Top U.S. Defense Stocks to Watch According to Jefferies Analysis

UBER (NYSE:UBER) news has been flashing in the media this week ahead of the earnings on Wednesday, May 07, premarket. Uber to buy controlling stake in Turkey’s Trendyol GO food delivery business for $700 million. Partners with China’s Pony AI to deploy self-driving taxis in the key Middle East market. Also, Partners with Family Dollar for on-demand delivery.

Key Highlights

- The Uber One membership program has emerged as a significant success, reaching 30 million subscribers and displaying the company’s ability to build recurring revenue streams. The platform’s gross bookings have grown 21% year-over-year, indicating strong market momentum.

- Uber’s strategic positioning is bolstered by its diversified service offerings and robust technology platform, complemented by strategic partnerships with leading autonomous vehicle companies.

- Uber’s strategic partnerships with AV companies like Waymo position it well to benefit from the transition to autonomous vehicles.

- Increasing adoption of autonomous vehicles poses a significant risk to Uber’s traditional ride-hailing model.

- Uber could lose market share to new entrants like Waymo and Tesla (NASDAQ:TSLA) as they advance their AV technologies.

UBER Q1 2025 earnings premarket Wednesday May 7, 2025

|

Earnings Expectation |

|

|

EPS |

0.51 USD |

|

Revenue |

11.63 B USD |

Financial Health History

Financial Health for Meta (NASDAQ:META) Platform is determined by ranking the company on over 100 factors against companies in the Industrial sector and operating in Developed economic markets.

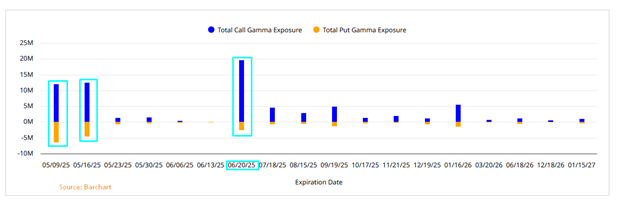

Option Statistics

- UBER has large Gamma exposure on the Calls on May 9, 16 and June 20 expiries. Any short fall in earnings & guidance may trigger a sharp selloff.

Technical Analysis Perspective

- UBER has been trading inside a rectangle formation since January 2024, ranging between the 87 and 55 bands.

- Stock has rallied three times above 80 mark. 82 in March 2024, 87 in October 2024 and 86.50 on May 05, 2025.

- Tested the base of rectangle in August 24 at 55, in December 2024 at 59 and recently in April 2025 at 60.

- A breakout of the rectangle is above 88 post earnings would initiate an additional rally to 93 with more room to 100 on the back of exceptionally good guidance.

- Good earnings and guidance are a good catalyst for investors.

- A rejection of 88 resistance post earnings would negate the upside outlook.

Weekly Candlestick Chart

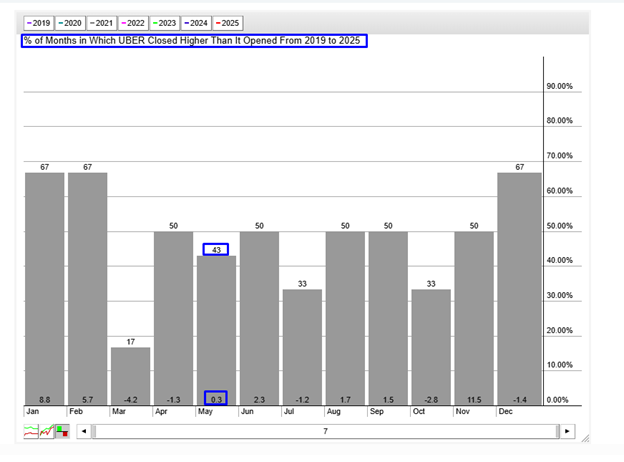

UBER Seasonality Chart

- UBER closes 0.3 % higher in May 43% of the time since 2019.

With major stock earnings on deck and market volatility rising, InvestingPro can help you stay ahead.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

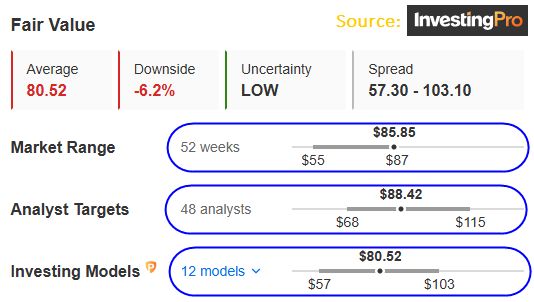

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”