United Homes Group stock plunges after Nikki Haley, directors resign

The Federal Reserve raised interest rates again this week and Chairman Jerome Powell says more hikes are coming. The bond market disagrees.

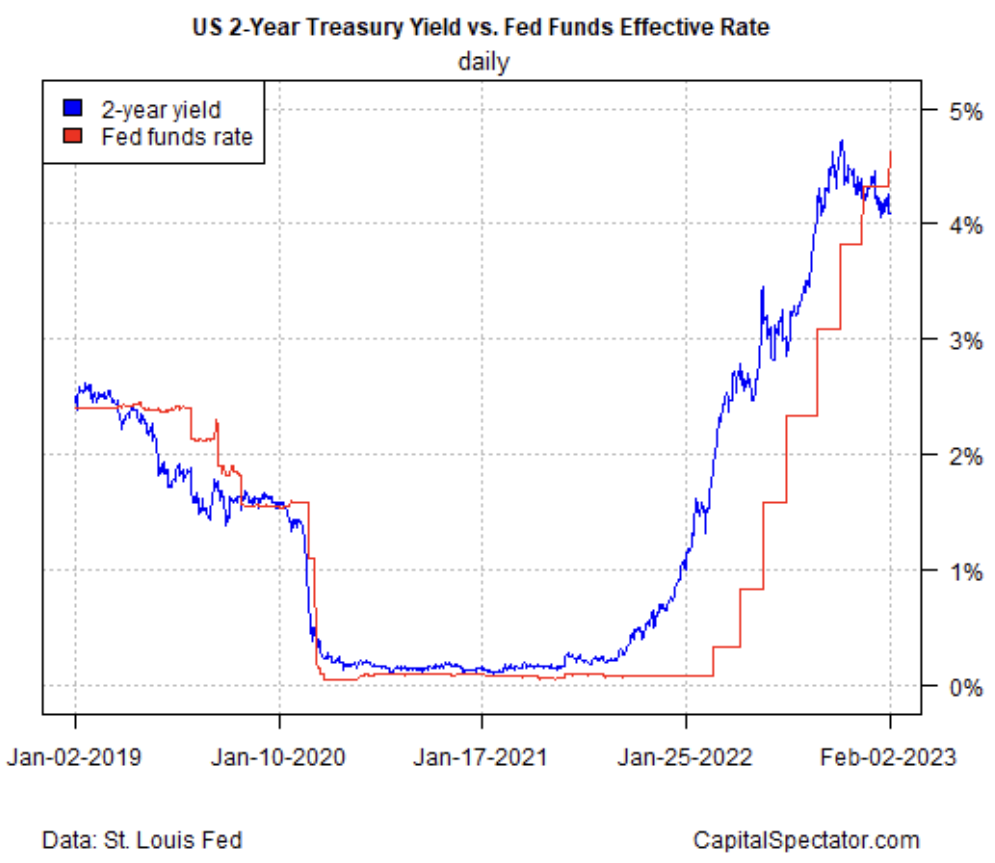

The 2-Year Treasury yield – widely monitored as a proxy for rate expectations – continues to trade well below its recent peak, holding steady at 4.09% on Thursday (Feb. 2). After the Fed’s 25-basis-points increase in the target rate to a 4.50% - 4.75% range on Wednesday, the spread widened and so the market’s implied forecast for a rate cut strengthened.

At the press conference following the Fed’s rate hike, Powell said, “It is our judgment that we’re not yet in a sufficiently restrictive policy stance, which is why we say that we expect ongoing hikes will be appropriate.”

But “the markets aren’t buying what the Fed is peddling,” advises Kroll Institute’s Global Chief Economist Megan Greene.

The diverging trends in the 2-year rate vs. Fed funds highlight this contrast. The downside bias in the 2-year yield vs. rising Fed funds implies that the market’s implied forecast that the end of rate hikes and the start of rate cuts is near.

The process worked in reverse in late-2021, when the 2-year yield began persistently rising above the Fed funds rate. As the spread became relatively wide, the central bank began lifting rates. Recent market action suggests this is about to unwind.

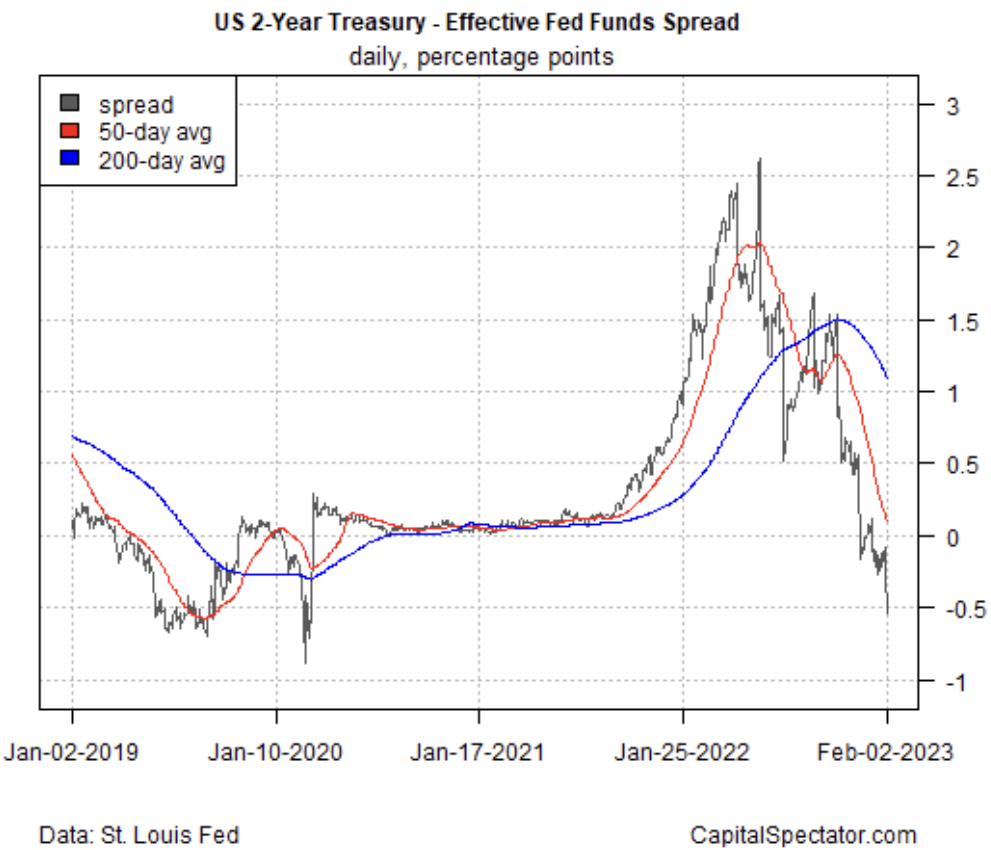

The next chart shows the degree of the spread in recent history. The main takeaway: the market’s forecast is comparatively robust in projecting a rate cut in the near future.

For the moment, the Fed still looks set to keep rates high and perhaps push a bit higher. Fed funds futures are pricing in an 80% probability of another 25-basis-points increase at the next FOMC meeting on March 22, according to CME FedWatch Tool.

The 2-year Treasury yield disagrees. The key question: Who’ll blink first?

The answer almost certainly depends on how the incoming economic data fares, starting with more signs that inflation is easing. In addition, the Fed would probably need to see the labor market weaken.

Professor Jeremy Siegel, author of “Stocks For The Long Run,” sees a change in central bank policy brewing.

“I really think we’re going to have a big, large decrease in rates in the second half of the year because of the weakening economy and because of the dramatic slowing in inflation.”