Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

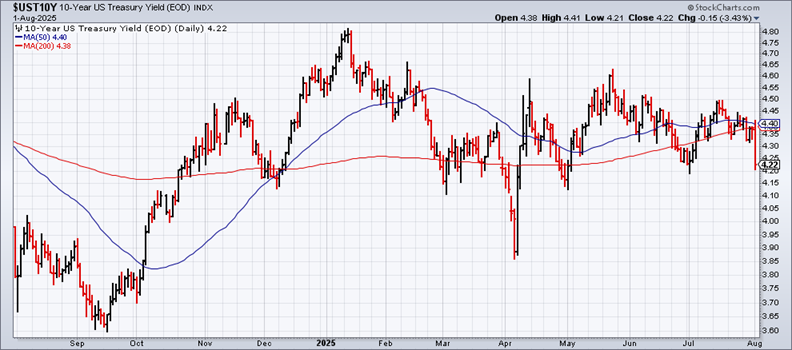

The bond market looks increasingly focused on slowing economic growth vs. tariff inflation. The two risk factors have kept the US 10-year yield trading in a range in recent weeks as investors weighed which threat was more pressing. Following Friday’s weaker-than-expected payrolls data for July, along with sharp downward revisions for hiring in the previous two months, Treasuries rallied, pushing yields abruptly down — a shift that suggests market sentiment is now prioritizing a softer economy as the leading driver for bonds.

The 10-year yield fell to 4.22%, the lowest close since April 30. It remains to be seen if the downshift holds in the week ahead. Incoming economic and inflation numbers will be keenly monitored. Meanwhile, the yield decline suggests that the recent range-bound market is giving way as expectations for softer economic activity prevail.

The catalyst for the dramatic slide in the 10-year yield: the Labor Dept. reported that nonfarm payrolls rose a modest 73,000, and May and June hiring was revised down to near-stagnant gains.

The soft payrolls data suggests that slowing economic growth is now the priority for the Federal Reserve vs. concerns that tariffs could lift inflation.

“The Fed’s job is becoming increasingly difficult based on the deterioration of the economic data,” said Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments. “These revisions are massive and really are a game changer to the Fed’s reaction function, and so I think [last week’s] Fed meeting is one that they’d like to revise” — a reference to the decision to leave rates unchanged.

The stock market seems to agree, and the S&P 500 Index posted its biggest weekly decline since the selloff in April.

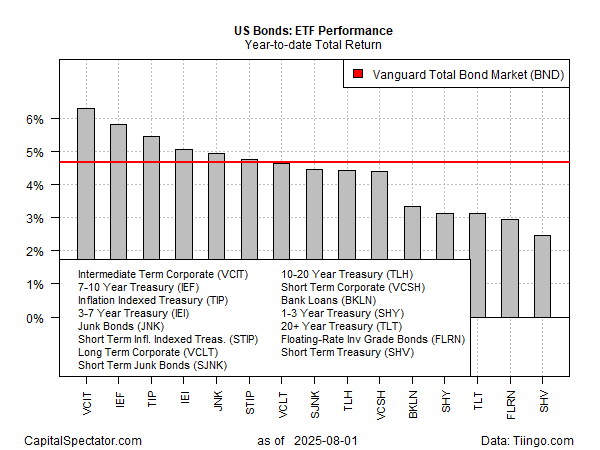

Bonds, by contrast, rallied sharply. The Vanguard Total (EPA:TTEF) Bond Market ETF (NASDAQ:BND), a proxy for Treasuries and investment-grade corporates, surged 1.0% last week to the highest level in more than three years.

Bonds are now posting solid gains year to date. The strongest fixed-income performer in 2025 is intermediate corporate bonds (VCIT), based on a set of ETF proxies, which is up 6.3%, just behind the US stock market’s 6.7% year-to-date rise vis SPDR S&P 500 ETF (NYSE:SPY).

Some economists are warning that the risk of a US recession is rising. As long as that view resonates in some degree, the safe-haven trade will likely endure, pushing bond prices higher and yields lower.

Market sentiment is now leaning heavily in favor of a rate cut by the Federal Reserve at its next policy meeting in September. Fed funds futures are currently estimating an 87% probability that the central bank will ease.

“Bond prices exploded higher on the all-important jobs report, as the door to a Fed rate cut in September just got opened a crack wider,” said Chris Rupkey, chief economist at FWDBONDS. “The labor market looks in much worse shape than we thought. Bet on it. The labor market is not rolling over, but it is badly wounded and may yet bring about a reversal in the US economy’s fortunes.”