BETA Technologies launches IPO of 25 million shares priced $27-$33

On Wednesday afternoon, the judges from the US Court of International Trade struck down some of President Trump’s tariffs. Notably, the judge’s actions included an injunction on the “Liberation Day” tariffs and specific tariffs targeting China, Mexico, and Canada. The court’s three judges found that Trump exceeded his authority under the International Emergency Economic Powers Act (IEEPA).

The IEEPA is the act Trump invoked to justify the tariffs as a national emergency. The judges essentially ruled that the Constitution assigns tariff-making powers to Congress. Furthermore, they note that trade deficits, Trump’s justification for tariffs, do not constitute an “unusual and extraordinary threat” required by IEEPA. The Trump administration has 10 days to comply. Accordingly, the administration has already filed an appeal with the U.S. Federal Court of Appeals.

Stocks and the US dollar initially surged on the news. However, they quickly relinquished their gains as the Federal Court of Appeals could overturn the decision. Moreover, if Trump loses his appeal, a Supreme Court hearing is highly likely. Interestingly, despite the narrative that tariff-induced inflation would push yields higher, bond yields initially rose slightly on the ruling.

The Fed blames tariffs and the potential for them to induce inflation for not cutting rates. They stated the following yesterday in the release of its May 6th FOMC minutes:

Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer.

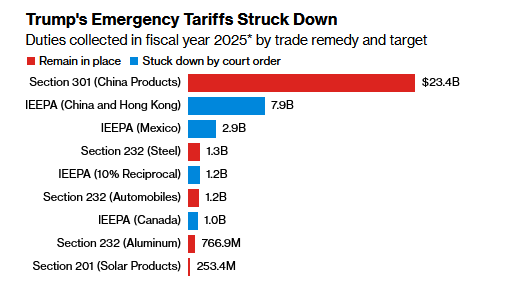

Lastly, we should consider that not all tariffs were struck down by the judges, as shown in the Bloomberg graphic below. Furthermore, there are other ways Trump can effectively limit imports and promote exports.

Even if the courts rule against Trump, trade-induced volatility may not be over. As Goldman Sachs states, the court ruling appears at first glance to be a “nothing burger.”

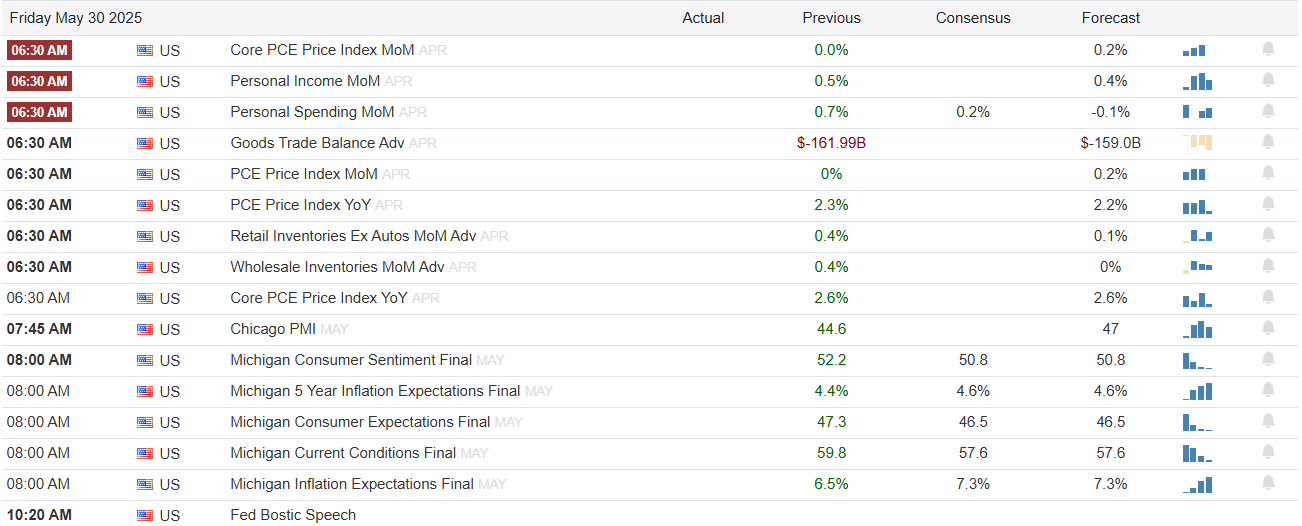

What To Watch Today

Economy

Market Trading Update

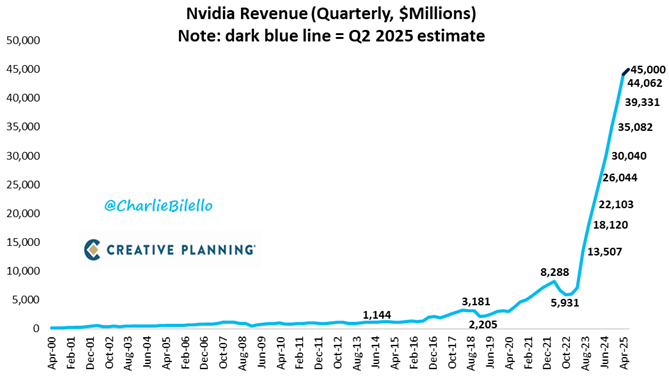

Yesterday, we noted that the market, while short-term overbought, was in a bullish formation, particularly with money flows remaining very positive. Yesterday, the market rallied further following Nvidia’s (NASDAQ:NVDA) earnings report, which did not disappoint.

As shown, revenue growth for the company continues to escalate, and Wall Street analysts remain bullish on prospects. For the moment, there seems to be nothing that can slow this juggernaut down.

However, that is just one company in the index, and while NVDA was the “belle of the ball” yesterday, the rest of the market was a mixed bag without a lot of clear direction. Of course, today is the last day of the month, so we may just be seeing some repositioning as we close out May.

However, as stated above, the market is short-term overbought and close to triggering a MACD momentum-sell signal from a high level. With May putting in such a strong performance, and share repurchases fading in the first two weeks of June, we could continue to see the market struggle into early July when Q2 earnings season begins.

We continue to hold elevated cash levels and have reduced some equity risk in the portfolios. Once the overbought condition is reversed, we will be more confident in increasing equity exposure for the next leg of the rally.

Nvidia Keeps Printing Money

The chart below, courtesy of Charlie Bilello, shows the stunning growth of Nvidia’s revenue. Once again, Nvidia did not disappoint with its earnings release on Wednesday night, posting revenue of $44.062 billion, up 12% from the previous quarter and 69% year-over-year. Analysts were expecting revenues of $43.30 billion. The bulk of revenue is from its data center division.

Data center revenue, driven by demand for AI and the company’s latest Blackwell chips, reached $39.6 billion, representing a 73% increase from last year. The only fly in the ointment was a $4.5 billion charge related to excess inventory resulting from new trade restrictions and export licensing requirements with China.

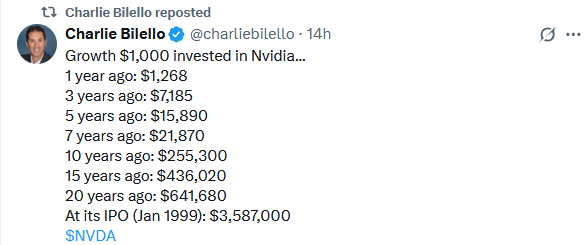

Tweet of the Day

Have a great weekend.