Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

In early October the near-term outlook for the US business cycle looked mildly grim and output was forecast to turn slightly negative starting in November. But after four weeks the dark estimate reversed and economic activity is again set to stay moderately positive in the immediate future. Recession risk still lurks on the horizon, but for the moment the near-term macro trend has strengthened.

The latest numbers reflect a moderately stronger trend for the US economy than previously reported by CapitalSpectator.com. On Oct. 5 I wrote that an NBER-defined recession looked set to start in November, based on forecasts for a set of proprietary indicators published in The US Business Cycle Risk Report. (The outlook was previously noted in the newsletter sent to subscribers a few days earlier.) The expected contraction was mild, virtually indistinguishable from stagnation, which was effectively a sign that the forecast was vulnerable to revision. Yet for the next three weeks the forecast held, until it didn’t.

In this week’s update (sent to newsletter subscribers on Oct. 30) the estimate for November strengthened and US output is now expected to extend its run of slow growth. He explained:

One reason for the improvement: the release of robust consumer spending data in the September report (published Oct. 28). As Bank of America CEO Brian Moynihan said last week:

“You’re seeing a mitigation of the rate of growth, not a slowdown. Not negative growth. If you raise rates and slow down the economy to fight inflation, the expectation is you have a slowdown in consumer spending. It hasn’t happened yet. So it could happen, but it hasn’t happened yet.”

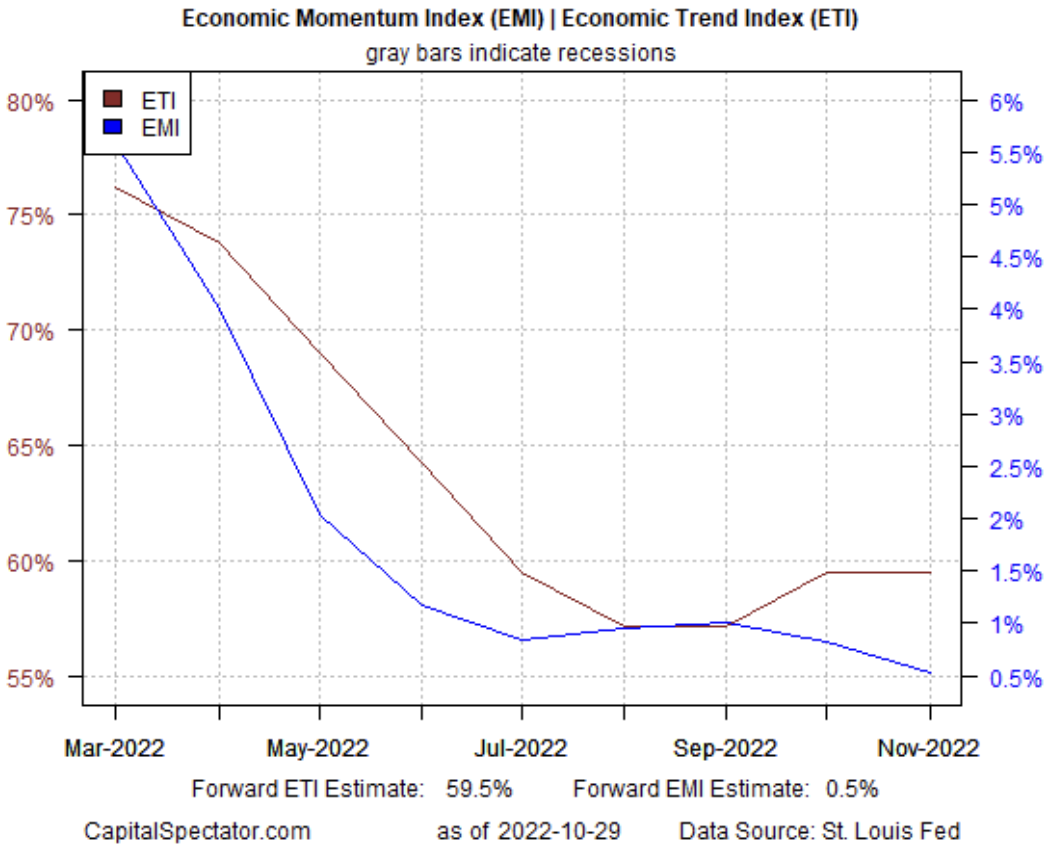

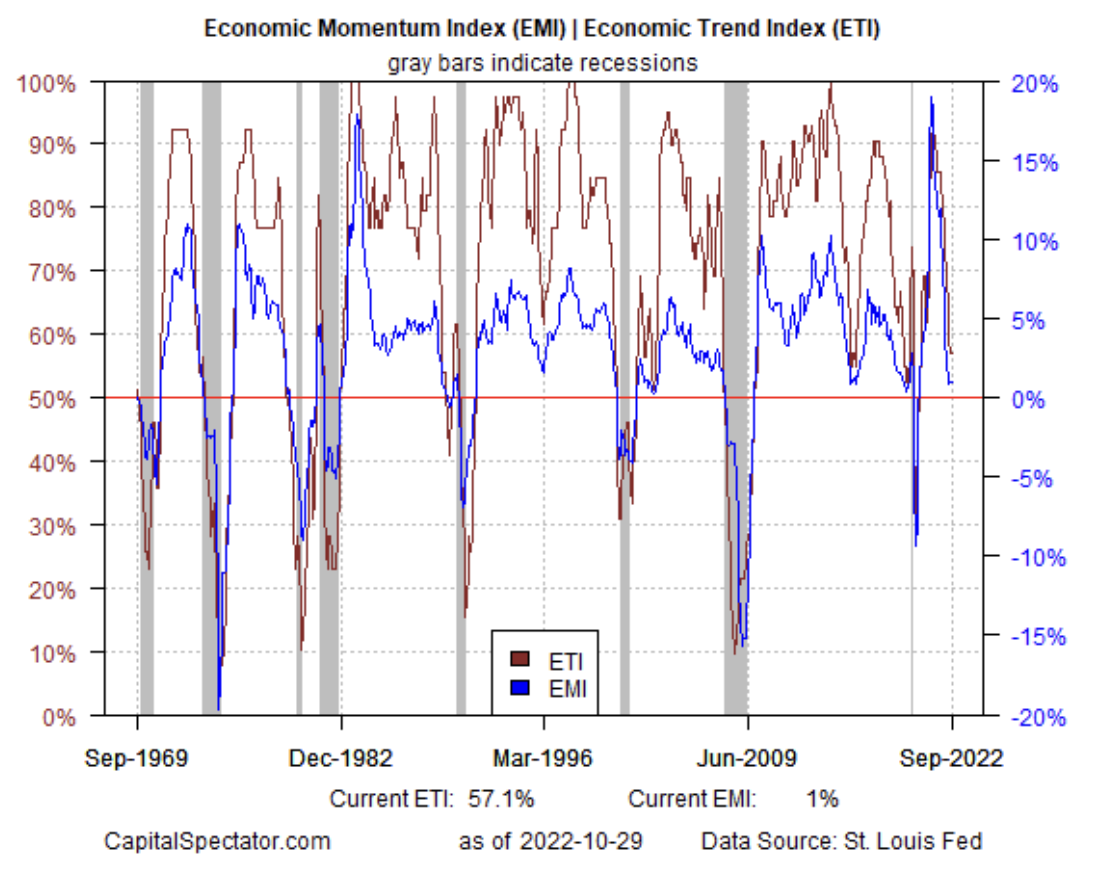

The relatively firmer activity was picked up by revised forward estimates of the Economic Trend Index (ETI) and Economic Momentum Index (EMI) in the Oct. 30 update of the US Business Cycle Risk Report. After several weeks of posting November estimates below their respective tipping points (50% and 0%), new data lifted the projections, which now show this month will escape the slight contraction previously forecast.

ETI and EMI are calculated using a broad range of US economic and financial indicators. The track record for the indicators has an encouraging history of identifying turning points in the business cycle and the start and end of NBER-defined recession dates.

The recent back and forth between a mild forecast for recession and a moderate expansion highlights the challenge of the moment for US macro analysis. On several fronts the US economy has defied recent forecasts of weaker performance, due in no small part to resilient consumer spending and ongoing labor-market growth. Nonetheless, a number of warning signs are still flashing and there’s a good case for expecting that a mild recession has been delayed rather that avoided.

The combination of elevated inflation and rising interest rates are a key part of the calculus. Although the economic expansion has proved more durable than expected, the headwinds are still building and so the near-term outlook remains challenged. Estimating exactly when a recession could start, how long it will last and how far output will fall, remains ambiguous as always. Nonetheless, in the current environment, with several critical risk factors weighing on the outlook, the near-term outlook remains wobbly.

Harvard economist Kenneth Rogoff says:

“You really have to look at the world, which is in bad shape. So it’s very hard for the United States to resist that. I worry that not only we’re going to get a mild recession, I think the chances that we’ve got a significant recession are really pretty high.”