Vsee Health regains Nasdaq compliance after equity increase

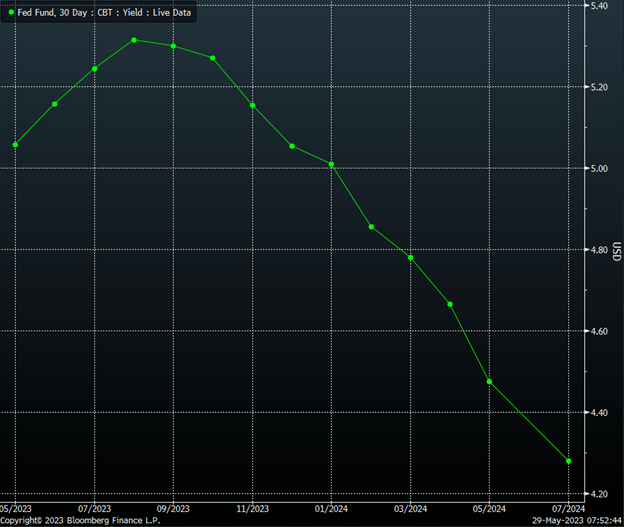

The upcoming week promises to be busy in the stock market, with significant data due for release, ranging from ISM manufacturing figures to the BLS job report. The PCE data, disclosed last Friday, suggests the Federal Reserve still has substantial work ahead, nudging the likelihood of a rate hike back to 60% for June and almost a 100% chance by July. Additionally, any prospects of rate cuts have been removed for 2023.

The Jobs data on Friday is anticipated to reveal an uptick in the unemployment rate to 3.5% from 3.4% last month and a drop in job creation figures to 190,000 in May, down from 230,000. Meanwhile, average hourly earnings are predicted to have risen by 4.4%, maintaining pace with the previous month. If these figures meet or exceed estimates, it seems probable that more rate hikes will be factored into future forecasts.

For weeks, I have been emphasizing that the trajectory for interest rates is higher for a longer duration. This forecast and thought process seems to be unfolding as expected, with rates experiencing a steep increase in recent weeks. Much of the escalation is noticeable at the longer end of the yield curve, with the 30-year nominal rate now at 3.95% and on the verge of exceeding the 4% threshold once more, which may lead to an advance approaching its October peak.

While the economy may be heading into a recession someday, that day is not here yet. We continue to be in this slowing growth, high inflation environment, which means the pressure will remain on the Fed to keep rates higher.

Meanwhile, the higher rates and prospects for more rate hikes push the dollar higher. The dollar could still climb further, and how high the dollar ultimately rises will depend on how wide the spreads between U.S. and international rates become. In the meantime, 105.80 is one place where the DXY may consolidate.

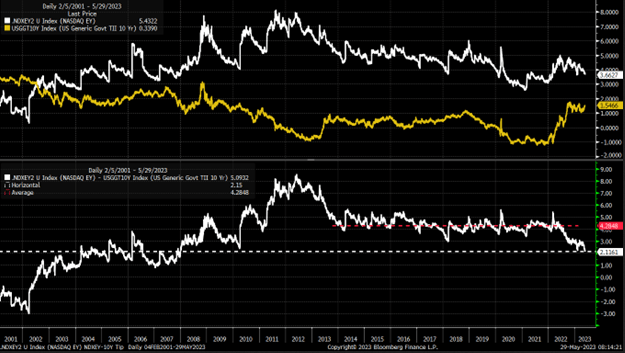

Equities have been ignoring the rate move due to concerns over the debt ceiling. That is very noticeable in the equity risk premium, which measures the difference between the NASDAQ 100 earnings yield and the 10-Year real yield.

The spread is currently just 2.11%, which is the narrowest the spread has been since 2007, and that narrowing, I believe, is a defensive push as investors are looking for a place for safety during the period of interest rate risk. The larger mega-cap stocks offer safety and make up a large portion of the NASDAQ 100 overall, given they are liquid, have large balance sheets, and sometimes have market values larger than most countries.

If this has been a defensive move, and these names have been merely a hiding spot, then with the debt ceiling now resolved, the trade could quickly unwind. Remember, it isn’t always about the return on capital, but the return on capital that always drives investors during periods of heightened uncertainty.

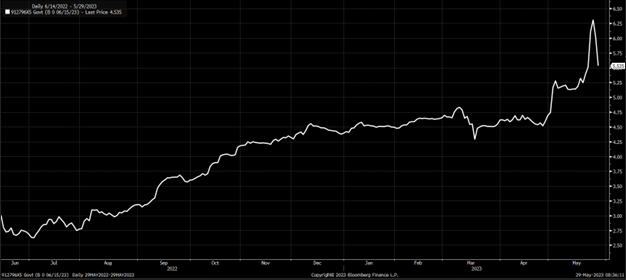

T-Bills have shown tremendous volatility heading into the debt ceiling debate, with yields spiking to 6.3% on May 24 on the bills maturing at the beginning of June.

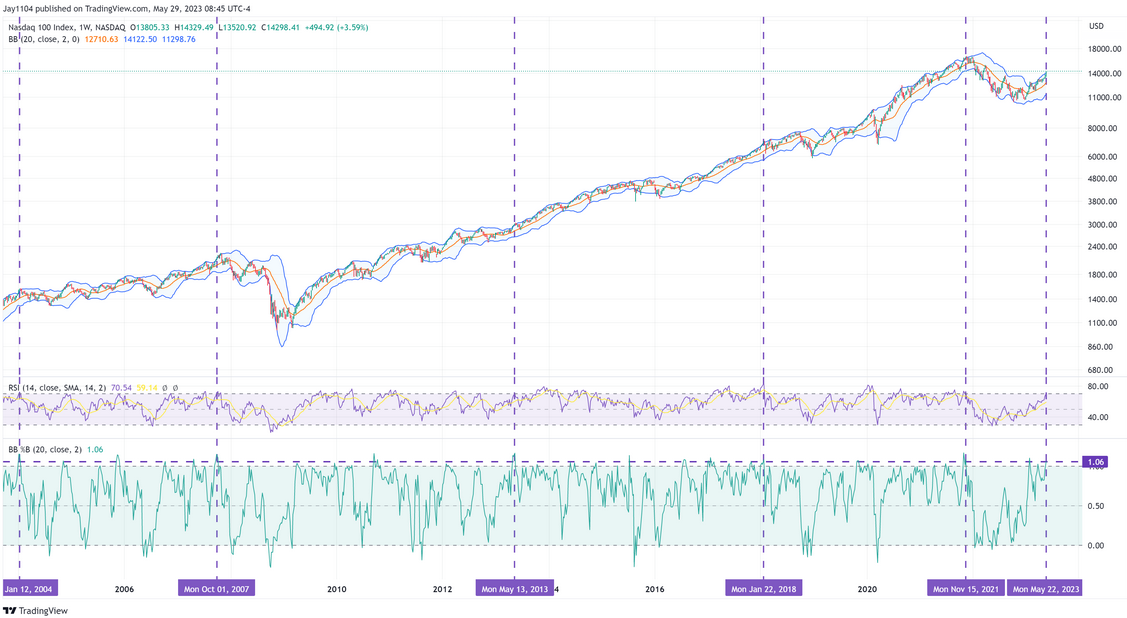

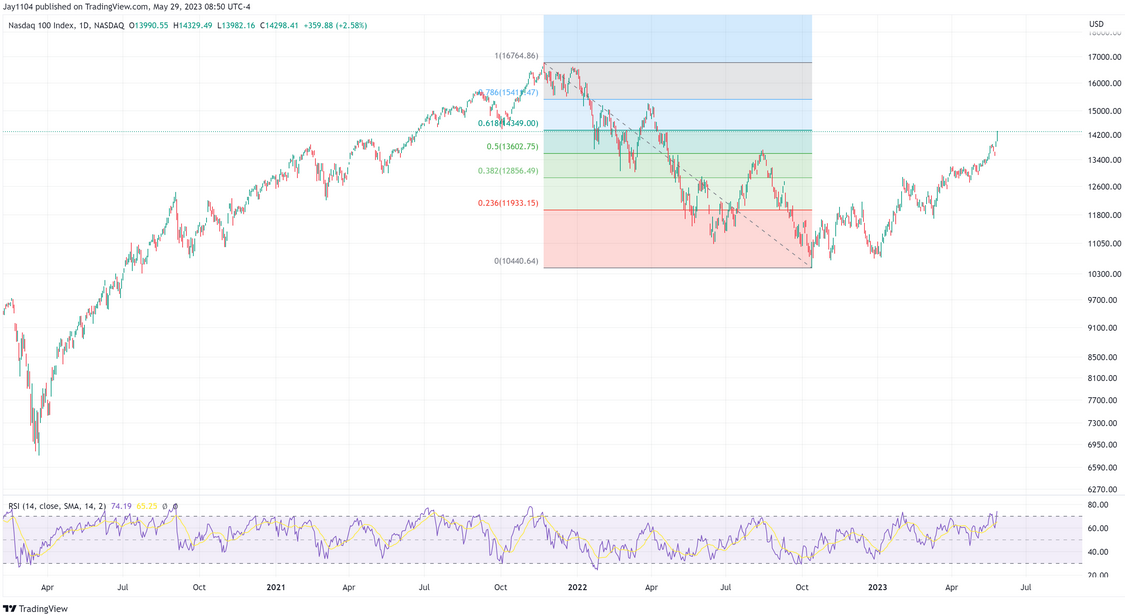

So not only could the debt ceiling be a sell-the-news event, but from a technical standpoint, the NASDAQ 100 is extremely overbought on the weekly chart. There have only been a handful of times since 2004 where the NASDAQ 100 has seen its RSI close above 70 on the weekly chart and the index close above 1.06 on its Bollinger Band. From what I can tell, those times came in January 2004, October 2007, May 2013, January 2018, November 2021, and now. In all of those cases, a sizeable decline followed.

Additionally, the Nasdaq 100 has retraced 61.8% of its decline from the November 2021 high. This is the deciding factor of whether this is a bear market rally or the start of a bull market. Because if this is merely a retracement, then the NDX shouldn’t rise much beyond that 61.8% boundary.

The same happened in the 2008 decline, with the index rising to the 61.8% boundary before stopping and turning lower again. It stalled out at that retracement level for several weeks. There is nothing outside of the norm in what is taking place in the market today compared to what has been witnessed in the past.

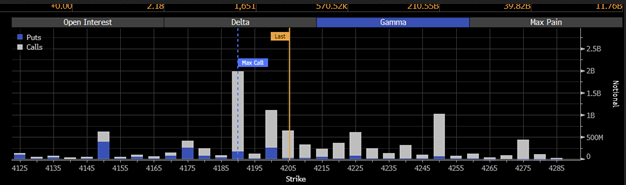

Meanwhile, the S&P 500 still can’t break beyond the 4,200 level, which has been a strong resistance zone. One of the main reasons for this is the presence of a significant call wall in the options market. There is a substantial amount of call gamma concentrated in the 4,200 to 4,225 range, particularly leading up to the expiration on May 31.

Also, at this level, the index trades at 19 times current year earnings. The market has been indicating for months that the S&P 500 is not perceived to be worth more than 19 times its earnings.

Anyway, good luck this week.