Intellia presents positive data for hereditary angioedema treatment

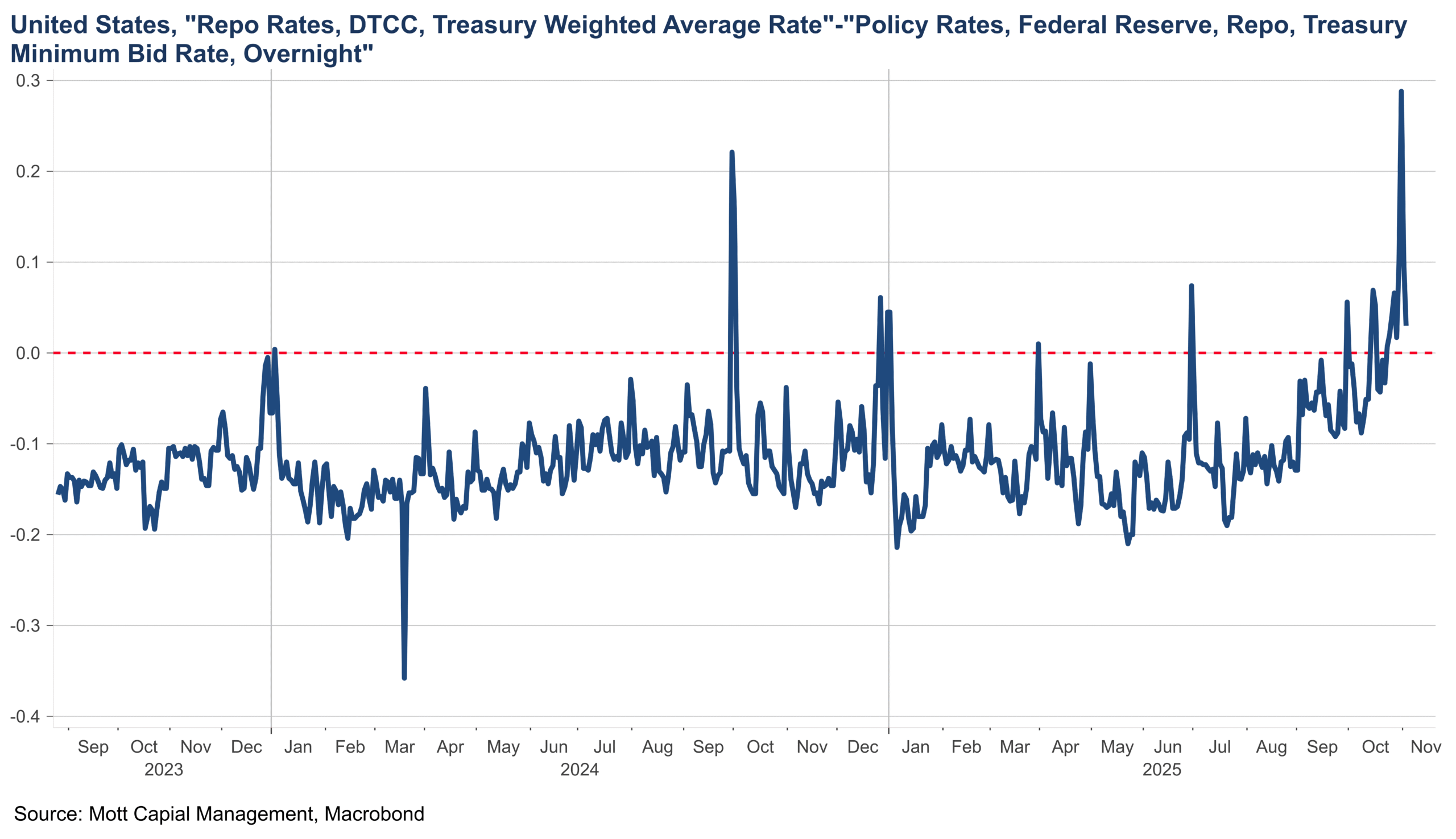

When you look across the market landscape, it’s becoming fairly apparent that the liquidity drain we’ve been witnessing—likely starting in mid-July with the steady rebuilding of the TGA—has now caught up with much of the market.

Bitcoin, which I think of primarily as a liquidity gauge, was hammered on Tuesday, dropping as much as 7% at one point and currently trading down about 6.5%. It broke through significant support around 101,000, and the big question now is whether it’s headed toward 93,000.

There aren’t many asset classes that trade more directly in line with liquidity than Bitcoin. Historically, there’s been a clear relationship between reserve balances and Bitcoin’s performance, and it looks to me like we’re now starting to see the effects of that tightening show up in full force.

We’ve seen overnight funding pressures ease since month-end, but liquidity conditions remain extremely tight, with little sign of improvement anytime soon—unless the Fed were to expand its balance sheet again, which seems highly unlikely.

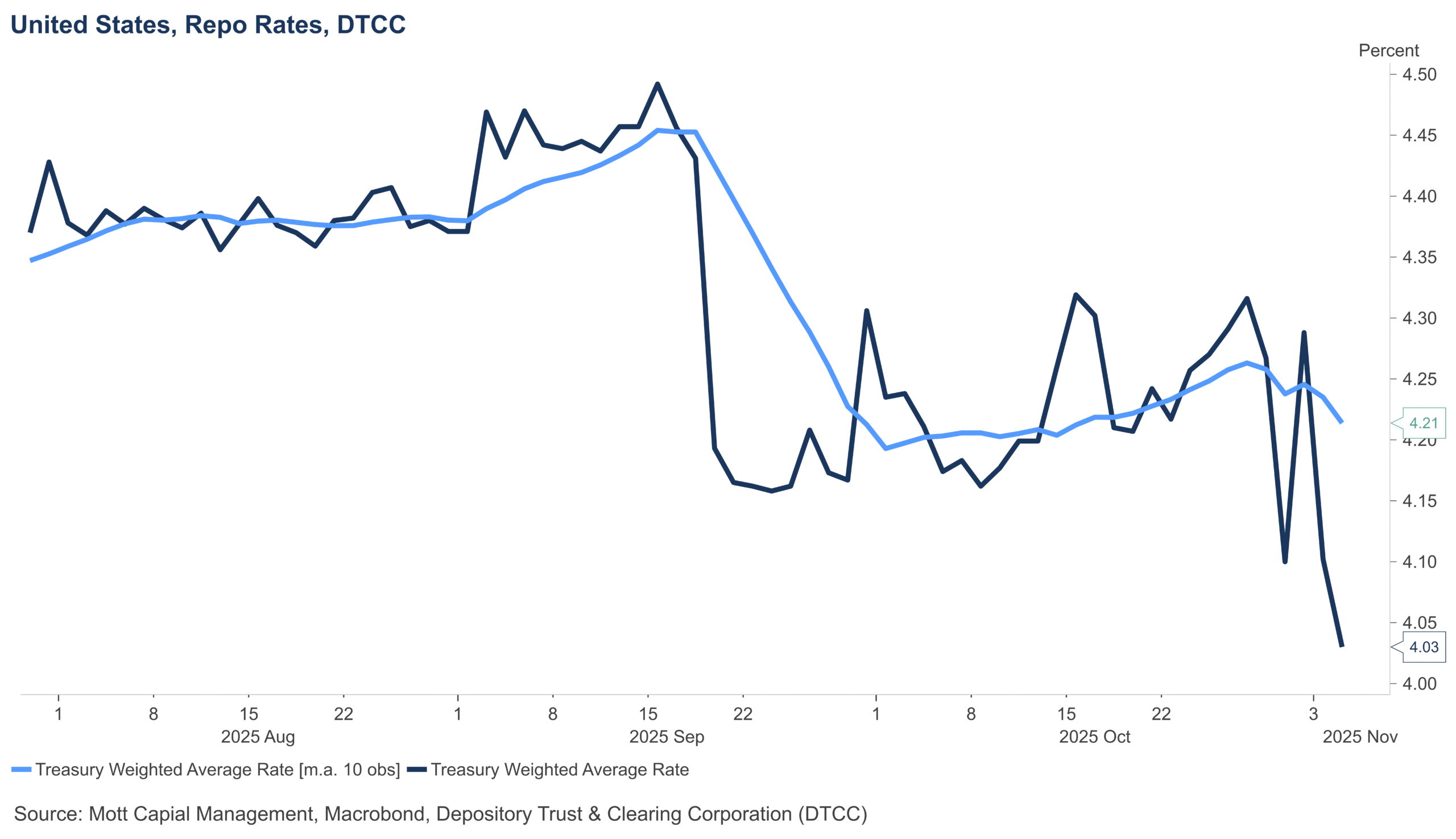

On Tuesday, the average repo rate at the DTCC fell to 4.03%. That’s still above the Standing Repo Facility rate of 4% and remains well above the effective federal funds rate. This continues to signal that liquidity conditions are strained and that demand for repo access remains elevated.

The investment-grade CDX spread index widened again on Tuesday. It’s been trending wider for the past few sessions, though it remains relatively low at around 54. Still, it appears to be moving higher, which would make sense—particularly if we continue to see credit spreads like Oracle’s (NYSE:ORCL) widen the way they have. If that trend persists, it stands to reason that other investment-grade credit spreads will also begin to widen.

Historically, Oracle’s five-year CDS has tended to move in line with the CDX Investment Grade spread, so it wouldn’t be surprising to see the investment-grade spread continue to widen from here.

The US dollar continued to show signs of strength on Tuesday ahead of today’s ADP jobs report. The US dollar index rose to 100.2, breaking above what appears to be the neckline of a double-bottom pattern that has been forming over the past six months. This breakout suggests the US dollar index could be on its way toward the 102 level.

The stronger US dollar will only worsen liquidity conditions. In addition, widening credit spreads combined with a firmer US dollar will translate into tighter financial conditions. Risk assets typically struggle in such environments, so if both the US dollar and credit spreads continue to rise, it would serve as a major red flag for the stock market.