Bill Gross warns on gold momentum as regional bank stocks tumble

- The Children's Place (NASDAQ:PLCE) is a specialty apparel retailer, with the stock down 42% YTD, trading near its 52-week low.

- InvestingPro+ suggests a strong upside for the stock based on its solid fundamentals, even as the sector faces broader headwinds.

- This article shows how we found The Children’s Place, what its set-up is, and what investors should watch for next.

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Looking For Value Opportunities

One of the challenges in the current challenging and volatile macro environment is to find a stock with attractive growth prospects. As the market continues to sell off, it seems like a new sector is hit everyday. Tech sold off long ago, financials have struggled, and most recently retail got hammered, with Target and Walmart plunging 29% and 20% last week following disappointing earnings results.

Bottom picking in this environment can be dangerous. At the same time, these past few years have shown how the market will overreact on both the upside and the downside, and there may be opportunities as a result.

In this article, we will analyze The Children's Place, Inc. (PLCE), which we believe is poised to outperform the market even amid ongoing inflationary pressures that negatively affect the Specialty Retail industry. Investors might consider The Children’s Place a safe haven given its low valuation, good fundamentals and upside potential.

Note: All pricing data is as of May 20th closing price.

Finding The Place

Let’s go step-by-step through the process of how we filtered down the potential stocks we could select to decide on The Children’s Place.

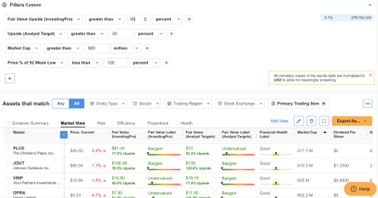

We’ll start using the InvestingPro+ screener preset to filter Strong Upside companies. We will apply a number of additional filters. Specifically, we are interested in stocks that trade near their 52-week lows, that are listed on U.S. exchange, and that have significant growth prospects.

So, in Stock Screener we first choose Strong Upside strategies and apply the following custom filters: (1) More than 50% fair value upside based on investing pro models, (2) more than 50% upside based on Analyst Target; (3) companies with greater than $500 Million market capitalization, and (4) Price % of 52-week low of smaller than 120%.

From the list of the companies matching the above filters, The Children's Place, Inc. has a very low PE ratio of 3.8x and over 70% upside potential. On the surface, that’s interesting.

Moreover, the company’s stock price is down around 42% since the start of the year, trading near its 52-week low.

The Children’s Place: Value or Value Trap?

Basic stats:

- Market cap: $617.1 million

- Current price/52-week range: $45.65 ($42.70 - $113.50)

- P/E Ratio: 3.8x

- Revenue compound annual growth last 5 years: 1.4%

The Children's Place, Inc. is an apparel retailer, operating 672 stores in the United States, Canada, and Puerto Rico, online stores at childrensplace.com, gymboree.com, and sugarandjade.com, as well as seven international franchise partners operated 211 international points of distribution in 16 countries. The company’s primary focus is small children’s apparel (sizes 4 to 14).

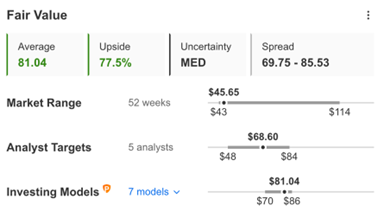

InvestingPro+ shows that the average price target for the five analysts who follow the stock, is $68.60 (50.2% upside from current stock price) as an average price target by 5 analysts, while the fair value based on InvestingPro models is $81.04 (77.5% upside from current stock price).

InvestingPro+ also rates the company’s financial health as a 3 out of 5, positioning The Children's Place, Inc. for good performance.

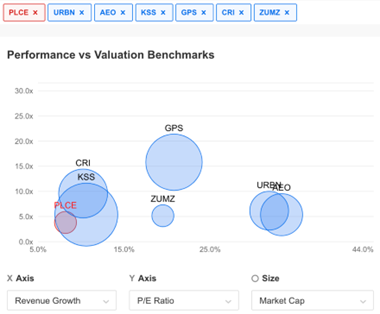

As can be seen from the Performance vs. Valuation Benchmarks graph, the majority of the company’s peers also have very low PE ratios.

The Headwinds PLCE is Facing

While PLCE, like most of its apparel retail peers, has experienced a meaningful year-to-date decline in stock price (PLCE is down over 42% YTD), they are still trading well below historical PE multiples.

Given the continued upward trend in consumer spending year-over-year, the industry does not appear to be in a recession (as may be assumed from near recession PE multiples) despite the challenging and volatile macro environment.

For The Children's Place in particular, the major headwind this year and into 2023 is higher raw materials costs, such as cotton. With raw cotton prices nearly doubling from pre-pandemic levels and continuing to climb higher, gross margins are under significant pressure.

The overall retail sector is also under pressure with accelerating macro and supply-chain/transportation headwinds. As mentioned above, Target and Walmart's sell-offs last week grabbed a lot of attention, and dragged many stocks down with them. Given the extreme negative sentiment, stocks with strong fundamentals that can ride out the headwinds could be interesting stories—like the Children’s Place.

Recent Earnings Sign of a Bottom?

On May 19, The Children's Place, Inc. reported its Q1 results, with EPS of $1.05 coming in worse than the Street estimate of $1.46. Revenue was $362.4 million, missing the Street estimate of $401.59 million. The quarter was negatively impacted by an unprecedented level of inflation, which has a significant impact on the lower income consumer, particularly due to higher gasoline and food prices. The company reaffirmed confidence in its margins and EPS outlook for the year, however.

Following the Q1 results, Dana Telsey, an analyst at Telsey, lowered the price target on the company’s shares to $70.00 from $80.00, while reiterating an Outperform rating. Paul Lejuez, an analyst at Citi, lowered the price target to $48.00 from $60.00, while reiterating a Neutral rating.

For all that, Children’s Place rose 10% after earnings, suggesting that sentiment had swung too far against the company’s fundamental position. While PLCE shares have given back some of that gain (and some of the prior loss was related to Walmart's and Target’s sell-offs), it is a reminder that low valuations and extreme sentiment can turn into positive returns.

The Children’s Place: The Place for Bottom Fishing

At a price point of $45.65, near its 52-week low, we believe The Children's Place, Inc. is undervalued. First of all, given both the InvestingPro model based fair value estimate of $81.04 and analysts’ average target of $68.60, there is a case for upside of 50.2-77.5% in the next 12 months.

Second, the InvestingPro+ financial health score of 3 positions the company for a good performance, and the company (as well as most of its peers) appears to be undervalued, as suggested by the low PE ratio of 3.8x, even after a significant YTD stock price decline of nearly 42%.

Third, while the main headwind the company faces, rising cotton prices, is expected to persist and could have a negative impact on gross margins, longer term cotton futures suggest prices will come down into the summer and fall, heading toward the $110-$130 range.

And finally, despite the Q1 miss, management is still confident the company is able to reach a double-digit EBIT margin and EPS in 2022 and beyond. Management also noted that the company’s cost structure has changed meaningfully since pre-pandemic—significant merch margin gains, a more productive store fleet, a mix shift to higher margin ecommerce, and improvements in digital fulfillment—and can withstand revenue shocks.

So, the specific pressures the company is facing might ease, and the fundamentals suggest a turnaround for shareholders before too long.

Disclaimer: The author has no positions in The Children's Place, Target (NYSE:TGT), Walmart (NYSE:WMT), or any other stock mentioned.