Gold prices dip as December rate cut bets wane; economic data in focus

The week ahead will be light on economic indicators and heavy on executive orders (EOs). While the markets are closed on Monday for MLK Day, President Donald Trump was inaugurated into office for his second term. Out of the gate, Trump 2.0 is likely to target tariff, immigration, regulatory, energy, and cultural issues with a deluge of EOs.

Bitcoin might get a huge boost this week if Trump issues an EO on setting up a strategic Bitcoin reserve. Launched Friday night, Trump's so-called "memecoin" surged from less than $10 on Saturday morning to $74.59 before giving up some of its gains on Monday.

The Chinese stock market might react negatively to EOs that impose a big increase in tariffs on China. Any volatile pullbacks in the US stock market on the implementation of widespread tariffs are likely to be short-term buying opportunities. EOs aimed at deregulating business are likely to be bullish for stocks. Banks come to mind as potentially significant winners.

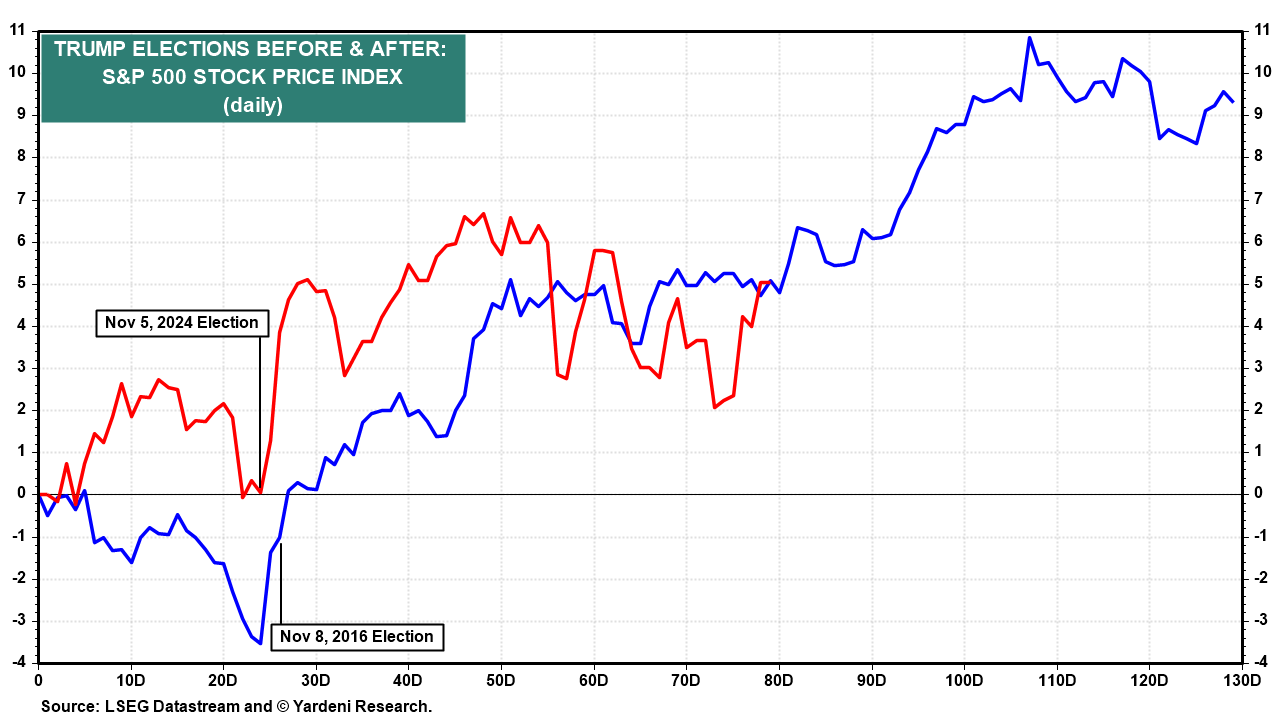

Stock prices rallied during the first 100 days of Trump 1.0 and should do so again during the first 100 days of Trump 2.0 (chart). Anything is possible this week. Maybe Meta (NASDAQ:META) will buy TikTok? Who knows?

Here's more on what to expect from the week ahead:

1. Tariffs

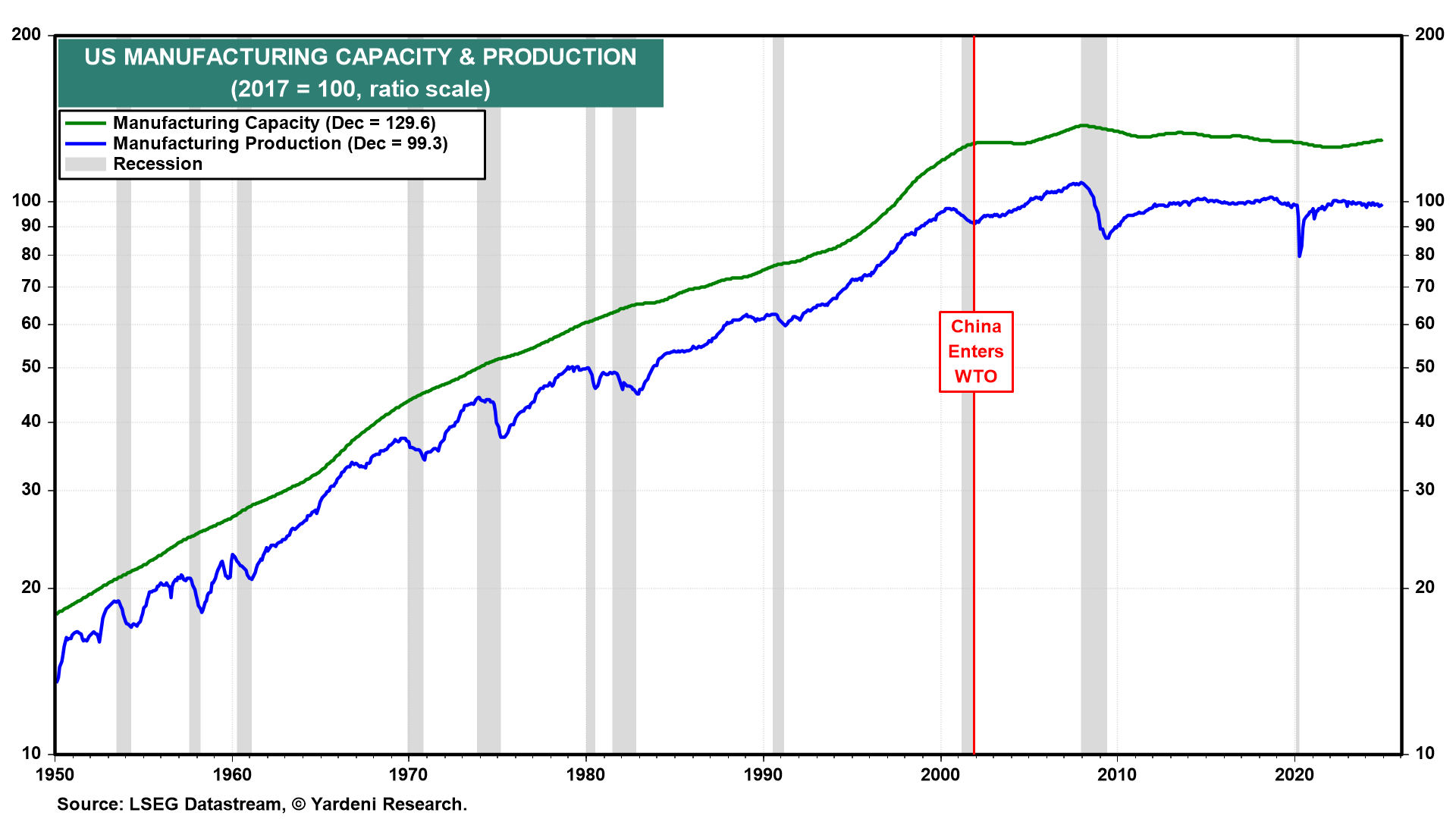

The costs of higher tariffs include potentially higher prices for American consumers. If the dollar strengthens on higher tariffs, as we expect, then foreign exporters might pay the price in lower revenues in their local currency. If tariffs lead to expanded capacity in the US, that could be disinflationary. US industrial production and capacity have been flat since China entered the World Trade Organization and took advantage of its liberal trading system (chart).

Supply chains are in much better shape today than before the pandemic. In the Fed's January Beige Book, firms in both the Atlanta and Boston regional areas said that diversified supply chains can offset tariffs.

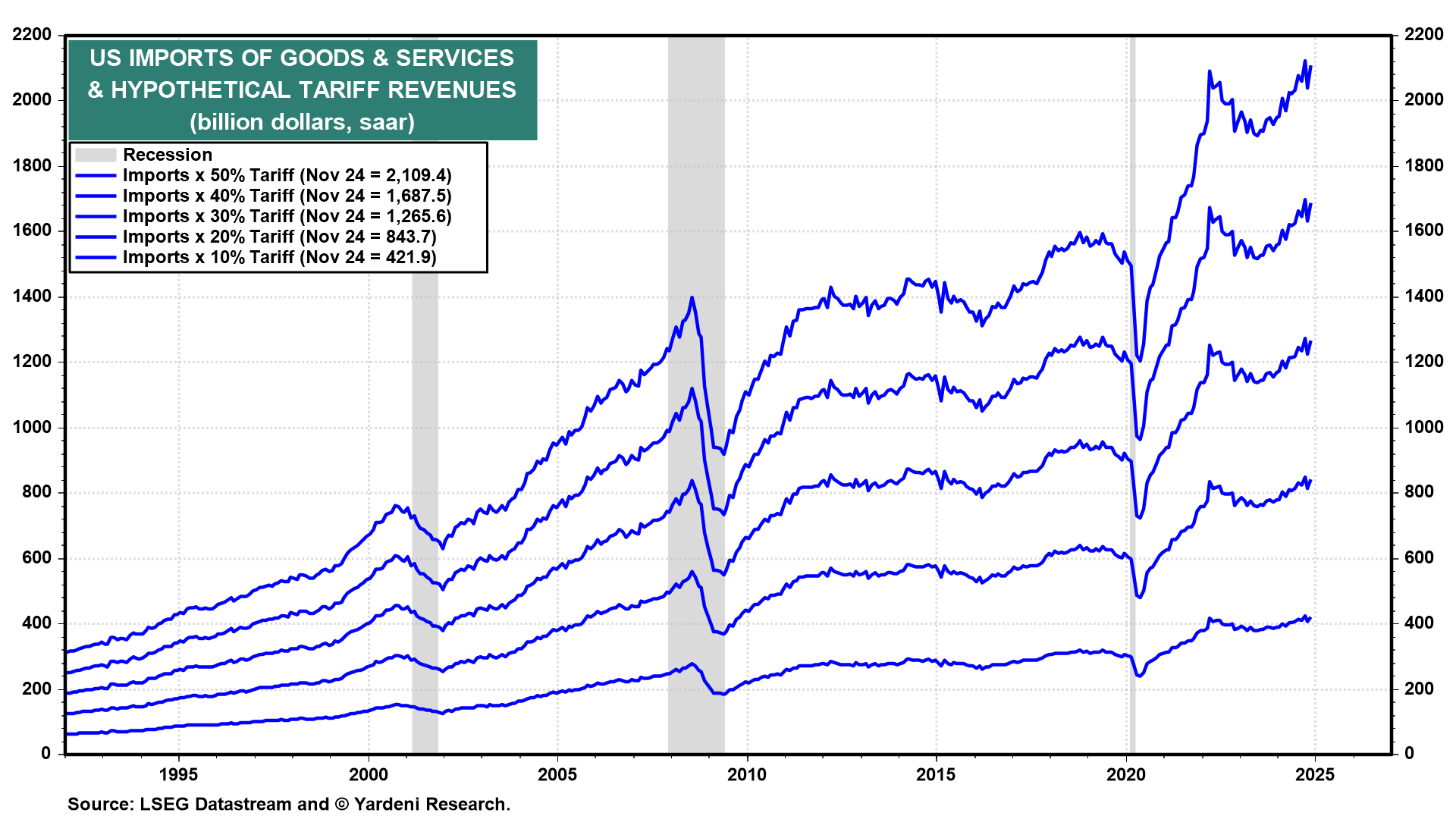

Trump expects that his new External Revenue Service will be a significant source of receipts for the US government once tariffs are raised across the board. An across-the-board tariff of 10% to 20% would bring in revenues of $400 billion to $850 billion annually (chart). That is, if they don't trigger a trade war.

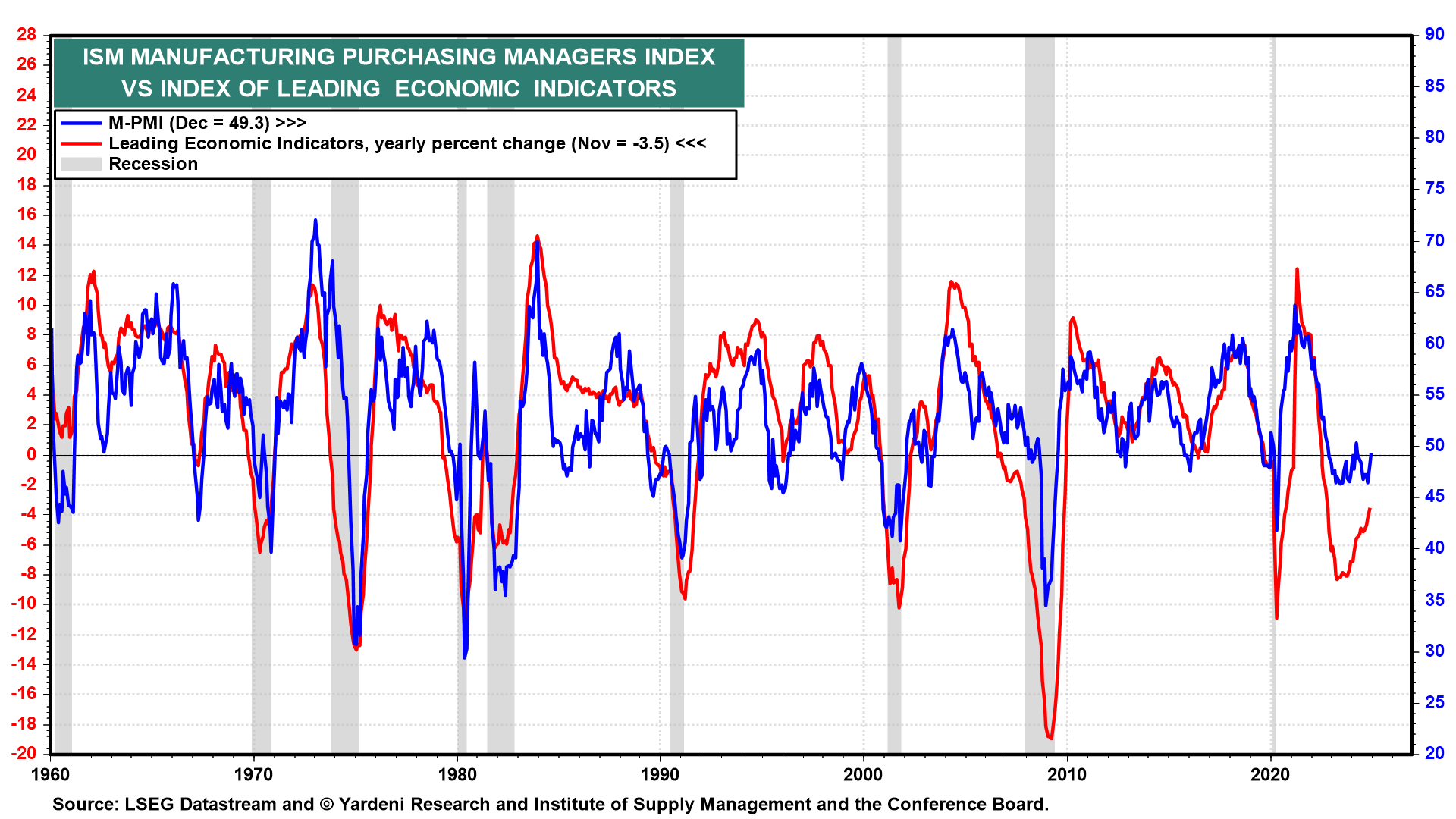

2. Composite cyclical indicators

The index of Coincident Economic Indicators (Tue) likely rose to another record high in December. The index of Leading Economic Indicators (LEI) has misleadingly predicted a recession since late 2021. The LEI is a better indicator of manufacturing production than overall real GDP (chart).

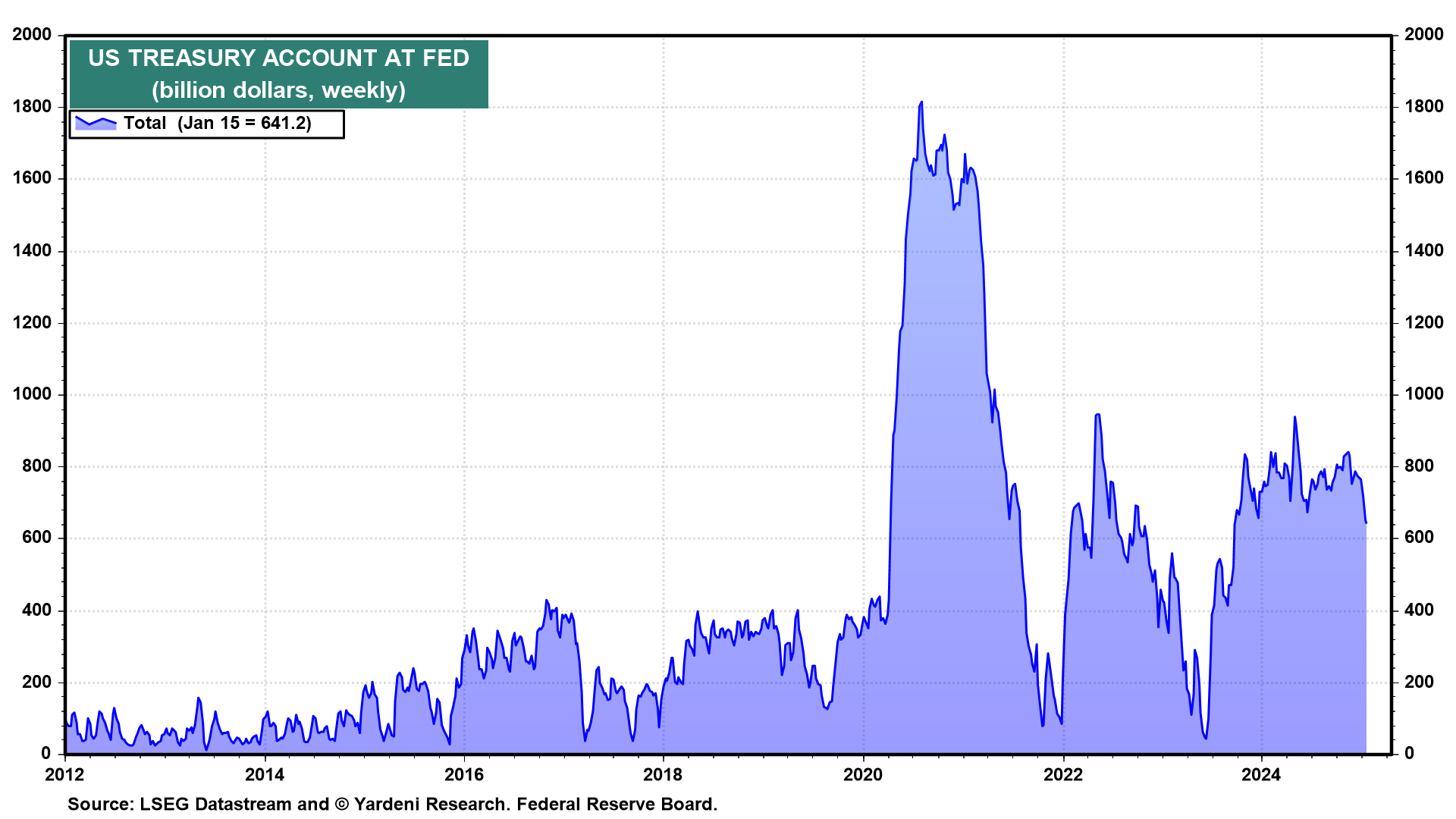

3. Debt ceiling

Without a congressional debt-ceiling deal, incoming US Treasury Secretary Scott Bessent will have to spend down the $641 billion in the Treasury General Account to fund the government (chart). However, with the GOP in full control of DC, Congress should be able to raise or abolish the debt ceiling in short order.