InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

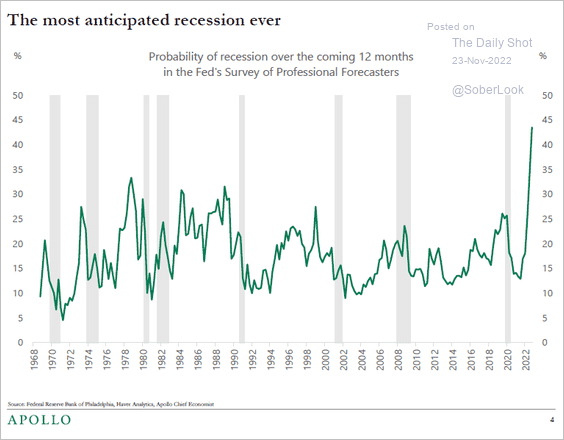

The risk of a recession in the U.S. is not zero. This is particularly true as the current Administration tackles Government bloat and implements tariffs. However, before we discuss why the risk of a recession could increase, it is crucial to remember the 2022 experience. At that time, most economists were convinced a “recession was imminent.” As discussed in early 2023, it was the most anticipated recession ever.

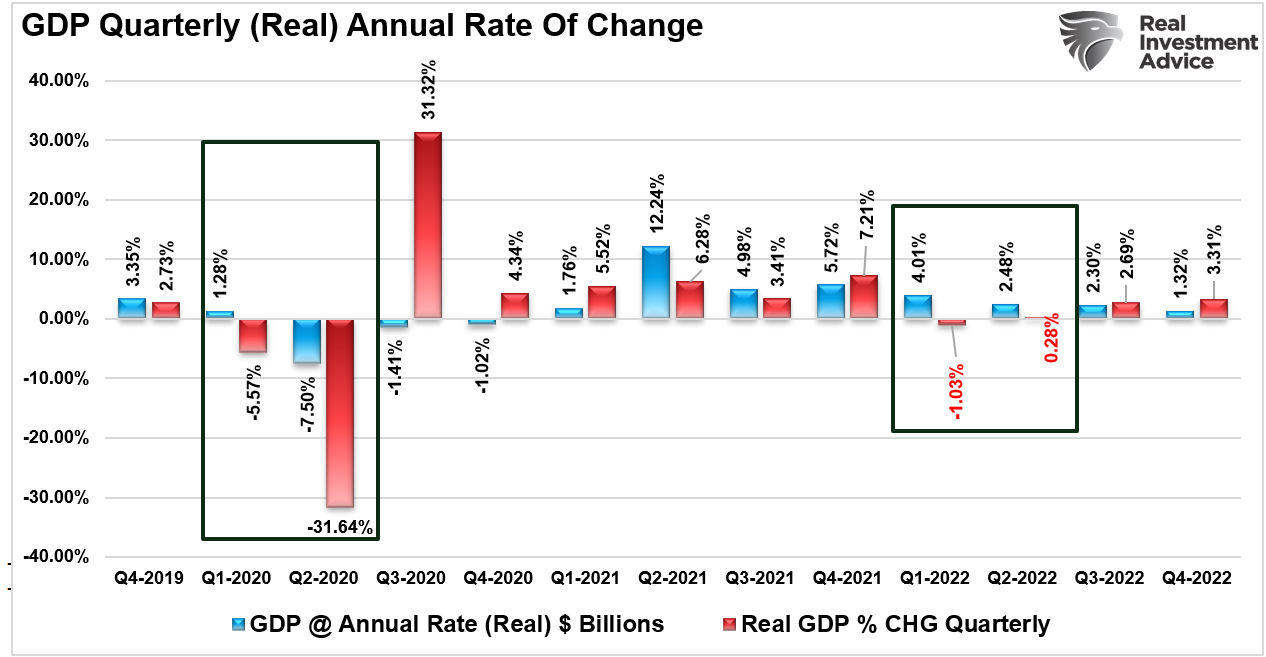

The economy printed very weak quarterly reports in early 2022. Therefore, it was just a function of time before the National Bureau of Economic Research (NBER) announced it.

Yet, it never occurred.

As we penned at the time, there were two reasons for this. The first was the signal from the financial markets.

“While the “recession alerts” from various sources suggest a forthcoming recession, the market continues to trade more bullishly. The market is often said to be a leading indicator of the economy. Therefore, market participants suggest an economic recovery is at hand. A case can be made that data has become so negative that even economic stabilization may start turning sentiment-based surveys more optimistic.”

Those signals turned out correct, as economic surveys turned more optimistic and earnings growth expanded as the economy accelerated.

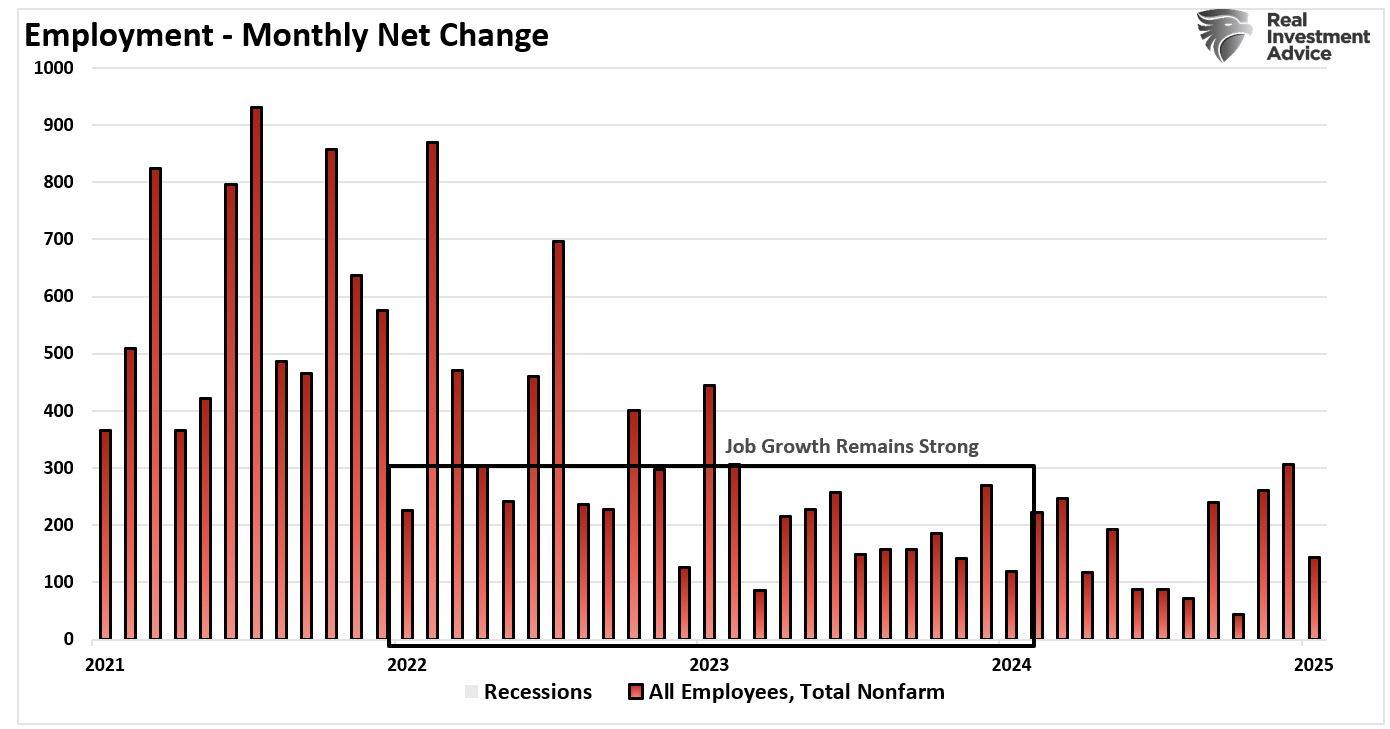

As the NBER later noted, the second reason is that employment never fell to recessionary levels. Despite recessionary indicators like inverted yield curves and the Leading Economic Index suggesting a recession was forthcoming. The hopes of a “soft landing” scenario were squarely pinned on the consistently strong employment reports.

Notably, the NBER was correct in not calling a recession based on two-quarters of very weak GDP prints. Employment is the backbone of a consumption-driven economy. Therefore, the consistently strong employment reports suggested the economy would likely begin to accelerate, which it did.

However, the risk of a recession may now increase as the Trump Administration attacks the three previous economic supports.

Spending, Immigration & Employment

As noted, while many indicators suggested a recession was imminent in 2023, we said three factors kept the economy from declining.

- Massive federal spending via the Inflation Reduction and CHIPs acts

- Accelerated immigration provides companies with cheaper labor

- Massive expansion in Government hiring.

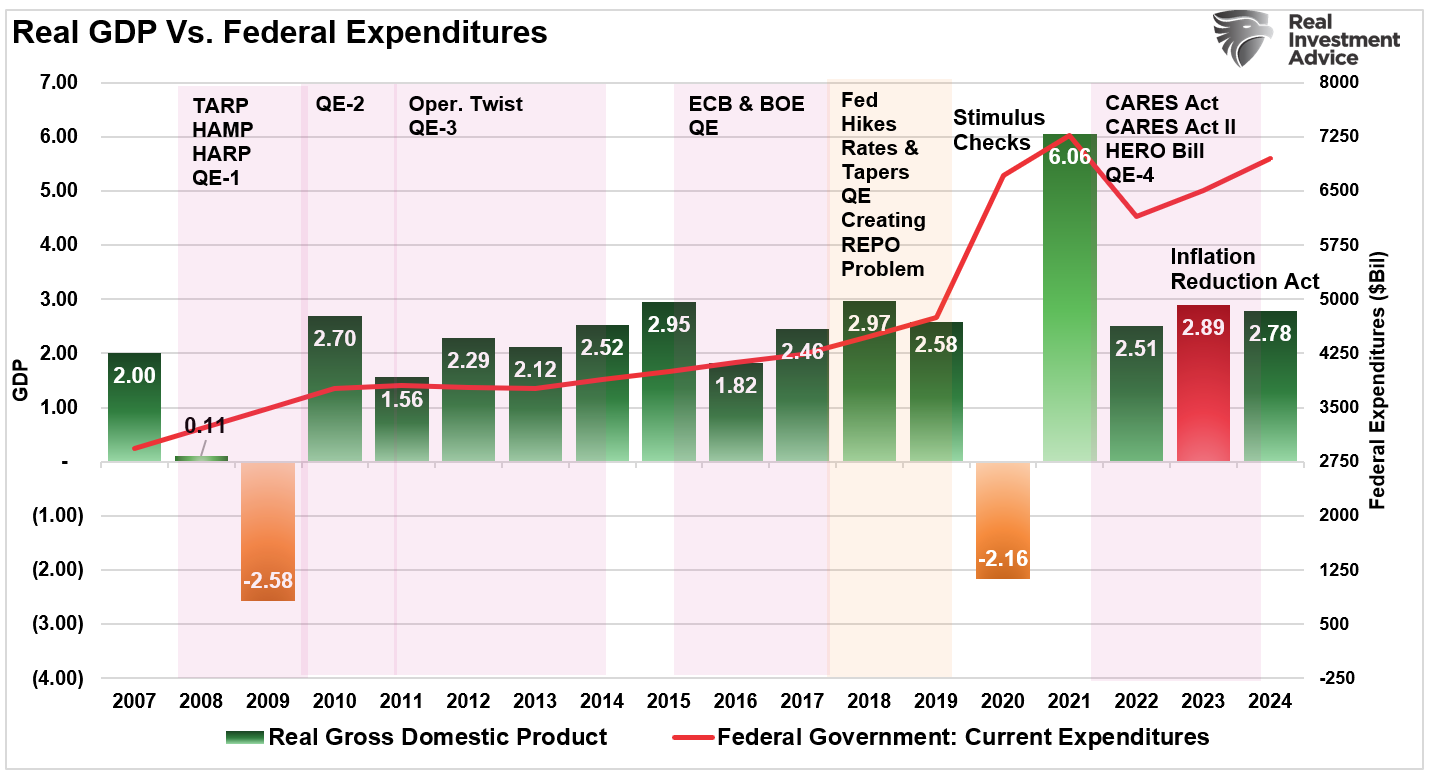

The amount of federal spending injected into the economy was enormous. Therefore, the economy’s strength was unsurprising, given the ongoing financial stimulus from the Inflation Reduction Act and the CHIPS Act and a surge in deficit spending. As we discussed, deficit spending keeps the economy out of recession.

“As noted, the problem remains on how the economy has avoided a recession despite the Fed’s aggressive rate hiking campaign. Numerous indicators, from the leading economic index to the yield curve, suggest a high probability of an economic recession, but one has yet to occur. One explanation for this has been the surge in Federal expenditures since the end of 2022 stemming from the Inflation Reduction and CHIPs Acts. The second reason is that GDP was so grossly elevated from the $5 Trillion in previous fiscal policies that the lag effect is taking longer than historical norms to resolve.”

That surge in spending has a relatively long “lag effect,” as it takes time from the passage of the fiscal spending bills to distribution to economic utilization.

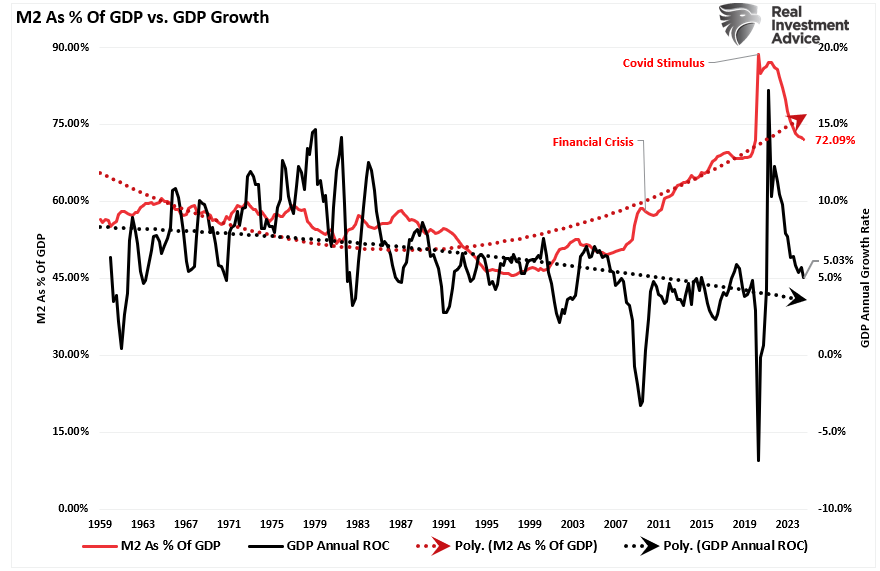

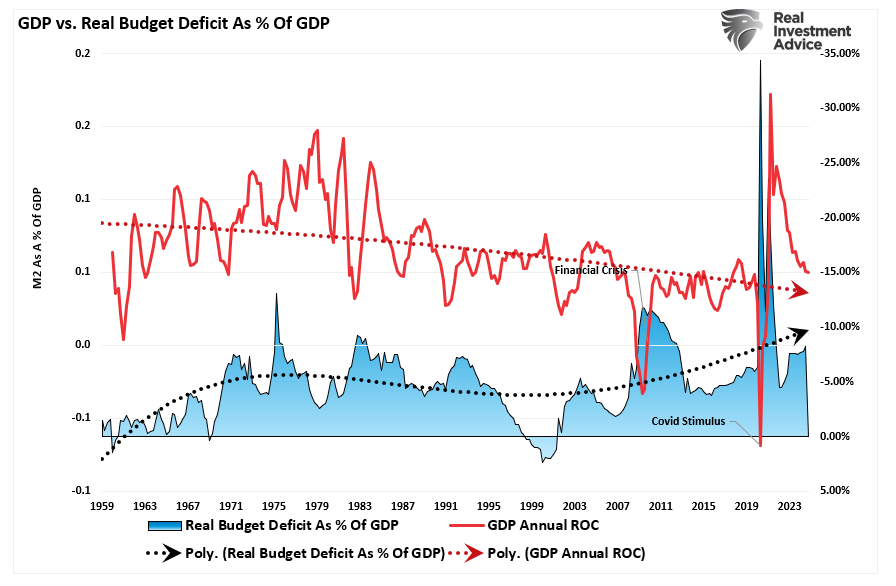

Billions of dollars remain in those bills, seeping into the economy. However, budgetary support for the economy is declining as the amount of M2 as a percentage of GDP reverses.

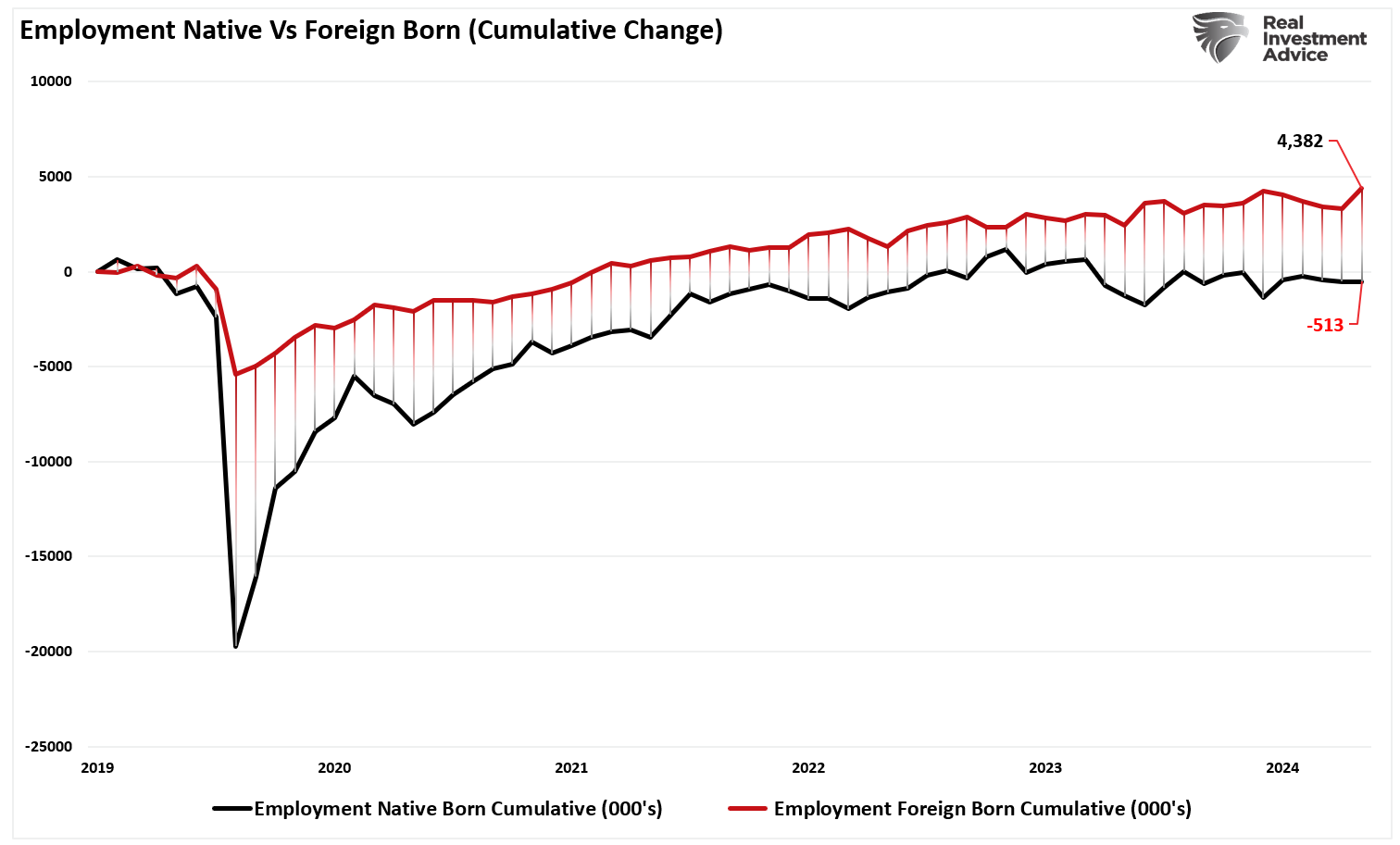

Secondly, two primary drivers were behind the “consistently strong” employment reports. The first was the massive influx of immigration into the U.S., which led to a surge of “cheaper” employees for companies to boost profit margins. Since 2019, foreign-born employment has increased by 4.38 million jobs, while native-born employment has dropped by 513 thousand.

Federal Reserve Chairman Jerome Powell noted that point in a 60-Minutes Interview. To wit:

“SCOTT PELLEY: Why was immigration important?

FED CHAIR POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans. But that’s primarily because of the age difference. They tend to skew younger.“

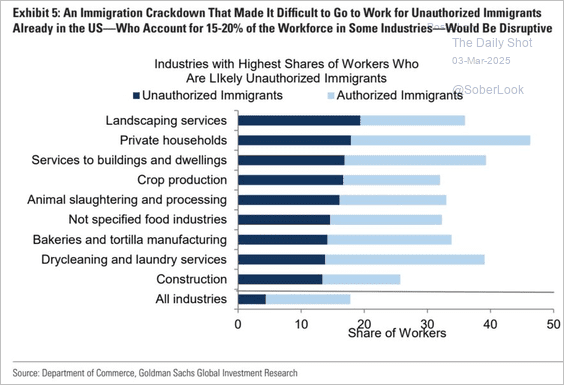

As shown below, hiring unauthorized immigrants has been significant in recent years.

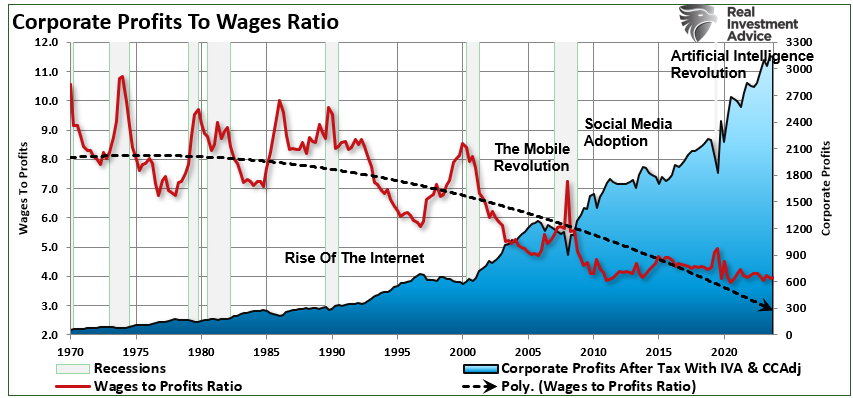

If Jerome Powell is correct, hiring unauthorized immigrants has helped suppress wages. When combined with increased productivity, it reduces the amount of required labor improving corporate profitability.

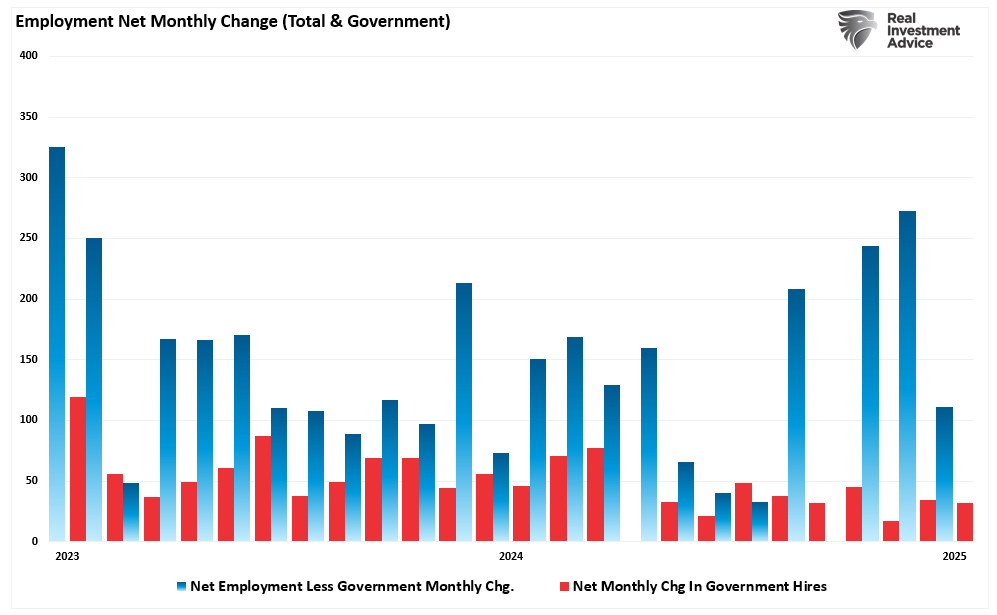

Lastly, a significant chunk of the “stronger than expected” employment reports also came from Government hiring.

As shown, post-pandemic, Government hires comprised a large portion of the monthly net employment change, particularly in 2022 and 2023.

However, the current Administration is now keenly focused on reducing immigration, cutting the size of government, and reducing the deficit.

The Risk Of A Recession Is Not Zero

As noted, since the beginning of the year, immigration flows into the U.S. have dropped dramatically as U.S. policy toward immigration has tightened significantly. While the full impact of these changes has yet to be felt, they will most likely appear in areas primarily exposed to cheaper labor, such as restaurants, leisure and healthcare, construction, and manufacturing-related industries. Those areas have provided substantial employment gains over the last few years, so any reversal will not go unnoticed.

Secondly, with the Department of Government Efficiency (DOGE) working to streamline government expenditures, reducing Government spending will also negatively impact economic growth. The chart below shows the budget deficit as a percentage of GDP (inverted) versus the annual rate of change in GDP.

What should be noted is that when the budget deficit increases, so does the economy. This is because increased government spending eventually finds its way into the economy. Therefore, if DOGE is successful in its endeavors to reduce Government spending and, more notably, Government employment, it will reduce the deficit by extracting capital from the economy.

What is crucial to understand is that the surge in monetary support acted as an “adrenaline” boost to the economy. Yes, many economic data series still suggest the risk of recession is elevated. However, the surge in government spending has kept the economy afloat, defying economists‘ “recession predictions” in recent years.

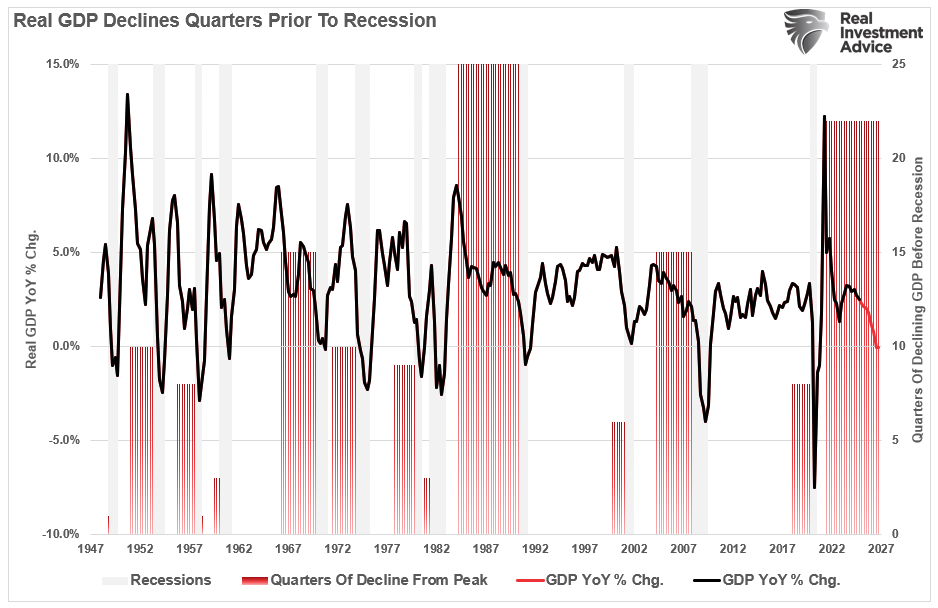

The crucial point to understand, and what eludes most economists, is that the economy will slow as that “adrenaline” boost fades. Had the economy been growing at 5% nominal, as in 2019, the decline from the post-pandemic peak would already register a recession.

However, given that nominal growth neared 18%, it has taken much longer than normal for growth to revert below zero. To show this, we looked at the number of quarters between peak economic activity and the entrance into a recession. Using that historical analysis, we can estimate the reversion of economic growth into a recession could take roughly 22 quarters. Such would time the next downturn in late 2025 to mid-2026.

Many things could certainly happen to lengthen or shorten that estimated time frame. However, it is essential to note that a reversal of growth from elevated growth rates has taken much longer than usual, making mainstream economists comfortable claiming victory of the “soft landing” in the economy.

Yes, there are very few indications of recessionary risk today. However, with the current Administration’s focus on reducing government spending and immigration while imposing tariffs on our trading partners, the risk of a recession later this year or next is likely not zero.