TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

Shares of United Parcel Service (NYSE:UPS) are around the same price they were in March 2020, when the pandemic shut down economic activity. At the time, the global economy was decimated. In unprecedented fashion, the unemployment rate skyrocketed from 3.5% to 14.8% in one month. While the economic impact was tremendous, there was no relief in sight. The outlook for UPS was horrible, and its stock price reflected it.

After a couple of months, the market and economy began to rapidly recover with the help of excessive fiscal and monetary stimulus. Yet, despite the economic recovery since early 2020 and the stock market soaring by over 200% from the Covid lows, UPS shares are at the same price they had when the world was in an economic free fall.

UPS and some other well-known stocks are trading at or near their pandemic lows. Thus, in line with our article, The Low Beta Boom, in which we consider stocks that may outperform when this speculative bull market ends, we assess whether laggards like UPS can protect us.

In the future, we will write similar articles about other larger, well-known companies in situations like UPS. This may allow us to build out a list of stocks that serve us well when the market trends lower.

UPS Valuations

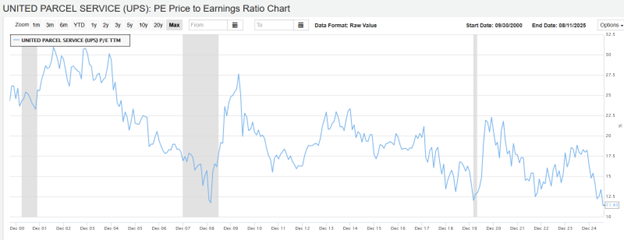

According to some metrics, UPS trades at cheap valuations. For instance, its forward and trailing P/E are 12.00 and 11.50, respectively. Its P/E is now slightly below where it was at the trough of the financial crisis and the lowest level since at least 2000.

Similarly, its Price to Sales ratio is 0.81, which is at its lowest level since the financial crisis. For context, the Trailing P/E, Forward P/E, and P/S on the S&P 500 are much more expensive at 29.5, 22.3, and 3.22.

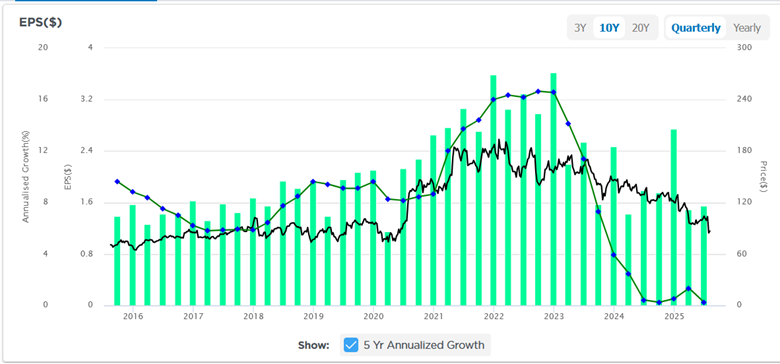

Of importance to us is the PEG ratio. The ratio normalizes valuations by factoring in expected growth rates. UPS has a PEG ratio of 2.50. Such implies expected earnings per share growth of 4.60%. That compares to a range of 6%-9% pre-Pandemic and a sub 4% growth rate over the last five years.

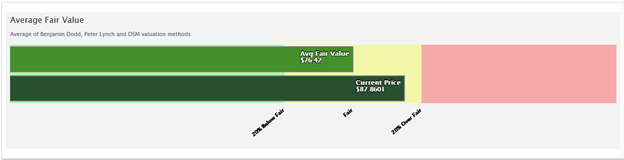

Despite the valuations, the stock is still trading about 14% above fair value.

UPS – Explaining The Poor Stock Performance

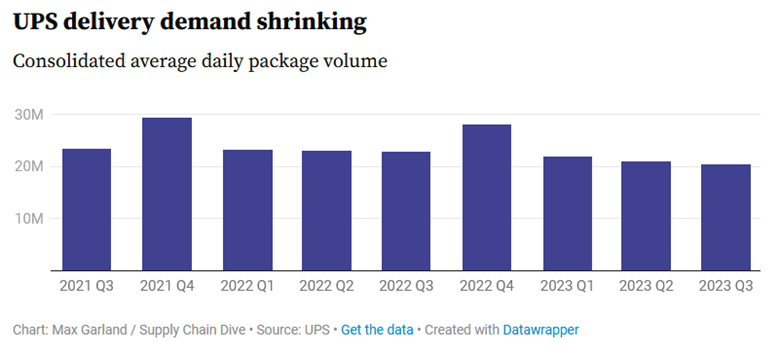

- Declining Delivery Volumes / Amazon (NASDAQ:AMZN): As we share in the first graph below, its daily average shipping volume has been declining over the last few years. This is primarily the result of reducing deliveries by 50% for its largest but least profitable client, Amazon. The move is a strategic shift to prioritize more profitable business lines.

- Higher Operational Costs: In 2023, UPS averted a strike by signing a 5-year deal with the Teamsters. Full-time employees will get an 18% pay raise by 2027, while part-time employees will receive a 48% wage increase. In addition to higher labor costs, the company, like most others, is also dealing with higher expenses due to inflation. Its profit margin is about 10%, which is the low end of the 10-15% range of the last 15 years.

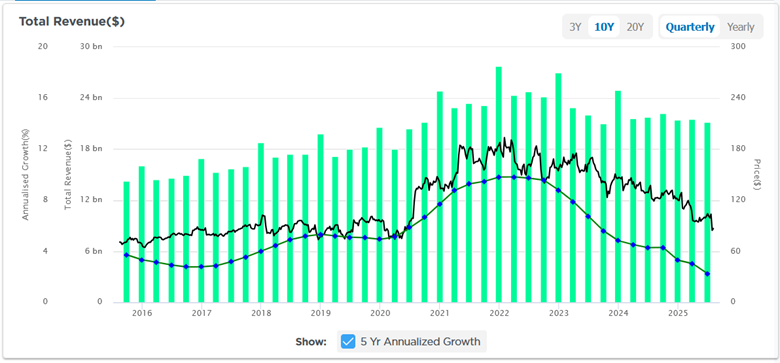

- Stagnant Growth: The second and third graphs below show the decline in earnings per share and revenue growth. In both cases, the growth rates have slowed significantly. Revenues are slightly higher than before the pandemic, yet EPS is below those levels. Such attests to little growth over the last five years and worsening profit margins.

UPS: Reasons For Optimism

- Cost-Cutting Initiatives: UPS is implementing an “efficiency reimagine” plan, targeting $3.5 billion in savings through workforce reduction, improved productivity, facility closures and consolidations, and fleet optimization. The goal is to reverse its weakening profit margins. Per the company: “Our Efficiency Reimagine plan is about working smarter, not harder. By leveraging advanced analytics, automation, and streamlined operations, we’re driving significant cost savings while enhancing service quality for our customers.”

- Volume Growth Recovery: U.S. delivery volumes showed a slight uptick in the most recent quarter. Such was the first in nine quarters, signaling a potential turnaround. The company attributes the pickup to the growth in E-commerce, the onboarding of the US Postal Service air cargo volume, and increased shipping from small and medium-sized businesses.

- Focus on Profitable Segments: By prioritizing higher-margin sectors like healthcare shipping, small- and medium-sized businesses, and international markets over low-margin Amazon deliveries, UPS aims to improve its revenue per piece.

- Attractive Dividend Yield: UPS offers a 7% dividend yield, which could attract income-focused investors and provide its shares stability as the company navigates its challenges.

- Stock Buyback Program: UPS has resumed share repurchases, which could enhance shareholder value and signal management’s confidence in a recovery. Over the last four years, it has repurchased about 30 million shares, accounting for about 3.5% of its total shares outstanding.

Summary

In our article The Low Beta Boom, we wrote that, in aggregate, the stocks with the highest profitability, cheapest valuations, lowest betas, and smallest market caps well outperformed most stocks and protected investors during the dotcom market bust.

Of these fundamental qualifications, the only factor UPS has is cheap valuations. And, as we write, that is debatable. Concerning the other factors, its beta has stayed around 1.0 for most of the last five years. It has a large market cap of $73 billion, and it has not been particularly profitable.

Despite not meeting three of the four criteria, UPS valuations provide a better margin of safety than many stocks. However, while it may fare better than many stocks, we would want to see improvement in earnings and sales trends before committing UPS to our roster of rainy-day stocks.

The bottom line is that even though the price is at the same levels as when the global economy was shut down in 2020, its loss of market share and weakening margins make the valuation somewhat fair. If they don’t improve their fundamentals, UPS, despite seeming cheap valuations, may likely be a value trap.