Flutter Entertainment beats Q3 earnings estimate despite sports results impact

US stocks ended Thursday's session in negative territory. However, the S&P 500 surged 8.5% off its lows on Wednesday as the administration announced a 90-day tariff pause for all countries except China. Sound familiar? In Tuesday’s Commentary, we wrote:

For those of you with bearish nightmares, we share one important takeaway from Monday’s market roller coaster. While there is a good chance the market may explore new lows over the coming months, we must appreciate that there is plenty of fuel for a sizeable bounce. The one piece of important evidence supporting this thesis was a Tweet claiming that Trump is considering a 90-day pause in all tariffs except those on China.

After the official announcement of the 90-day pause, the “fuel” propelled the market to its third-largest percentage gain in history. The two instances ahead of it both occurred in October 2008. The takeaway is that news about retalitory tariffs, pausing the tariffs, and any tariff agreements will continue to drive markets with extreme volatility.

If Trump can turn the 90-day pause period into a series of constructive agreements with our largest trade partners, there is more bullish fuel in the tank. Negotiations with China will be most important. Retaliatory tariffs from China and then America have weighed on markets. The longer negotiations take, especially with China, the more negative consumer and investor sentiment will negatively impact the economy and markets.

Market Trading Update

Yesterday, we discussed the market reaction to the 90-day pause in tariffs, which sent the stocks surging in the third-largest single-day rally since WWII. As we stated yesterday:

“With the weekly “sell signal” in place, we will very likely see the market either stall at those levels (best case scenario) or retrace to test recent lows (most likely case.). Let’s see if we can get some follow-through on today’s trading.

Unfortunately, the market did not get a follow-through to yesterday’s buying, and it was a classic bear market rally. As discussed yesterday morning, we took action and used the rally to rebalance portfolio and reduce exposure to equity risk.

“As we have discussed over the last two weeks, the deep oversold condition of the market would lead to a sharp reflexive rally that should be sold into to reduce risk and rebalance portfolios. That rally came yesterday, and we are reducing risk across all models this morning. The first step is to reduce exposure to positions, reduce target weights, and increase cash levels. The next step, if needed, will be to add a short position in portfolios. Today is step one.”

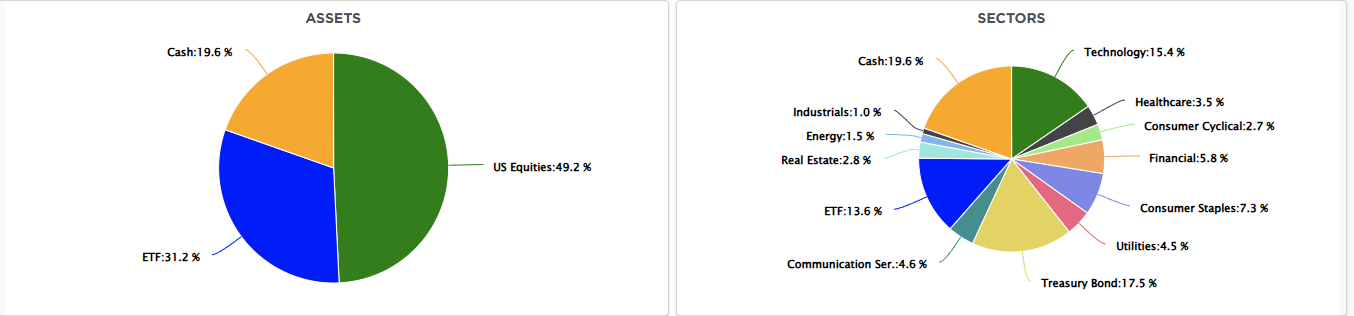

We increased cash levels to nearly 20% in the 60/40 portfolio and dropped equity exposure to 49%. With the weekly sell signal in place, we will look to reduce equity risk by another 4-5% by adding a short position to the portfolio on the next rally.

Despite inflation dropping sharply and the 10-year and 30-year bond auctions going well, the risk in the bond market is spreading through the equity markets. For more information on the “basis trade” and why it is such a risk, here is an excerpt from the Show on Wednesday.

The market remains oversold in the near term, which should provide some opportunity for reflexive bounces to reduce risk and rebalance as needed. I suspect that the larger corrective process remains well intact, and an eventual retest of lows, if not new lows, is likely before this process is complete.

Trade accordingly.

CPI Surprises To The Downside

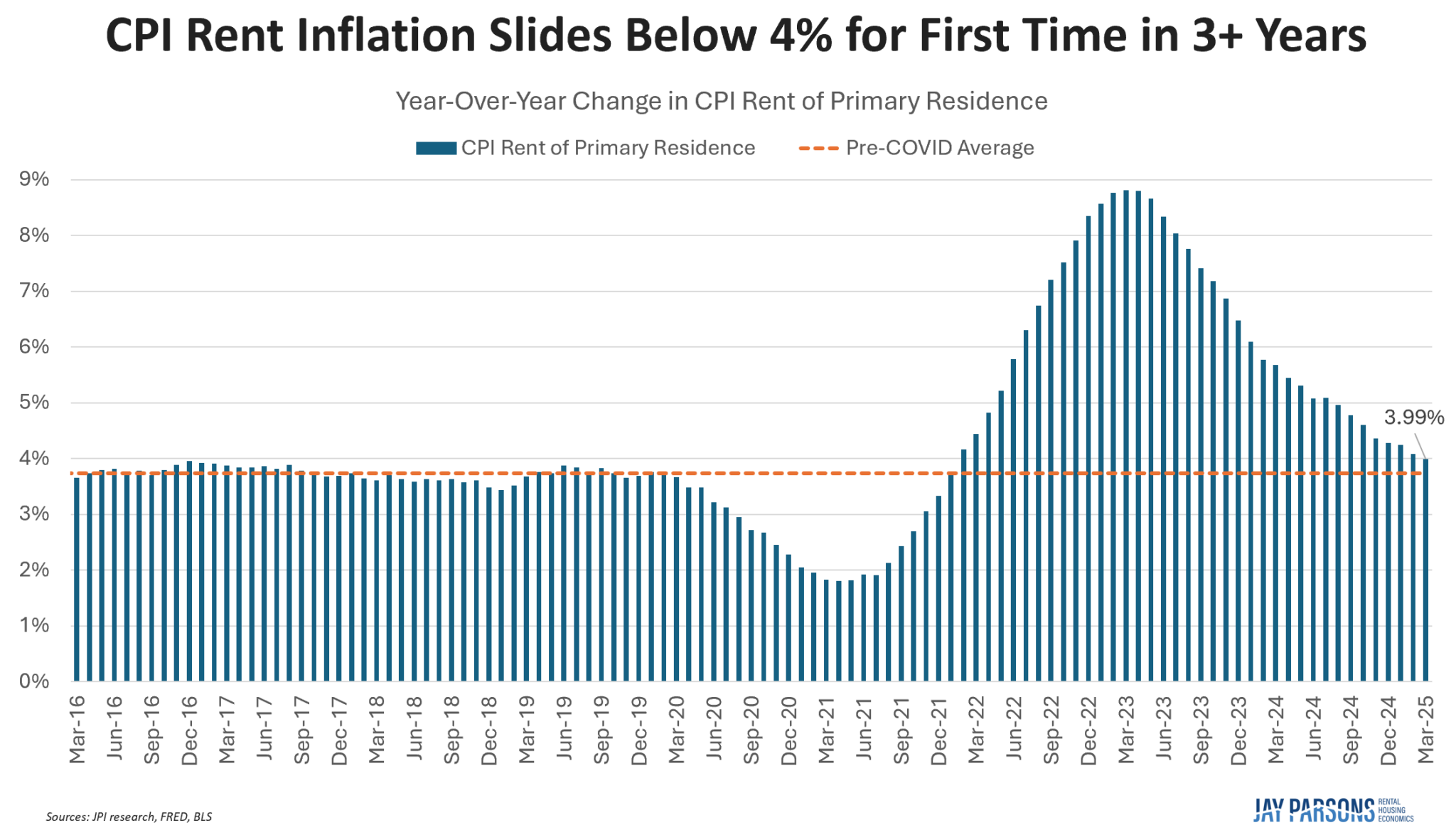

The CPI (-.1%) and Core CPI (+.1%) came in 0.2% below expectations. Year over year Core CPI (+2.8%), the Fed’s preferred inflation measure, is below 3% for the first time since March 2021. Also important, the so-called super core CPI fell by 0.24%, the lowest reading since May 2020. Supercore is the core calculation but also excludes housing.

CPI rent inflation, as shown below, continues to decline steadily. It now sits a hair below 4%. More disinflation in rents and shelter prices will continue, but the pace may slow from here.

While the data is very good, the initial impact of tariffs has yet to be felt. Inflation data could become volatile in the coming months as the tariffs’ inflationary and deflationary effects ripple through the economy.

Tweet of the Day