Goldman Sachs chief credit strategist Lotfi Karoui departs after 18 years - Bloomberg

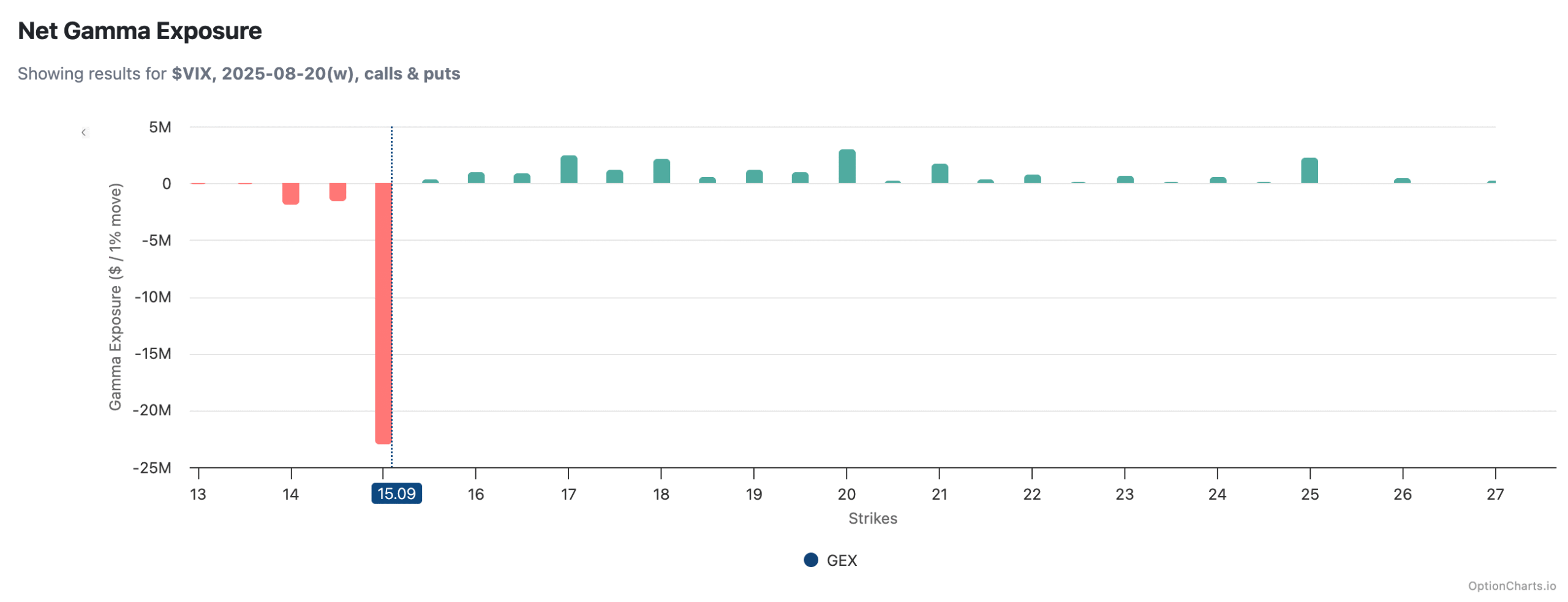

Stocks finished Friday lower, and with OPEX now behind us, volatility should begin to expand again. VIX OPEX is on Wednesday, creating one more potential hurdle for the market. The VIX appears well supported at 15, which is the put wall, so I would not expect the VIX to fall below that level, at least through Wednesday morning.

The big event this week will be Jackson Hole, where, under normal circumstances, markets would be listening closely to Chair Powell for clues on the Fed’s next move. At this point, however, Powell feels somewhat neutralized, with his term set to end in roughly six months and the next Fed chair likely to be in a rate-cutting mode.

The real question is whether Powell has enough support from the FOMC to hold rates steady. Calls for cuts are growing among some members, and I could see dissent at the September meeting rising to as many as three, with Bowman, Waller, and Miran (if cleared) likely candidates.

Still, Powell probably has enough backing to avoid cutting. If he plans to hold the line, he needs to make clear now that the bar for cuts is high, and that it would take a meaningful softening in the labor market—given the risk of higher inflation—to justify easing. With markets currently favoring a cut, managing expectations at this stage is critical.

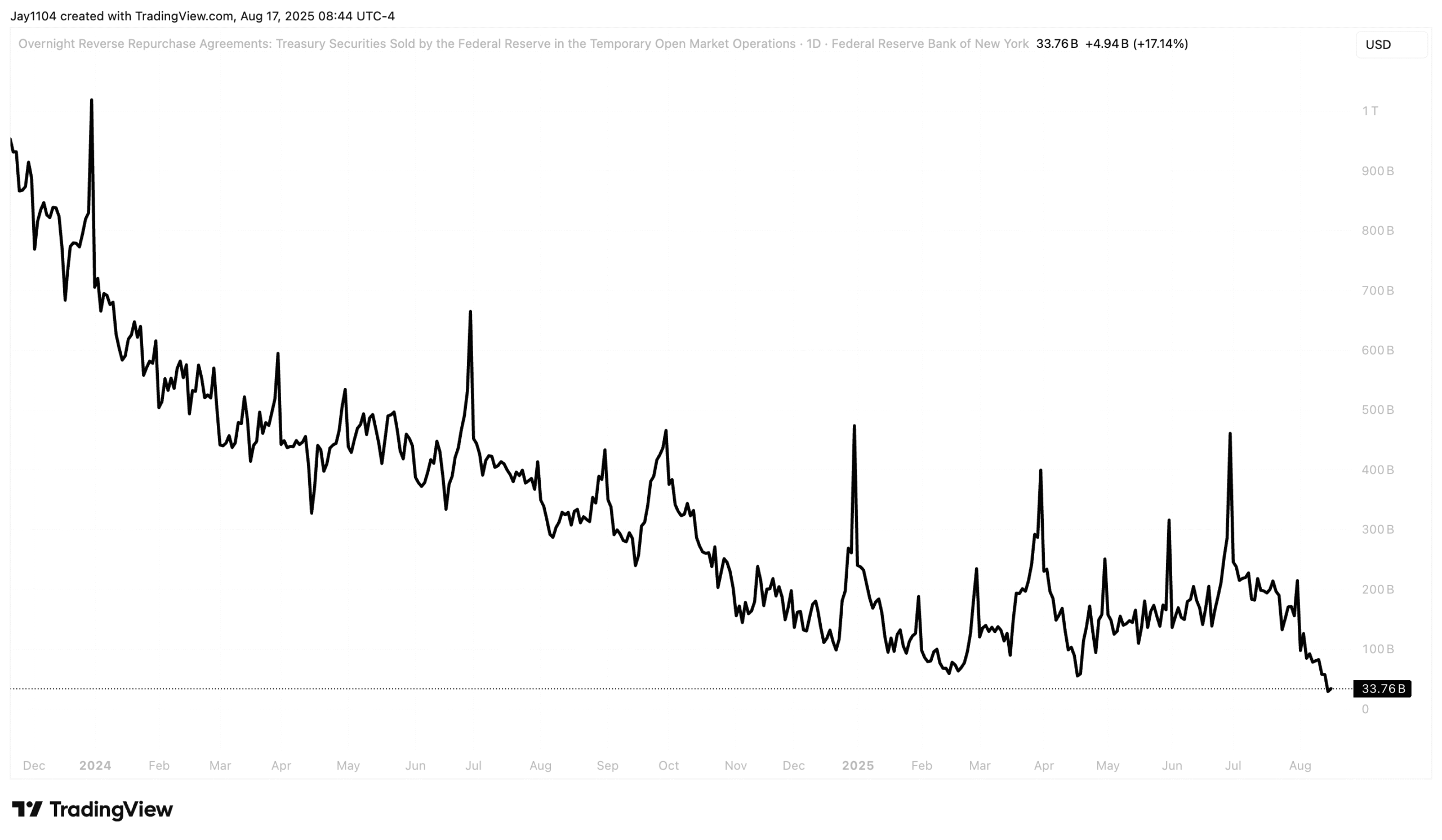

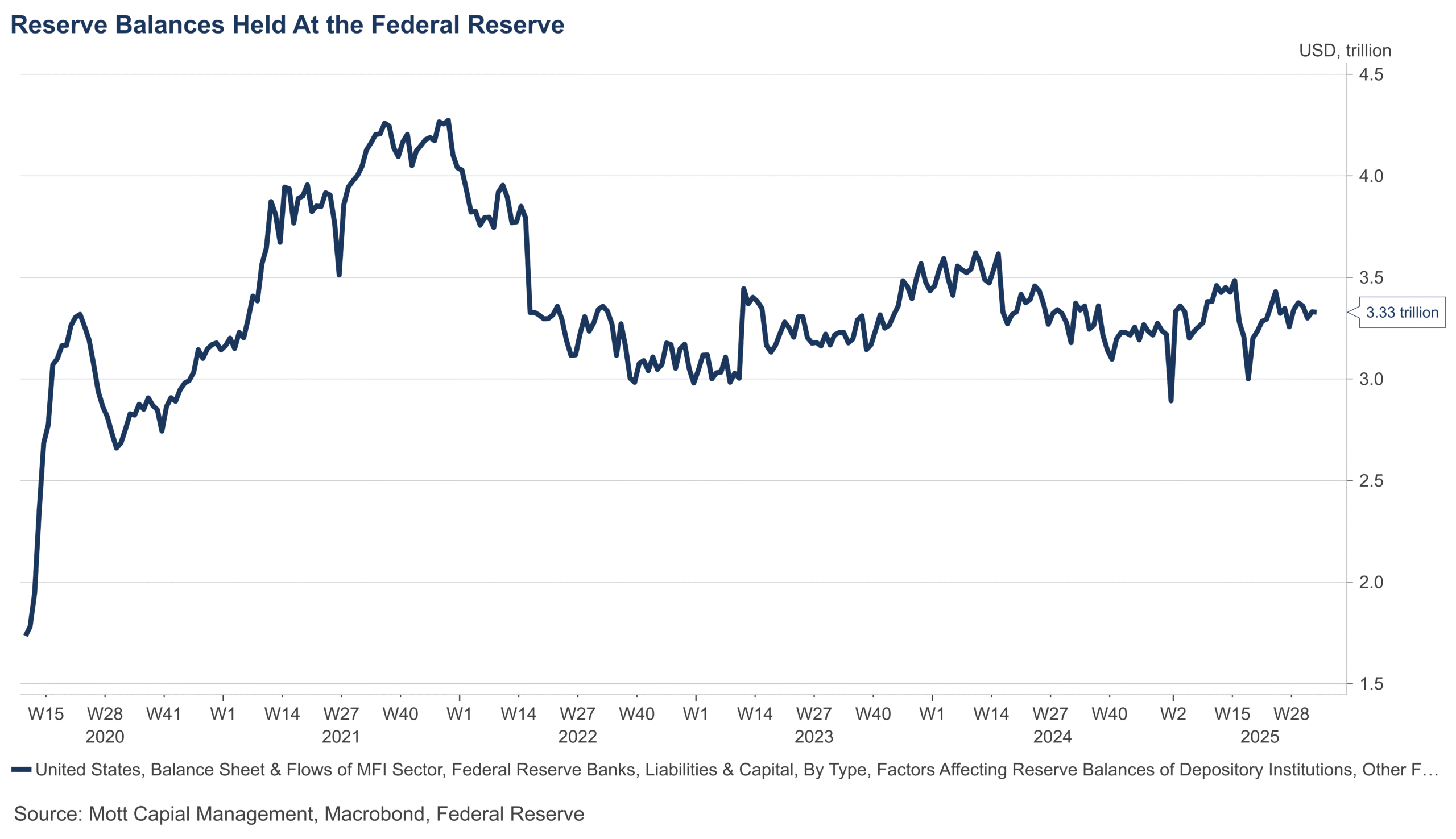

Liquidity will also remain in focus, with the Reverse Repo rising to approximately $34 billion on Friday after falling to around $28 billion the previous day. It is no longer serving as a buffer to offset the Fed’s balance sheet decline, nor as a source of funding for Treasury issuance. Given the size of the debt load the Treasury must issue, this could present challenges for markets going forward, as funding will now need to come from new sources such as money markets or primary dealer balance sheets.

We haven’t seen reserve balances impacted yet, but I expect that to begin this week.

The next couple of weeks will be a major test for the markets. Was it the draining of the reverse repo facility that helped push stocks higher over the past two years by boosting liquidity and driving P/E multiples, or was the rally truly organic? The coming weeks should provide some answers.