Qantas shares slide to 6-mth low as airline trims revenue outlook

Are you a “speculator” or an “investor”? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles. Over the last 15 years, due to repeated rounds of monetary and fiscal interventions, most investors are simply chasing performance. However, why would you NOT expect this to happen when financial advisers, the mainstream media, and Wall Street continually press the idea that investors “must beat” some random benchmark index from one year to the next?

However, if you are only chasing performance, are you an “investor” or a “speculator”

While some may hold a negative connotation of being called a “speculator,” that would be incorrect. However, it is critical to understand the difference, as being a “speculator” in financial markets requires a different set of “rules” than being an “investor.”

Let’s begin our discussion with a definition of both.

- Speculator: A person who utilizes strategies within a shorter time frame, attempting to outperform traditional longer-term investors. Speculators take on risk, especially when anticipating future price movements, hoping to make large gains to offset the risk.

- Investor: A person who systematically grows wealth by buying assets with reasonable levels of risk in exchange for long-term growth.

I asked ChatGPT to provide a table of the key differences between being an investor and a speculator.

When you examine your approach and expectations of investment returns, which definition describes you?

There is nothing wrong with either approach, but each requires a very different set of rules and expectations.

But no rule says you can’t be a little bit of both.

Investor Meets Speculator

As portfolio managers, we are, by nature, long-term investors. We focus on fundamental data like free cash flow, return on invested capital, earnings growth rates, and sales. While fundamental investing certainly provides better long-term returns, it becomes difficult for investors to stay the course during volatile markets. This is where our emotional behaviors, such as loss avoidance, confirmation bias, herding, and availability bias, interfere with our decision-making. Such is why we also engage in various actions to mitigate risk and reduce volatility.

A good example of this was in a post on January 7th entitled “Curb Your Enthusiasm in 2025.“

In that article, we explained why we expected increased market volatility and lower returns this year. Even though we are long-term fundamental investors, we suggested taking specific actions more often associated with market speculators. To wit:

“While 2025 presents its share of challenges, the solution is not to abandon the market altogether. Instead, investors can take practical steps to navigate these uncertainties. None of this means the next “bear market” is lurking. The data does suggest that being overly aggressive, taking excess risk, and increasing leverage may not have the desired outcome. Since exceedingly bullish markets are a function of psychology, they can last longer and go further than logic predicts. The requirement to “end” such a phase is an exogenous event that changes psychology from bullish to bearish. Such is when the stampede for the exits occurs, and prices can decline very quickly. As such, investors need guidelines to participate in the market advance. But, of course, the hard part is keeping those gains when corrections inevitably occur. This is our approach as portfolio managers for our clients.”

- Tighten up stop-loss levels to current support levels for each position. (Provides identifiable exit points when the market reverses.)

- Hedge portfolios against significant market declines. (Non-correlated assets, short-market positions, index put options)

- Take profits in positions that have been big winners. (Rebalancing overbought or extended positions to capture gains but continuing to participate in the advance).

- Sell laggards and losers. (If something isn’t working in a market melt-up, it most likely won’t work during a broad decline. It is better to eliminate the risk early.)

- Raise cash and rebalance portfolios to target weightings. (Rebalancing risk regularly keeps hidden risks somewhat mitigated.)

“Notice, nothing in there says, ‘Sell everything and go to cash.‘”

Those actions of reducing risk, rebalancing portfolios, and taking profits are things that speculators should do to mitigate risk. However, many individuals don’t understand the difference between being an investor and a speculator. Let me explain:

When markets rise sharply, individuals invest capital in them without understanding the underlying dynamics or fundamentals. They buy an asset because it is going up. The more the number goes up, the more they buy of it. However, when the price eventually falls, they fail to take action and get trapped within their own psychological biases. At this point, they are generally “investors” in that asset and “hope” that someday it will get back to even.

This same cycle has repeated throughout history, whether in stocks, bonds, gold, or bitcoin. However, investing, ultimately, is about managing the risks, which will substantially reduce your ability to “stay in the game long enough” to “win.” Robert Hagstrom, CFA, penned a piece discussing the differences between being an investor and a speculator:

“Philip Carret, who wrote The Art of Speculation (1930), believed “motive” was the test for determining the difference between investment and speculation. Carret connected the investor to the economics of the business and the speculator to price. ‘Speculation,’ wrote Carret, ‘may be defined as the purchase or sale of securities or commodities in expectation of profiting by fluctuations in their prices.’”

Chasing markets is the purest form of speculation. It is simply a bet on prices going higher rather than determining if the price being paid for those assets is selling at a discount to fair value. When prices are NOT selling at a discount, investors devise various rationalizations about why this time is different.

When you look at your portfolio today and assess its risk, are you an investor or a speculator? But more critically, whether you currently own stocks, bonds, gold, or bitcoin, are you a “speculator calling yourself an investor” and coming up with rationalizations to support your view?

To help you in your quest to be a better long-term investor, here are 10 investing guidelines from legendary investors.

10-Investing Guidelines From Legendary Investors

1) Jeffrey Gundlach, DoubleLine

“The trick is to take risks and be paid for taking those risks, but to take a diversified basket of risks in a portfolio.”

This is a common theme throughout this post. Great investors focus on “risk management” because “risk” is not a function of how much money you will make, but how much you will lose when you are wrong. In investing or gambling, you can only play as long as you have capital. If you lose too much capital while taking on excessive risk, you can no longer play the game.

Be greedy when others are fearful and fearful when others are greedy. One of the best times to invest is when uncertainty and fear are at their highest.

2) Ray Dalio, Bridgewater Associates

“The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.”

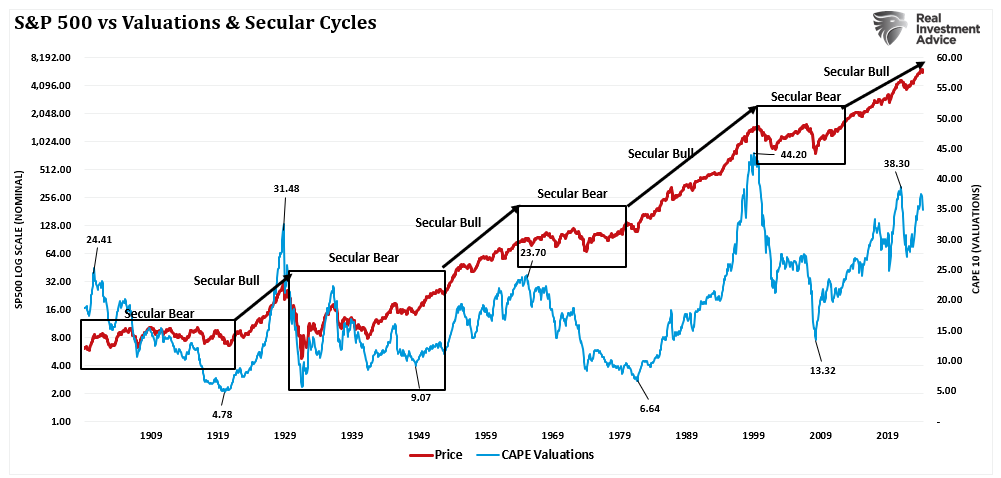

Nothing good or bad goes on forever. Investors repeatedly make the mistake of thinking, “This time is different.” The reality is that despite central bank interventions or other artificial inputs, business and economic cycles cannot be repealed. Ultimately, what goes up must and will come down. How many investments in history have never lost value at some point, and in many cases, a lot of value? The answer is none. The same goes for assets with a significant correction, as long as they are fundamentally sound.

3) Seth Klarman, Baupost

“Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.”

The most significant risk in investing is investor behavior driven by cognitive biases. Greed and fear dominate investors’ investment cycles, which ultimately lead to “buying high and selling low.”

4) Jeremy Grantham, GMO

“You don’t get rewarded for taking risk; you get rewarded for buying cheap assets. And if the assets you bought got pushed up in price simply because they were risky, then you are not going to be rewarded for taking a risk; you are going to be punished for it.”

Successful investors avoid “risk” at all costs, even if it means underperforming in the short term. The reason is that while the media and Wall Street have you focused on chasing market returns in the short term, ultimately, the excess “risk” built into your portfolio will lead to extremely poor long-term returns. Like Wile E. Coyote, chasing higher financial markets will eventually lead you over the cliff.

5) Jesse Livermore, Speculator

“The speculator’s deadly enemies are: ignorance, greed, fear and hope. All the statute books in the world and all the rule books on all the Exchanges of the earth cannot eliminate these from the human animal….”

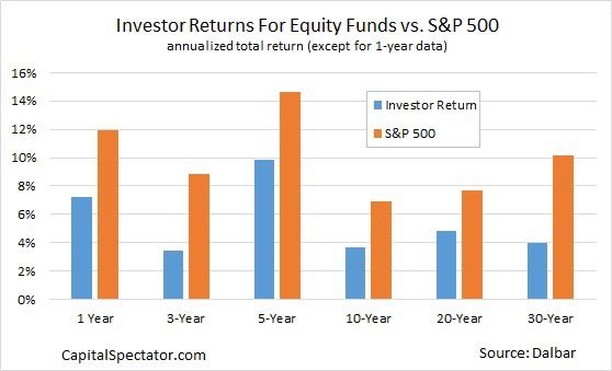

Allowing emotions to rule your investment strategy is, and always has been, a recipe for disaster. All great investors follow a strict discipline, strategy, and risk management diet. Emotional mistakes show up in the returns of individuals’ portfolios over time. (Source: Dalbar)

6) Howard Marks, Oaktree Capital Management

“Rule No. 1: Most things will prove to be cyclical.

Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1.”

As with Ray Dalio, realizing nothing lasts forever is critical to long-term investing. To “buy low,” one must first ” sell high.” Understanding that all things are cyclical suggests that investments become more prone to declines after long price increases.

7) James Montier, GMO

“There is a simple, although not easy alternative [to forecasting]… Buy when an asset is cheap, and sell when an asset gets expensive…Valuation is the primary determinant of long-term returns, and the closest thing we have to a law of gravity in finance.”

“Cheap” is when an asset sells for less than its intrinsic value. “Cheap” is not a low price per share. When a stock has a very low price, it is usually priced there for a reason. However, a very high-priced stock CAN be cheap. Price per share is only part of the valuation determination, not the measure of value itself.

8) George Soros, Soros Capital Management

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

Back to risk management: Being right and making money is great when markets are rising. However, rising markets tend to mask investment risk, which is quickly revealed during market declines. If you fail to manage the risk in your portfolio and give up all of your previous gains and then some, then you lose the investment game.

9) Jason Zweig, Wall Street Journal

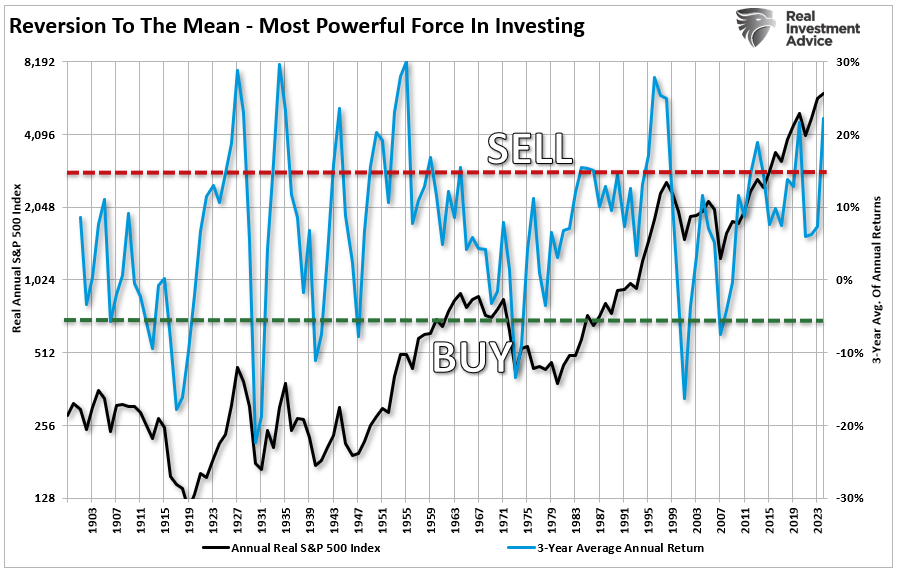

“Regression to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance.”

The chart below shows the 3-year average of annual inflation-adjusted returns of the S&P 500 from 1900. The power of regression is seen. Historically, when returns exceeded 15%, it was not long before they fell below 0% below the long-term mean, which devastated much of investors’ capital.

10) Howard Marks, Oaktree Capital Management

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.”

As should be obvious, the most significant driver of long-term investment returns is minimizing psychological investment mistakes.

As an investor, it is simply your job to step away from your “emotions” and look objectively at the market around you. Is it currently dominated by “greed” or “fear?” Your long-term returns will depend greatly not only on how you answer that question, but also on managing the inherent risk.

What should be obvious is that even great long-term investors adopted some of the traits of speculators to manage risk and volatility. Nothing says you can’t do the same.

Being a pure speculator and trying to “day trade” the market by jumping on the latest trends rarely works out well over the long term. However, as you will note, every great investor throughout history has had one core philosophy in common: managing the inherent risk of investing to conserve and preserve investment capital.

“If you run out of chips, you are out of the game.”