Apple shelves Vision Pro revamp in pursuit of AI glasses to rival Meta - Bloomberg

- Tesla stock has had a rollercoaster year.

- Musk’s brief stint in the U.S. government and disappointing earnings weighed heavily on the shares.

- Is the recent pullback in Tesla a buying opportunity?

- Find undervalued opportunities across global markets for less than $9 a month with InvestingPro.

Tesla (NASDAQ:TSLA) shares have been on a turbulent ride since the start of the year. The stock spent roughly the first four months in a downtrend before finding a floor in April, followed by a modest rebound that quickly ran out of steam.

Since May, Tesla has mostly traded sideways, hovering around a pivot point near $320. As of Monday’s close at $339.03, the stock was still down 16% year-to-date.

Plenty of Reasons to Be Cautious on Tesla in 2025

Investors have had no shortage of reasons to tread carefully with Tesla this year. The steep decline in the early months of 2025 was largely triggered by Elon Musk’s entry into the Trump administration.

His new government role pulled him away from Tesla, with the CEO reportedly spending only a fraction of his time managing the EV maker—a concern that rattled shareholders.

Moreover, some of Musk’s highly polarizing stances in his official capacity took a toll on Tesla’s brand image. Reports emerged of vandalized Teslas, and sales took a noticeable hit.

Aware of the damage to Tesla and under shareholder pressure, Musk began distancing himself from his government duties in April and officially stepped down at the end of May. However, this was not enough to spark a meaningful recovery in the stock.

To make matters worse, Musk’s divided attention wasn’t the only drag this year. Earnings have been far from stellar. Tesla’s Q4 2024 and Q1 2025 results, released on January 29 and April 23, disappointed on both profit and sales.

The Q2 2025 numbers, published last month, met expectations but still showed a 23% year-over-year drop in EPS and a nearly 12% decline in revenue.

The Simpler Explanation: Tesla Was Overvalued

Beyond these headlines, there may be a more straightforward explanation for Tesla’s performance in 2025—it was simply overvalued.

Our Fair Value model—an aggregate of up to 17 respected valuation methods—flagged this as early as December 2024, before Donald Trump even took office. At that time, Tesla was overvalued by more than 30%.

On December 18, 2024, with Tesla trading near record highs at around $465, the InvestingPro Fair Value estimate pointed to a potential 33.54% downside.

In other words, Fair Value was warning that Tesla’s price had far overshot its fundamental worth. Sure enough, the stock began to slide, recording a drop of more than—you guessed it—30% from that December alert.

- Already an InvestingPro member? Then check out which stocks are the most overvalued in the market right now.

If not, then here's your chance to subscribe for half the price as part of our summer sale. This means you can access the list of picks for less than $9 a month for a limited time only.

How Much Is the EV Giant Really Worth Now?

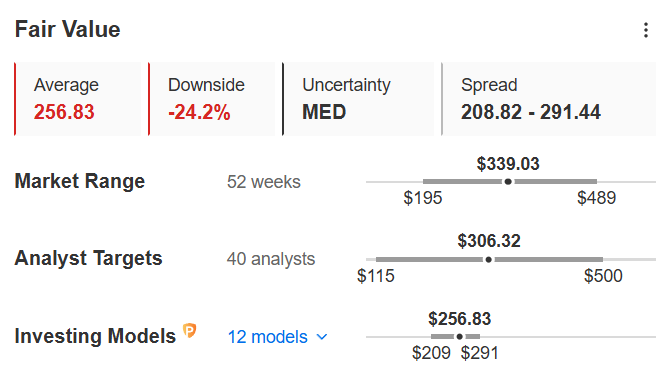

Today, with shares back at $339.03 and the latest Fair Value estimate for Tesla at $256.83, the stock still appears overvalued by more than 24%.

Source: InvestingPro

This suggests that Tesla’s troubles may not be over, and it’s still too soon—at least from a fundamental perspective—to bet on a sustained rebound.

How to Spot the Best Undervalued Stocks with Fair Value

For investors hunting for the next big opportunities, there are plenty of undervalued stocks to choose from right now.

The Investing.com screener currently identifies 258 U.S. stocks with an upside potential of over 50%, according to the InvestingPro Fair Value model.

- Are you an InvestingPro (Pro+ plan) member? Discover these 258 stocks on the screener by clicking here.

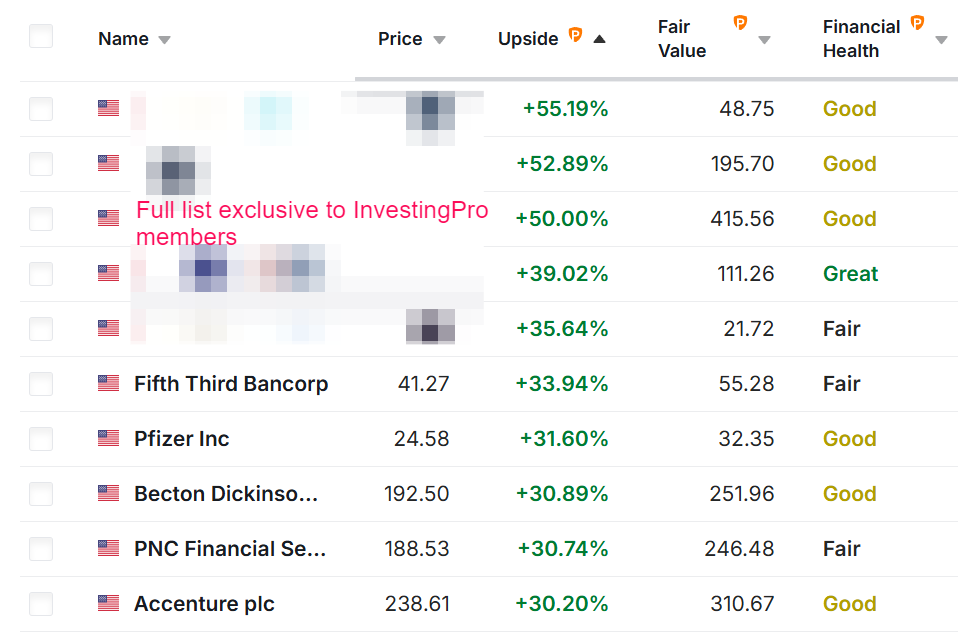

In addition to the screener, the Undervalued Stocks page on Investing.com features a constantly updated list of stocks flagged by InvestingPro Fair Value as having significant upside, along with solid financial health.

Right now, that page highlights 10 U.S. stocks with more than 30% upside potential and strong balance sheets.

Note: This list is available exclusively to InvestingPro members.

Bottom Line

InvestingPro Fair Value could have helped many investors sidestep Tesla’s slide this year—not through any magic formula, but by providing a practical way to assess whether a stock is over or undervalued using respected financial models.

Beyond helping investors know when to take profits (or which stocks to avoid), Fair Value is also a powerful tool for spotting undervalued stocks that could turn into strong buying opportunities.