ESGold secures C$9 million facility with Ocean Partners

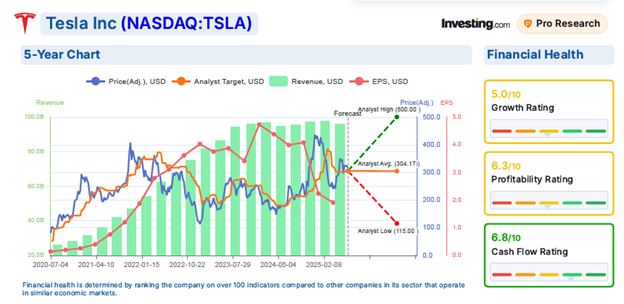

Tesla (NASDAQ:TSLA) faces declining sales and margins amid rising competition, while its energy and autonomous driving segments show potential growth.

Investors expect updates on Tesla’s robotaxi rollout, with a pilot launch planned for Austin by June 2025. Elon Musk may emphasize the progress and potential of Full Self-Driving (FSD), although regulatory hurdles remain.

AI, Robotics to Open New Revenue Streams?

Tesla’s focus on AI and robotics could open new revenue streams and market opportunities beyond traditional vehicle sales.

The upcoming loss of U.S. EV tax credits in Q3 2025 could impact Tesla’s sales and profitability. The phase-out of these incentives might reduce the affordability of Tesla vehicles for some consumers, potentially affecting demand unless Tesla adapts its strategies or benefits from other incentives and market factors. Tesla earned approximately $3.5 billion from regulatory credits in 2024.

Thriving Energy Generation & Storage Business: Tesla’s revenue from the Energy Generation and Storage business is on a robust growth trajectory on the back of the strong reception of its Megapack and Powerwall products.

Tesla’s Optimus robot project, designed as a humanoid robot, aims to automate repetitive and mundane tasks. It would have a transformative impact on several industries like manufacturing, logistics & warehousing, healthcare, retail, and hospitality.

TSLA Q2 2025 earnings after-market Wednesday July 22, 2025

|

Analyst Ratings |

|||

|

SOURCE |

BUY |

HOLD |

SELL |

|

Refinitiv |

23 |

20 |

10 |

|

TipRanks |

13 |

12 |

7 |

|

Earnings Expectation |

|

|

EPS |

0.40 USD |

|

Revenue |

22.28 B USD |

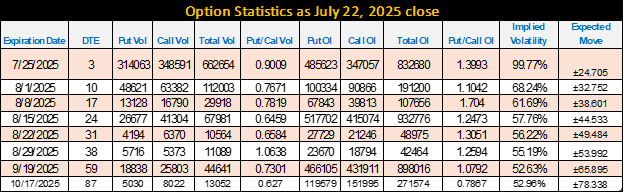

Option Statistics

The put/Call ratio suggests the following three scenarios:

- The Put/Call ratio between 1.704 and 1.1042 for the next four upcoming expiries suggests that the overall option traders’ position is inclined towards Puts.

- Lower earnings and guidance could trigger a sharp, short-lived sell-off as option traders would start selling their Puts.

- Better-than-expected guidance would trigger a sharp rally due to higher Put (bearish) Trades.

- The option market is showing a large net positive Gamma at the 350 strike versus a small net negative gamma exposure at the 290 strike from July 2025 to December 2027.

Technical Analysis Perspective:

- TSLA rallied from 138.80 in April 2024 to 488.54 in December 2024, forming point 1 of a huge triangle.

- Triggered a significant sell-off to 214.25 in April 2025, completing point 2 of the triangle.

- The rally to 367.71 in May 2025 most likely marked the end of point 3 of the pattern.

- Prices are hovering close to a falling trendline of a triangle that intersects between the 342 and 365 marks.

- TSLA may attempt to test the 342-365 resistance zone post-earnings.

- A rejection of this obstacle would confirm the completion of point 3 and pave the way for a decline between 250 -238 rising trendline support to complete point 4 before beginning a final leg higher to point 5 to penetrate 367 – 370 obstacles heading to an all-time high near 488.54.

- Earnings serve as a good catalyst for confirming point 3 and initiating point 4.

- Having said that, a strong and sustained move above the 367 – 370 zone post earnings would negate the triangle formation.

Monthly Candlestick Chart

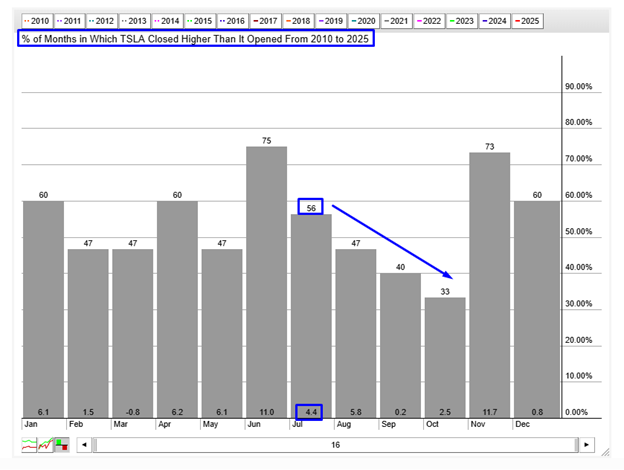

TSLA Seasonality Chart:

TSLA closes 4.4% higher in July 56% of the time since 2010.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”