Datavault AI completes second tranche with Scilex for 1,237.6 Bitcoin

The U.S. Dollar is a key variable in all aspects of the marketplace. The strength of the dollar factors into the price we pay for food, gas, and everyday groceries.

It also affects the equity and bond markets as investors factor in the risks of a dollar that is too weak or too strong versus the current economic climate.

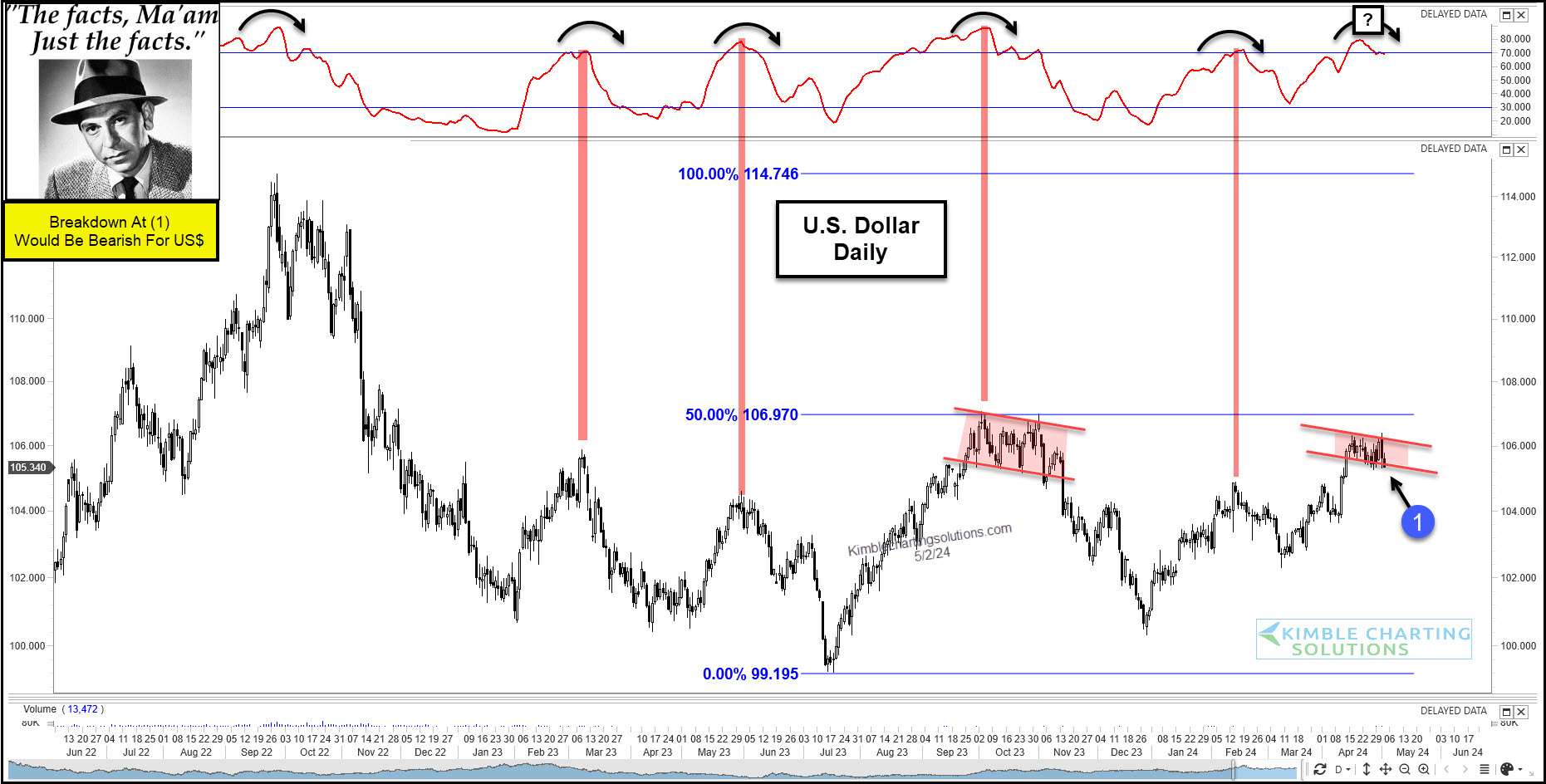

So today we look at a chart of the U.S. Dollar and highlight why active investors should be watching the greenback right now.

As you can see, the US Dollar traded into its 50% Fibonacci level again as its momentum is pulling back from historic highs.

In recent years, when relative momentum has traded this high, marking a top for the US Dollar.

Also, the dollar has formed a sideways consolidation, and should it break down at (1), it would send a few bearish messages to the US Dollar… and perhaps a bullish one to precious metals. Stay tuned.