the silence is deafening.