Senti Bio stock soars after positive cancer therapy trial results

After Elon Musk tied his fortunes with President-Elect Donald Trump, Tesla’s valuation has grown even more complicated. Tesla (NASDAQ:TSLA) naysayers paid the US election price dearly as hedge funds amassed over $5.2 billion losses (unrealized) on their short positions, per S3 Partners estimate.

Now that Musk is involved with USG’s operations with the memetic Department of Government Efficiency (DOGE), TSLA stock got a 54% boost within a 30-day timeframe. At $342 per share, this is the highest TSLA price level since early April 2022, just after the Federal Reserve began raising interest rates to combat inflation it caused.

But what is the long-term outlook for Tesla’s valuation, and is there cause for concern despite the current post-election hype?

Tesla’s Hybrid Valuation Problem

Tesla’s valuation has been a complicated affair. On one hand, it is a car manufacturer in an emerging EV market. According to Fortune Business Insights forecast, the electric vehicle (EV) should expand at 13.8% CAGR between 2024 and 2032. On the other hand, Tesla is a tech stock, owing to pioneering technological implementations and a direct-to-consumer business model.

The tech part of the hybrid package is underpinned by the potential of Full Self-Driving (FSD) which could transform Tesla into a robotaxi business. By upgrading from a buy-car-once company into an autonomous ridesharing company, even existing Tesla owners could start generating recurrent cash flows.

But the Robotaxi Event failed to impress, as expected.

Musk projected that robotaxi evolution could eventually propel Tesla to a $5 trillion market cap. Last week, billionaire investor Ron Baron expressed similar bullishness on CNBC’s Squawk Box. From today’s TSLA price of $336 per share, such a development could boost it to over $1,600 within the next 10 years.

Elon Musk is also counting on the mass deployment of humanoid Optimus robots. At Tesla’s 2024 annual shareholder meeting in June, Musk suggested this could land Tesla as a $25 trillion company in the distant future, making Tesla over 7x larger than present Apple (NASDAQ:AAPL).

After Donald Trump secured his belated 2nd term, it is fair to say that federal lawfare against Musk’s assets, including Tesla, will wind down. That is, if President-Elect Trump is serious about unraveling the political weaponization of institutions.

But outside of politics, and removing the weight on speculative FSD/robotaxis/robots, is Tesla on track to fulfill its core mission as an EV company?

Tesla’s Substantial Misallocation of Resources

Over the years, from poll to poll, it has been widely known that EV affordability is the main obstacle to EV’s mass adoption. This is typically followed by charging concerns and range. Elon Musk fully recognized this problem early on.

In 2016, Musk noted that a $35,000 Model 3 would be available by the end of the next year. After a two-year delay, by 2019, this temporarily materialized. But the model’s price ended up oscillating between the minimum of $42.5k and the maximum of $59.5k for a fully upgraded Long Range Model 3.

The new price threshold of $25k first popped up in 2020 at the Battery Day event. Most recently, Reuters reported that a $26.8k car is planned for production at Gigafactory Berlin-Brandenburg. In the meantime, Chinese EV manufacturers have already gone under the $15k price threshold.

Elon Musk has been fully aware of Chinese scaling operations, having said that “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world,”.

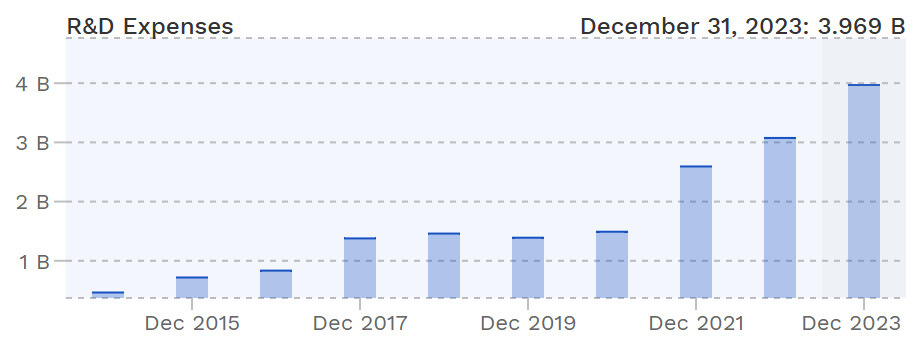

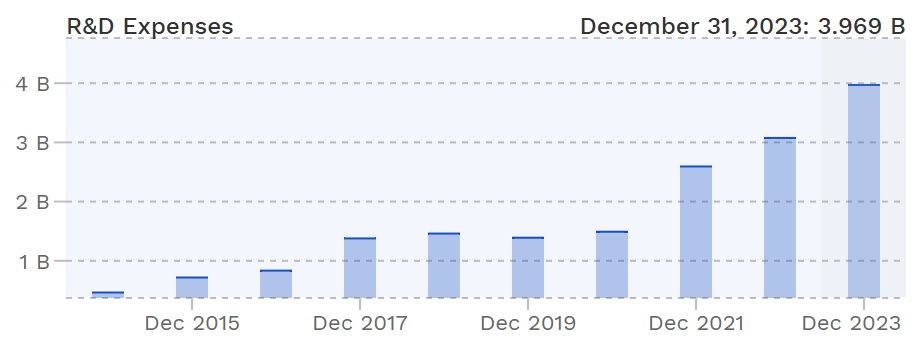

Yet, substantial resources in time, financial and human capital have been expended on Cybertruck. It has been estimated that this luxury pickup truck took over $2 billion R&D toll. By the end of 2023, Tesla’s R&D expenses climbed to nearly $4 billion.

More importantly, not only did Cybertruck significantly depart from Tesla’s established EV design, causing consumer confusion, but it did so in a negative manner. First, instead of tackling the EV affordability problem, Cybertruck escalated it, having gone from the first projected price of $40k to over $80k.

In 2016, Musk noted that a $35,000 Model 3 would be available by the end of the next year. After a two-year delay, by 2019, this temporarily materialized. But the model’s price ended up oscillating between the minimum of $42.5k and the maximum of $59.5k for a fully upgraded Long Range Model 3.

The new price threshold of $25k first popped up in 2020 at the Battery Day event. Most recently, Reuters reported that a $26.8k car is planned for production at Gigafactory Berlin-Brandenburg. In the meantime, Chinese EV manufacturers have already gone under the $15k price threshold.

Elon Musk has been fully aware of Chinese scaling operations, having said that “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world,”.

Yet, substantial resources in time, financial and human capital have been expended on Cybertruck. It has been estimated that this luxury pickup truck took over $2 billion R&D toll. By the end of 2023, Tesla’s R&D expenses climbed to nearly $4 billion.

More importantly, not only did Cybertruck significantly depart from Tesla’s established EV design, causing consumer confusion, but it did so in a negative manner. First, instead of tackling the EV affordability problem, Cybertruck escalated it, having gone from the first projected price of $40k to over $80k.

Throughout 2024, since Q3 ‘23, Tesla failed to beat earnings per share (EPS) estimates, yielding negative YTD performance. This changed after the Biden admin announced tariffs on Chinese EVs. On its own merit, Tesla eventually beat the EPS estimate in Q3 2024, at $0.62 reported vs $0.46 EPS estimated.

It is now expected that the Trump admin will rely on tariffs even more, which could stave off Chinese EV competition further for Tesla. Moreover, this could affect Japanese hybrid EV manufacturers.

It is still a big question if pure EVs will win the game in the long run. As noted at the end of 2023, Toyota’s hybrid rollout has been widely successful. After all, plug-in hybrids eliminate the range/charging concerns while also being roughly in the same price range as Tesla’s cheapest offering.

In the end, notwithstanding further Cybertruck-like blunders, the Elon-Trump alliance is poised to be beneficial for both parties in more ways than one.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.