Here’s why Citi says crypto prices have been weak recently

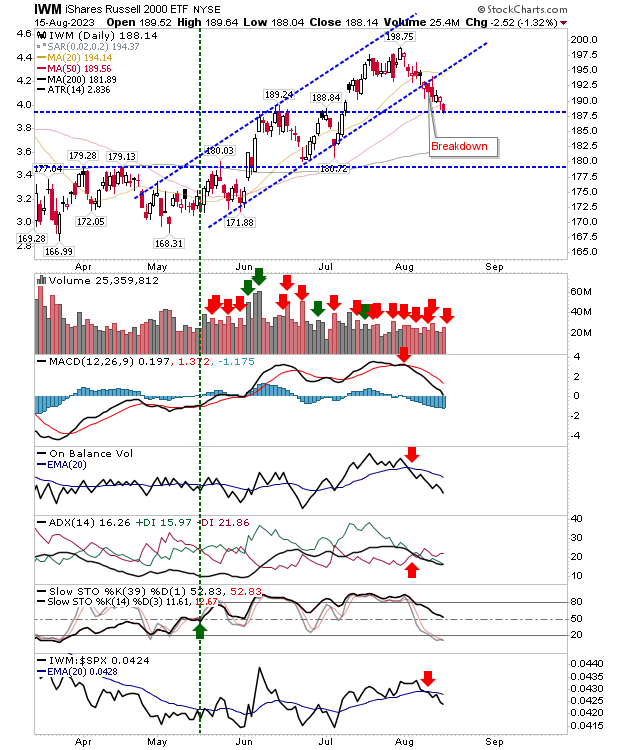

The selling is orderly, but it's still selling. I'll keep with the Russell 2000 (IWM) as this is the guiding (and leading) index for others. It didn't pause for long at its 50-day MA.

Instead, it only managed a day before delivering a clean open and close below the moving average. It's still holding $188 breakout support, but if that gives up, then we are looking at the 200-day MA.

Another point of optimism is bullish momentum in stochastics; if that can hold (the mid-line in stochastics) with a price bounce (even a price bounce without obvious price support), then an aggressive buy may not be such a bad idea here.

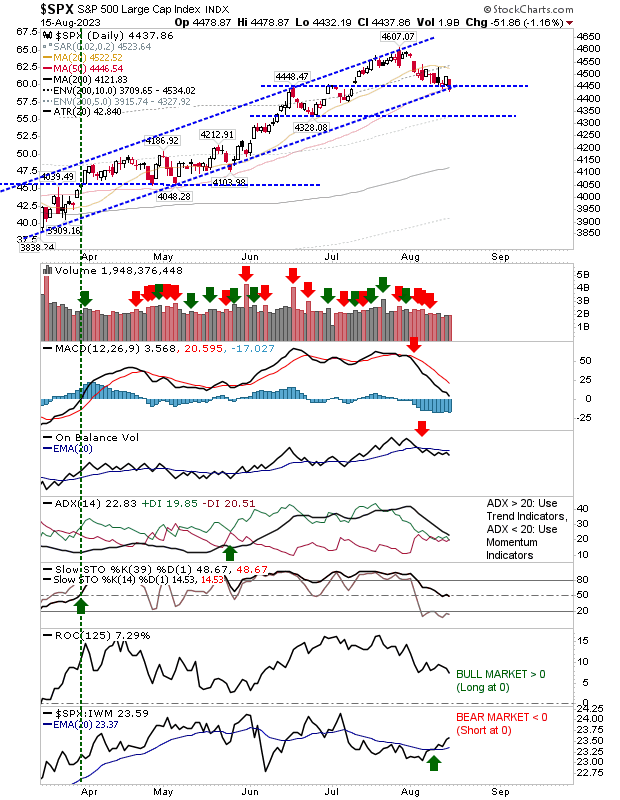

The S&P 500 is at a channel trendline in a more traditional support test. There was no higher volume selling, and overall volume is light. Stochastics are also running along mid-line support, support typical of a bullish market.

While the MACD and On-Balance-Volume are firmly bearish, it is countered by strong relative outperformance against Small Caps and a positive Rate-of-Change associated with bull markets. If you are looking for a more cautious buying opportunity, this is the time.

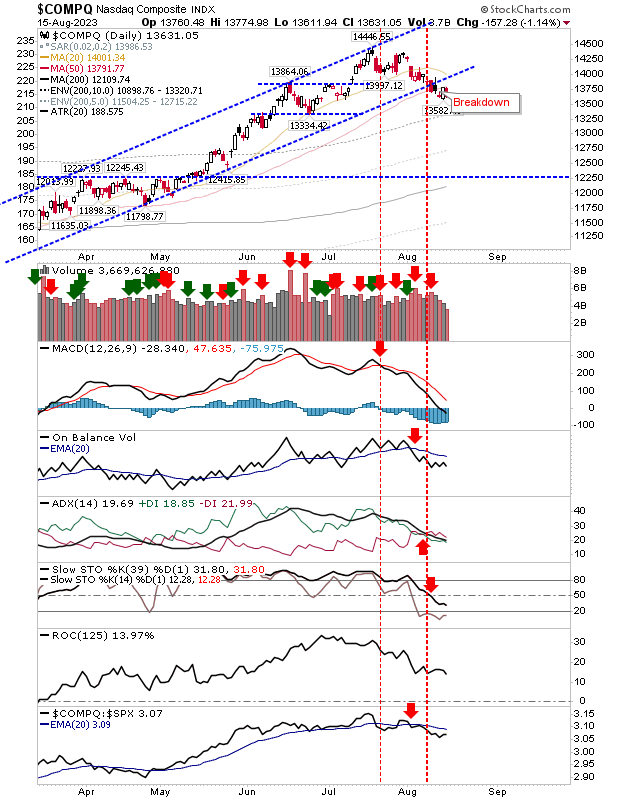

The Nasdaq has more in common with the Russell 2000 as it trades below channel support and its 50-day MA. The scary thing is that the index is a long way from its 200-day MA or the May breakout level.

The positive is that should the market return to 12,250 support, we will have a great buying opportunity, but it might be best to stay aside for now.

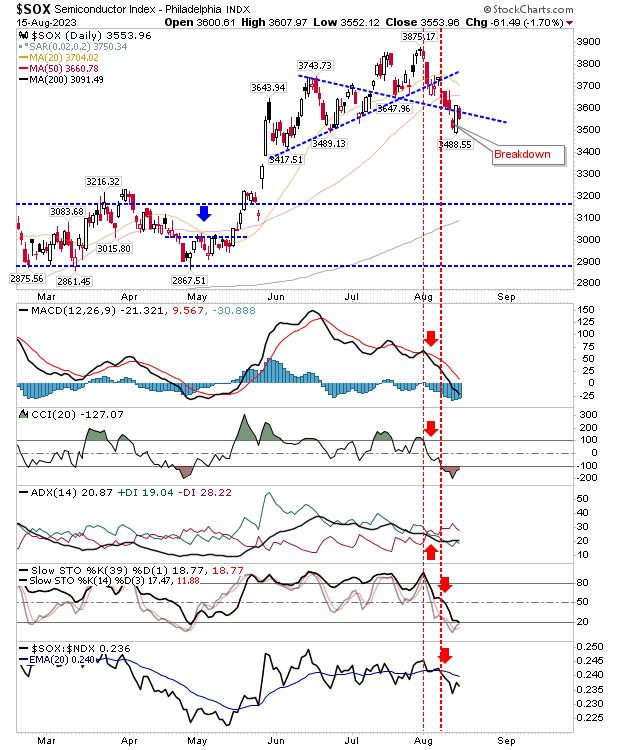

The Semiconductor Index is battling with resistance, and not in a good way. It's this weakness that is pressuring the Nasdaq.

While it could take a while before we get to a bounce-worthy support level, it will do so before the Nasdaq gets there, and this might be enough for the Nasdaq to rally. One to watch.

While recent losses could accelerate, I'm relatively happy with the nature of the declines. Assuming an acceleration doesn't occur, or at least occurs in combination with higher volume, then the best course of action is to let this play out.