Gold prices stabilizes after Fed’s Williams signals a December rate cut

So the Fed cut rates, no surprise there. Really, there was nothing in the dot plot that was unexpected. Under Jay Powell’s leadership, the Fed thinks that neutral is around 3%, which is the level I’ve been expecting as the neutral rate for some time. So if you’re wondering why the 10-year yield rose following the rate cut, I’d attribute it to two factors: it’s still taking longer to get inflation back to 2%, and the neutral rate seems to be coming into clearer view.

Right now, the 10-year minus the 3-month spread is only 10 bps. A 3-month Treasury at 3% suggests a 10-year at 5%, based on historical spreads, and potentially as high as 6.8%. Perhaps this will change in a couple of days, and rates across the curve will collapse. I just don’t think that’s likely to happen unless we find out we’re entering a recession.

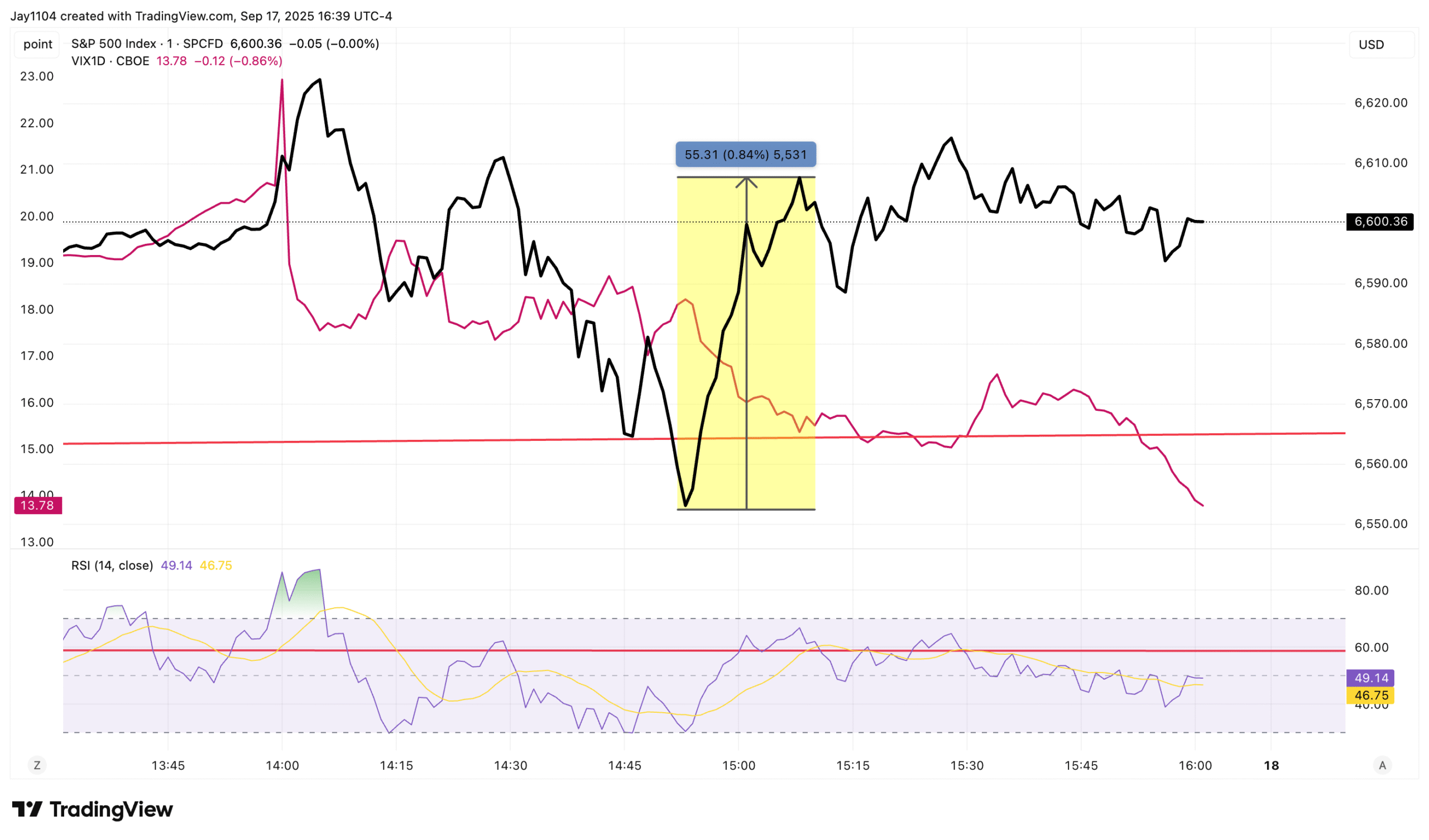

To no surprise, the VIX 1-Day rose above 20 yesterday but managed to close lower at 14.77. The S&P 500 was hit fairly hard following the FOMC statement and the start of the press conference, largely because the volatility drop was slow to materialize. Still, it ultimately saved the day, with the index rallying by almost 90 bps between 2:50 PM ET and 3:10 PM ET.

The BOJ meeting has kicked off, with its decision due this evening. There will also be an inflation report on September 18, with core CPI expected at 2.7%. I would think that BOJ will stick with the narrative of pushing towards rate hikes as long as the economy continues to develop as expected. Japan’s 2-year and 5-year yields look ready to surge.

Earlier in the day, it looked like the USD/JPY was ready to break down, and it did briefly. But then US rates started to rise following the Fed announcement, and the USD/JPY reversed, finishing the day higher.

So far, my thoughts on SMH trading lower haven’t worked out as planned, but you never know—it still might. Now that Nvidia (NASDAQ:NVDA) is no longer allowed to sell its GPUs in China, we may even see Nvidia’s stock start to come down soon.