60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

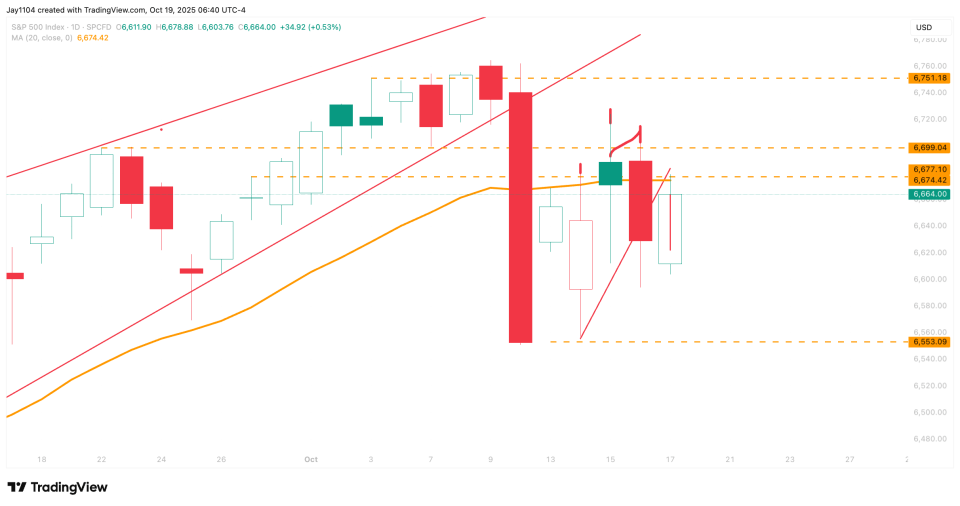

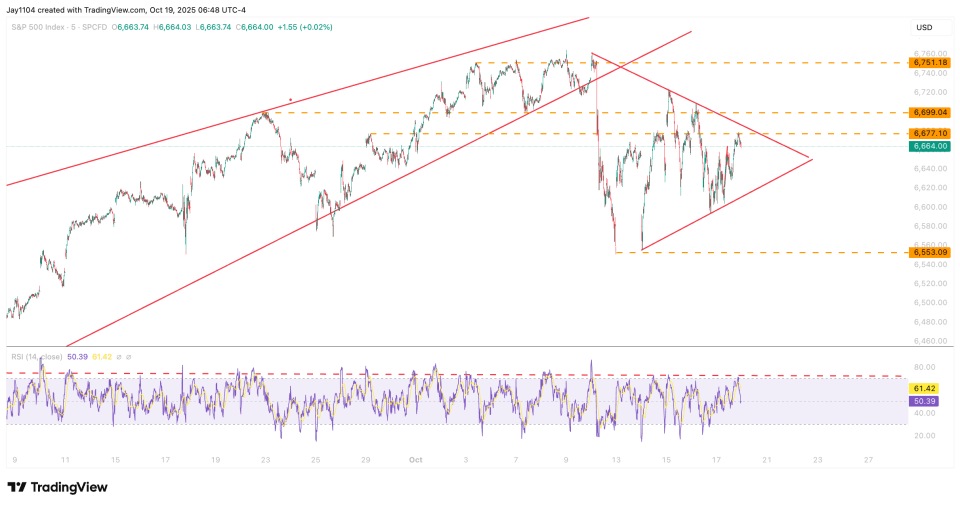

The S&P 500 managed to rise a bit on Friday, which was also OPEX. However, once the index failed to move above the 20-day moving average, that marked the sixth straight day it failed to close above that level — and the fourth time it traded above it intraday but couldn’t hold the gains. Perhaps that’s the hand of systematic sellers, but whatever the case, the index has been unable to clear the 20-day moving average, which for now appears to be an important resistance level.

The index has been consolidating sideways over the past week, likely due to the pinning effects from OPEX. Now that OPEX has passed, it’s possible the trading range could begin to expand.

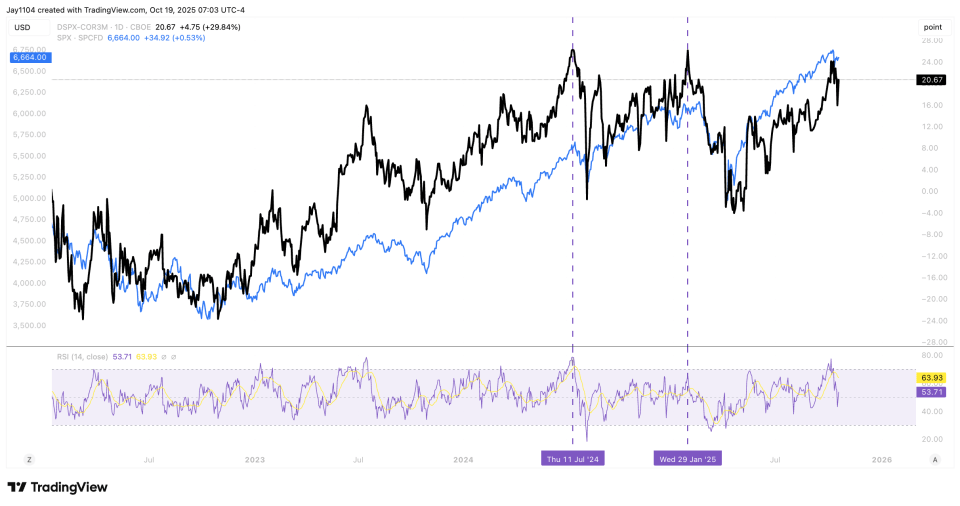

The spread between dispersion and correlations remains historically wide, but as we move further into earnings season, that spread should begin to narrow. This would imply falling dispersion and rising correlations — a combination that typically points to lower stock prices.

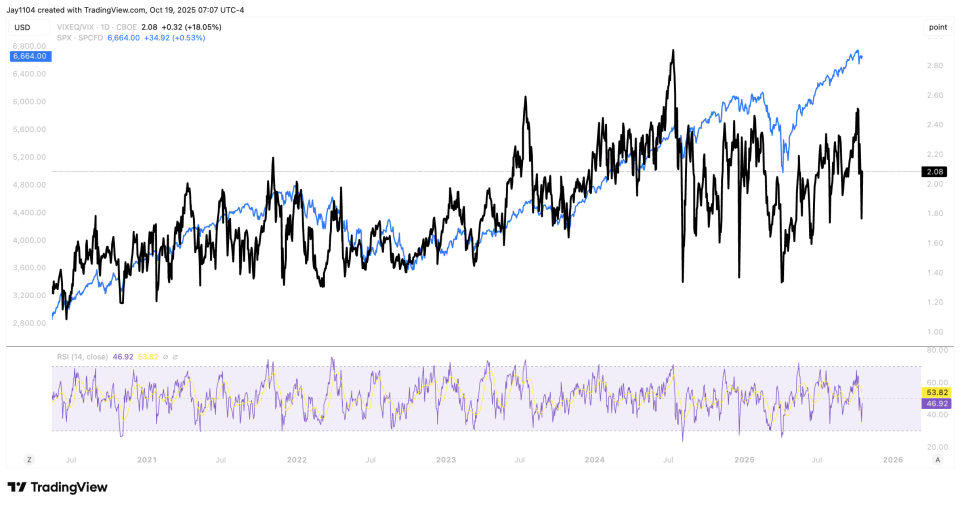

That’s because the VIXEQ is currently nearly double the VIX. As companies report earnings, their individual implied volatility will decline, while index-level volatility should rise — or at least fall less. This will cause the ratio to contract, and historically, when that ratio falls, stocks tend to follow lower.

We’re also seeing the classic rotation away from out-of-the-money tail-risk hedging toward more immediate at-the-money protection, as reflected by the sharp collapse in the SKEW/VIX ratio.

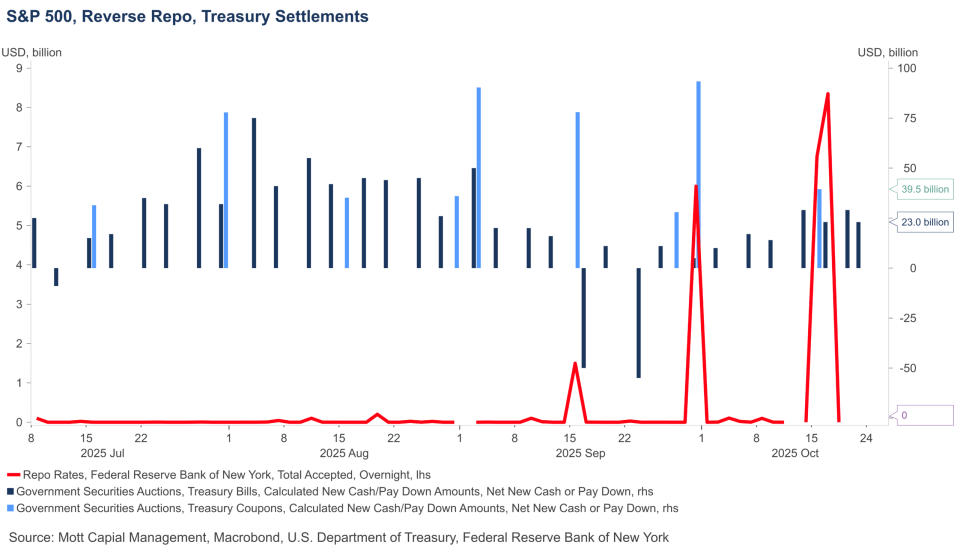

This week will also include two Treasury settlement dates, on October 21 and 23, which means liquidity will likely tighten again. As a result, usage of the Standing Repo Facility could pick up on both Tuesday and Thursday.

For now, rates and the dollar have been cast to the side — that could change toward the end of the week when the CPI report is released, but until Friday, that’s not the market’s main concern.