Flutter Entertainment beats Q3 earnings estimate despite sports results impact

One of the biggest stories of the past week has been the synchronized strike by the United Auto Workers (UAW) against the Big Three auto makers in Detroit. Although so far only 13,000 workers out of the 146,000 who pledge allegiance to the UAW have struck, the strategy of striking against each of the Big Three at the same time is interesting.

In the past, the UAW would choose a particular automaker to strike, win concessions from that company, and then use the new contract as the basis to cudgel the other automakers into a similar deal. This would completely shut down one company, but not the entire country’s car-making capacity. In this case, the UAW is significantly impacting operations at all three while not completely shutting down any of them – although the implicit threat is that they could, at any time, do so.

What is also interesting is that the demands of the union are aggressive, not to say ambitious. The union is asking for a 36% increase in pay, implemented over four years…plus a reduction to a 32-hour work-week while being paid for 40 hours.

Combined, those two demands represent a 70% increase in compensation per hour for a union employee (or, put another way, assuming that a car can’t suddenly be made with 20% less labor, it means the cost of labor going into the vehicle will increase 70%). Additionally, they want a restoration of defined-benefit pension plans and contracted cost-of-living adjustments, which isn’t included in that 70% figure.

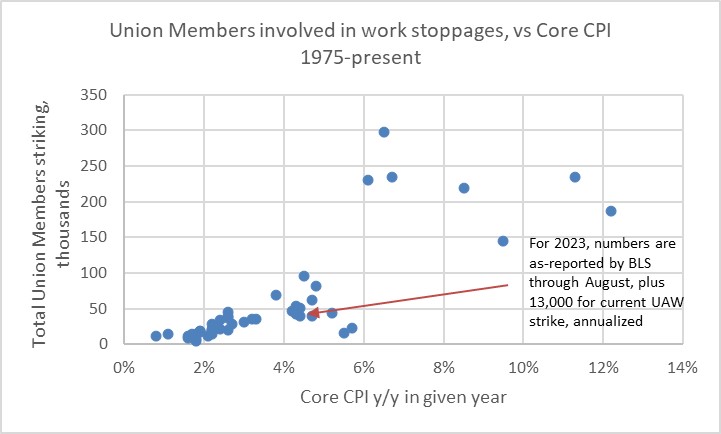

Whether or not the union is able to get a sizeable portion of its demands (so far, the auto companies have offered 20% over four years, but the other components of the deal are at least as important), this clearly stands out as one of the most audacious labor asks of the last quarter-century. The timing should not be surprising. Historically, union size and activism is positively related to the level of inflation (see chart, source BLS).

You might think that unions also strengthen when unemployment is high. This is not as true as you would think: when unemployment is high, the union would be asking a company to deliver jobs even though there is no work to be done and the company’s viability may be threatened by a weak economy.

Consequently, union actions in a recession tend to be less vigorous (the UAW in fact points out that they made concessions in the Global Financial Crisis to help keep automakers afloat), and unionization is less valuable to the workers in those cases.

But in inflation, the union is asking the company to give more to the workers it has and needs, out of its growing revenues and profits (even though those revenues and profits look less impressive, and may even be shrinking, after inflation). Moreover, while unemployment hurts the workers who are unemployed (and unable to pay union dues, also), inflation hurts all workers. Consequently, it is inflation and not unemployment that energizes unions.

Naturally, this is part of the feedback loop that concerns policymakers. When I talk about the wage-price feedback loop, I’m generally talking about how it manifests in core services ex-shelter (“supercore”), where a large part of the cost of the product is labor.

In the case of a car, labor is only about 15% – although the exact figure depends who you ask and whether you’re asking about the percentage of cost or the percentage of price. So a 70% increase in that cost would “only” add about 10% to the cost/price of a new car whereas a 70% increase in the cost of an accountant would raise the cost of getting your taxes done by something pretty close to 70%. However, union power has its own momentum, and it manifests in things like (for example) automatic cost-of-living adjustments and persistent pressure on fringe benefits and pensions from a union whose influence in this sort of environment is growing.

That’s not to say that it’s good or bad – but this is another cost of letting the short-term inflation spike linger on by not addressing it by aggressively shrinking the balance sheet early on.

The longer inflation stays higher, the more power unions have. And the more power unions have, the more momentum inflation has.