ION expands ETF trading capabilities with Tradeweb integration

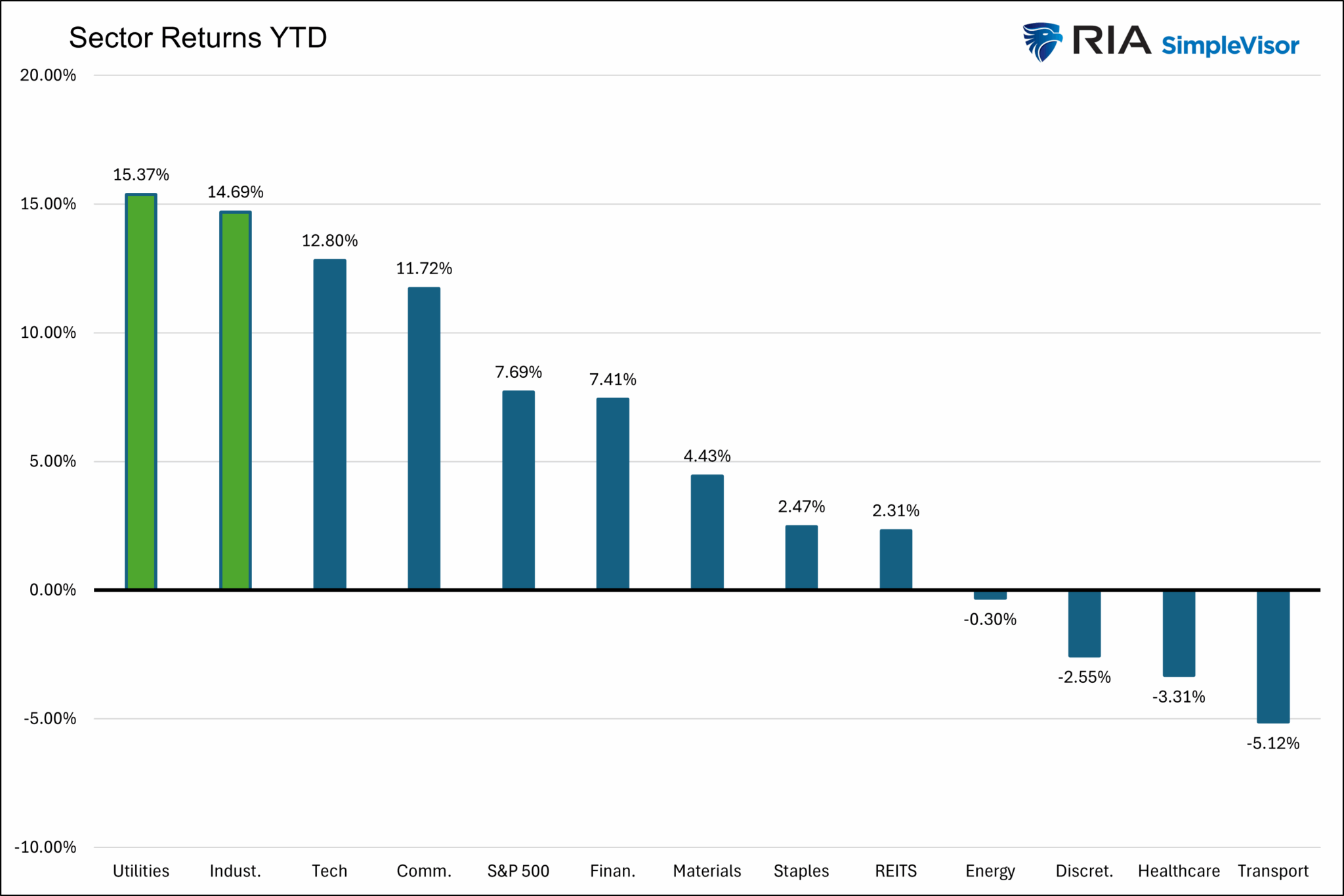

The race to build and power AI data centers is creating an interesting anomaly in the stock market. Despite the S&P 500 being up over 7% on the year, and the higher-beta stocks seemingly leading the way, utilities and industrials are the best-performing sectors.

The surging demand for power drives utilities, while industrials benefit from building out the power grid infrastructure. So while utilities and industrials are having their day in the sun, we must start thinking about what other sectors or industries are benefiting from the power grid build expansion, but whose stocks are not leading the market.

At its core, the ability to produce electricity is dependent on the energy source used to create it. Currently, utilities rely most on natural gas, with coal and wind in a distant second and third. Furthermore, natural gas usage as a percentage of all sources used by the power grid is expanding. This is primarily because natural gas is cheap and abundant.

Presuming the data center and power grid expansion continues, might the next beneficiary be natural gas companies? As a disclosure, our equity model holds two natural gas pipeline stocks (OKE and KMI) while our sector models hold an ETF of pipeline stocks (AMLP).

Generally, the pipeline stocks have not performed nearly as well as the utilities and industrials, despite them also being a bet on infrastructure expansion with solid growth potential, higher-than-average dividends, and favorable government policy tailwinds.

Might they be among the stocks next in line to benefit from the infrastructure boom?

Another View Of The Labor Market

We ran across an excellent analysis that helps us assess the recent weakness in the labor market. The following series of graphs and comments is courtesy of Parker Ross (@Econ_Parker).

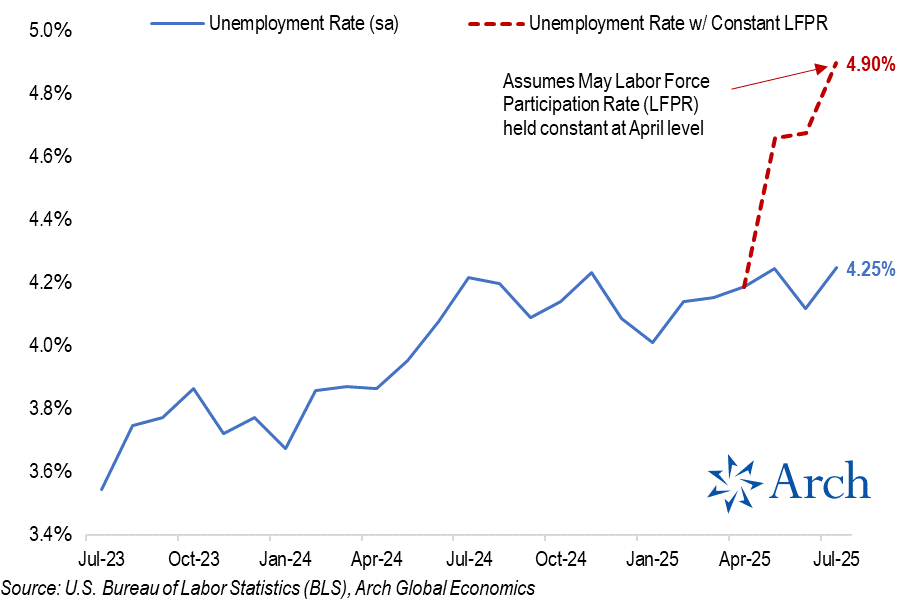

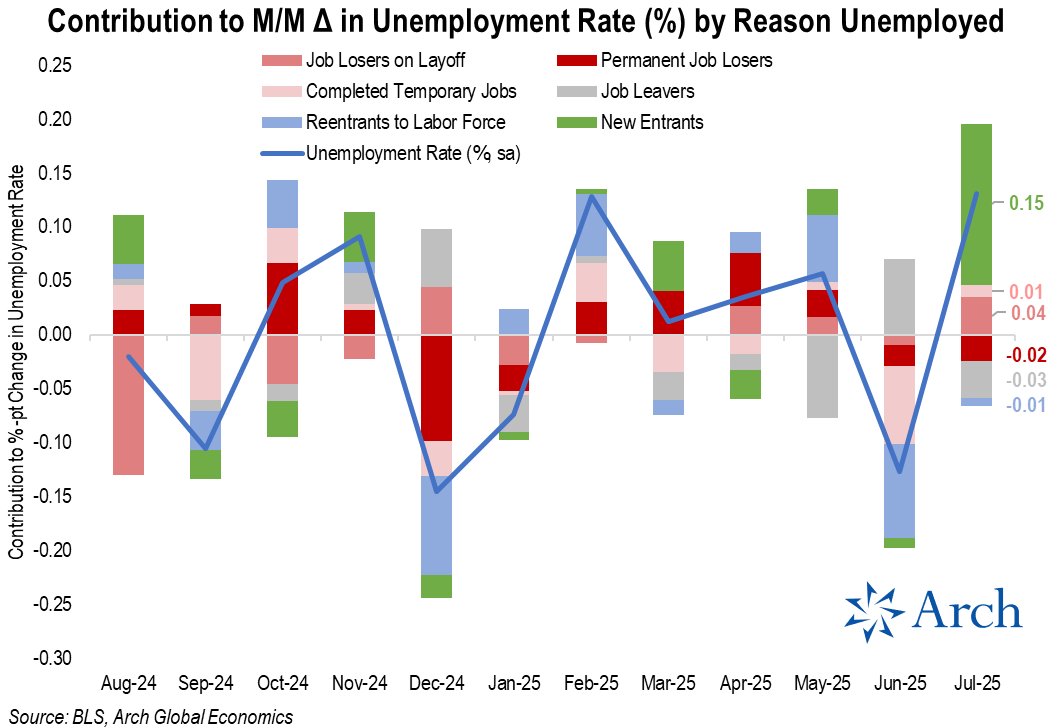

If not for collapsing labor force participation since April, unemployment would’ve climbed to 4.9% today instead of 4.25%.

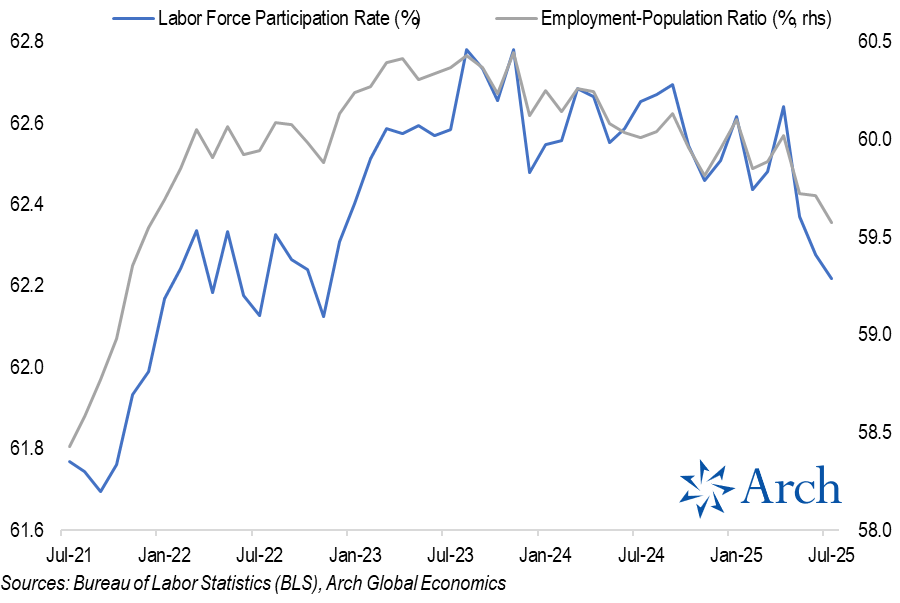

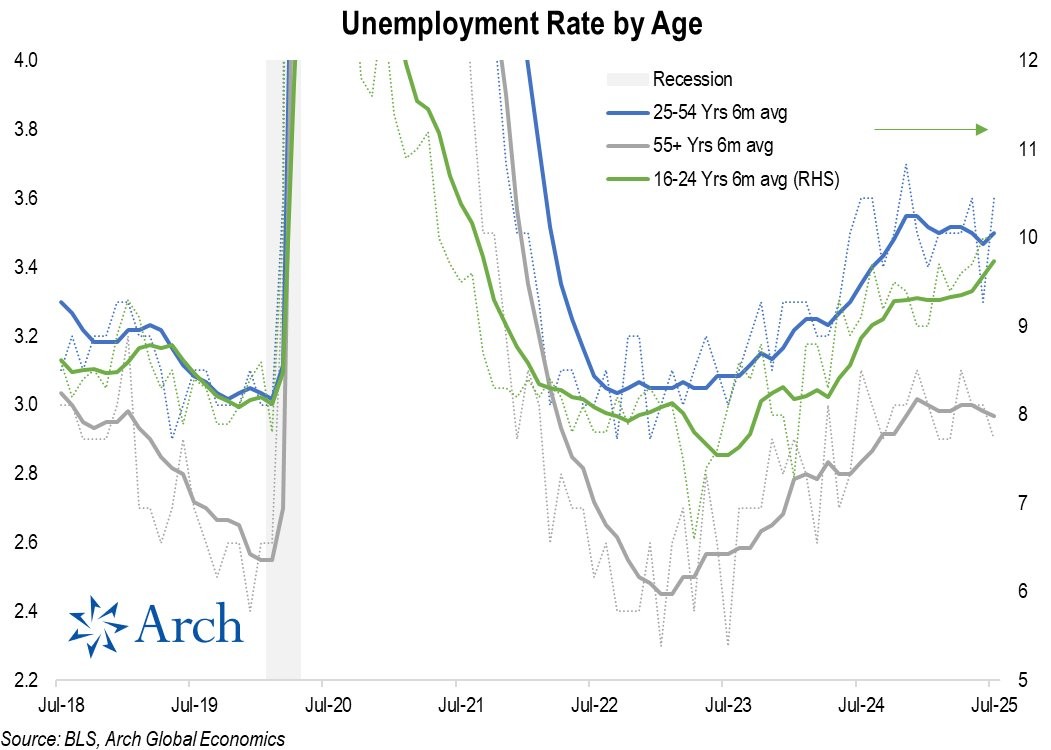

The labor force participation rate dropped from a recent peak of 62.8% in Nov ’23 to 62.2% in July ’25. The pace of that decline accelerated sharply in May and has continued through July.

That “not in the labor force” segment of the unemployed surged in July. New entrants not finding jobs put 15bps of upward pressure on the headline unemployment rate.

The new entrant/youth unemployment angle is not new, but it is clearly the segment of the labor market feeling the greatest softening in recent months.

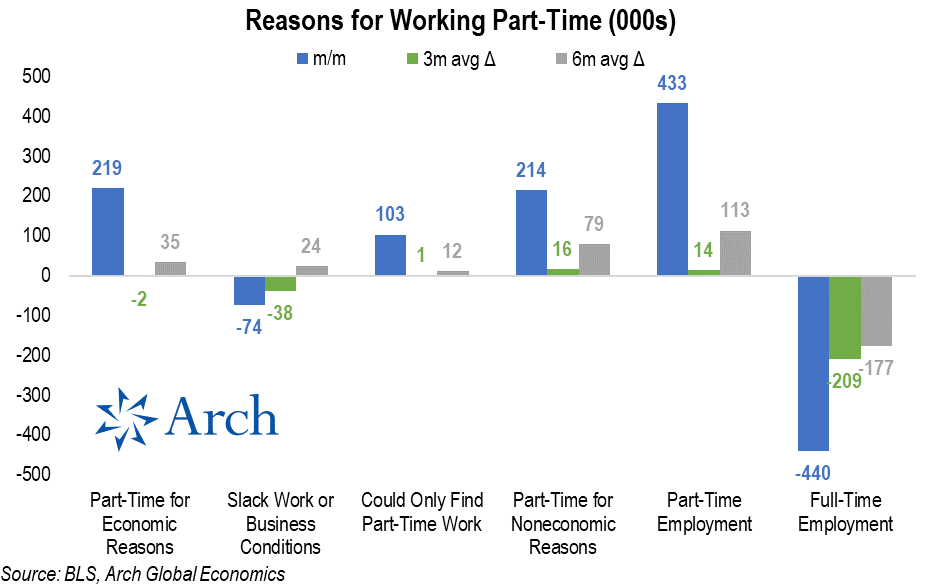

Workers are increasingly resorting to part-time work as full-time employment has trended lower.

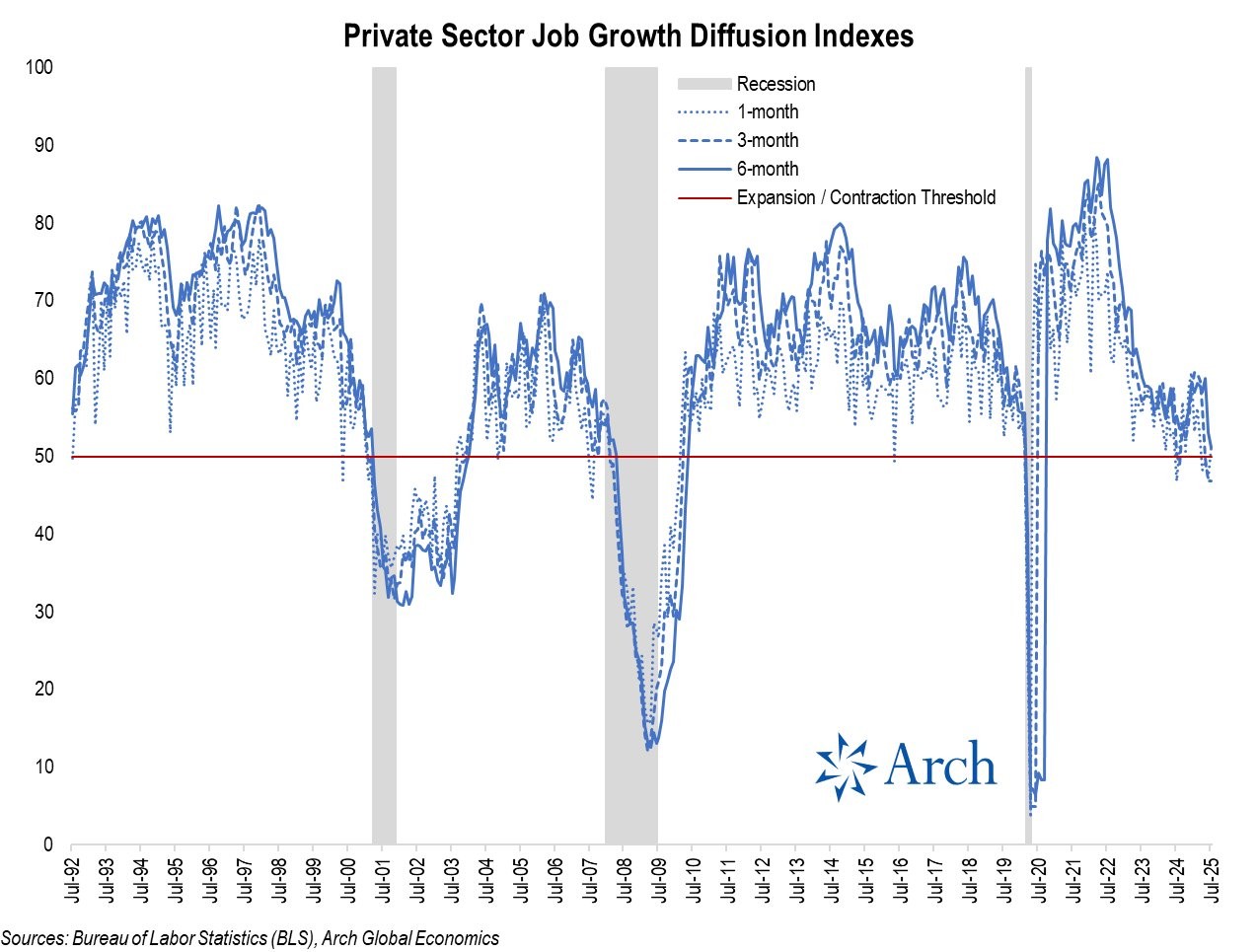

That brings me to my favorite metric from the establishment survey: the private job growth diffusion index, which reflects the breadth of job gains across industries. The 3m index dropped below the 50 expansion/contraction threshold back in May and remained at 46.8 in July, down from 60.8 back in Jan ’25.

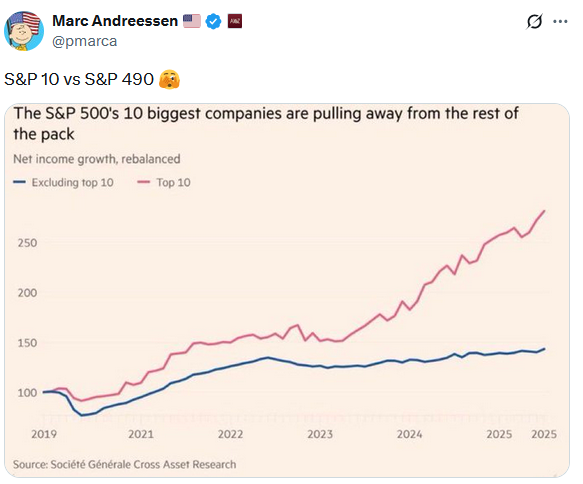

Tweet of the Day