Nvidia’s desktop AI supercomputer now available to the general public

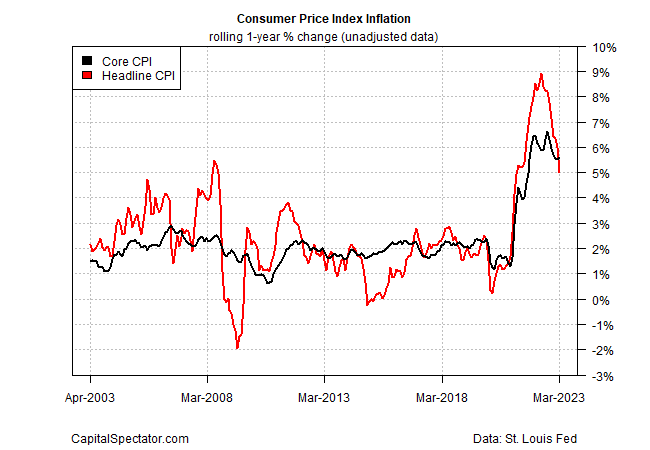

The Consumer Price Index eased more than expected in March, providing fresh evidence that pricing pressure has peaked and inflation remains on track to decelerate further in the months ahead. The core reading of CPI posted a firmer reading, but this looks like an outlier when viewed in context with a range of alternative inflation metrics.

Let’s start with the official numbers from the Labor Department. Headline CPI in year-over-year terms eased sharply to 5.0%, down from February’s 6.0% pace. The drop marks the slowest increase in nearly two years. The caveat is the slight uptick in core CPI, which the Fed prioritizes as a superior measure of the inflation trend.

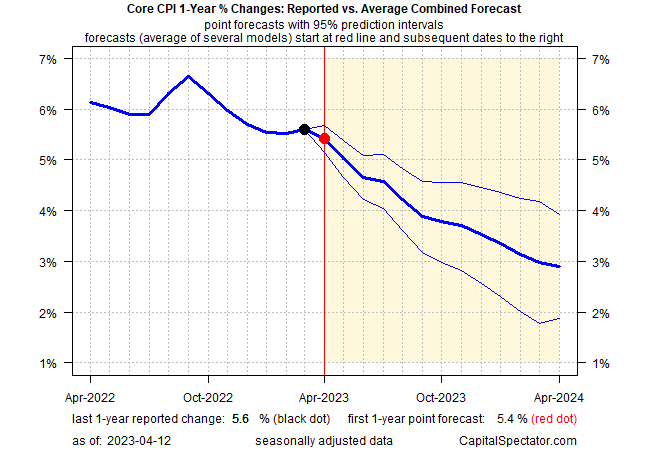

Core inflation rose 5.6% in March vs. the year-ago level, up from 5.5% previously. The slightly stronger increase marks the first time in six months that this measure of inflation picked up. The firmer reading in core inflation gives the Federal Reserve more scope for raising interest rates again at the next FOMC meeting on May 3. As of this writing, Fed funds futures are pricing in a near-70% probability for a ¼-point hiking at that meeting.

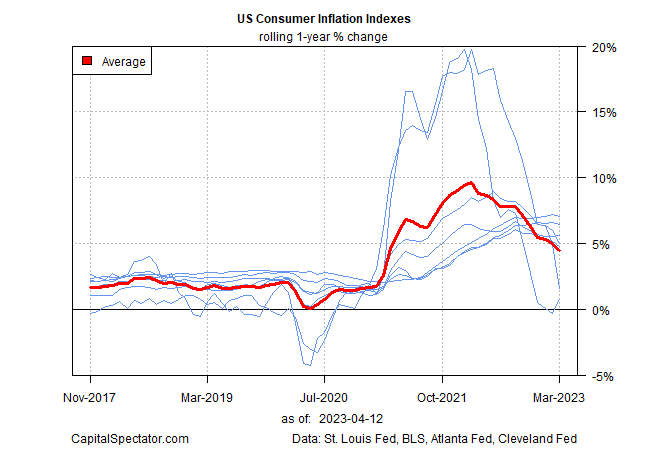

Despite core’s slightly stronger annual pace, several alternative measures of inflation suggest that pricing pressures continue to ease. The average for these five indexes (see list below), plus the standard headline and core CPI numbers, on a year-over-year basis posted another softer increase in March and so the downside trend looks set to continue. (The five alternative CPI metrics, published by the Atlanta and Cleveland Federal Reserve banks, are: Sticky Core CPI, Sticky Core CPI Ex-shelter, Median CPI, Flexible CPI and Flexible core CPI.)

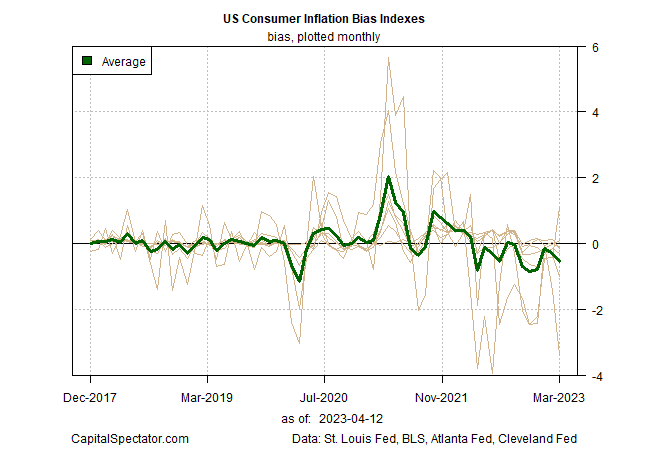

For a clearer view of how all seven inflation indexes are evolving for the year-over-year trend, the next chart below tracks the bias of the average for one-year. The persistent negative bias of late implies that the inflation trend will ease further in the months ahead.

Softer core inflation is also expected in the months ahead based on CapitalSpecator.com’s ensemble model.

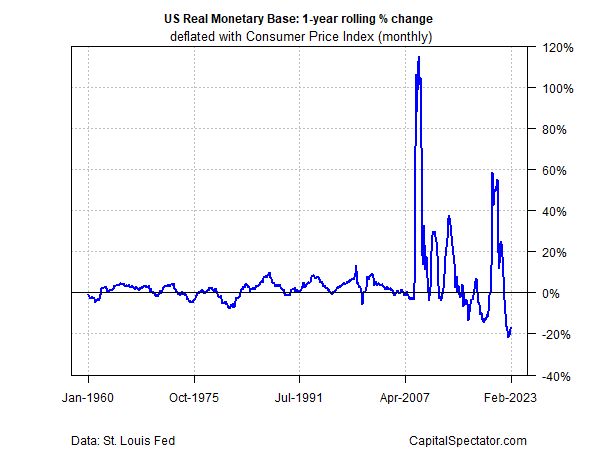

Another reason to expect further easing in inflation is the sharp, ongoing decline in money supply. For example, the real (inflation-adjusted) slide in the monetary base suggests that the annual rate of prices changes will continue to face strong downside pressure.

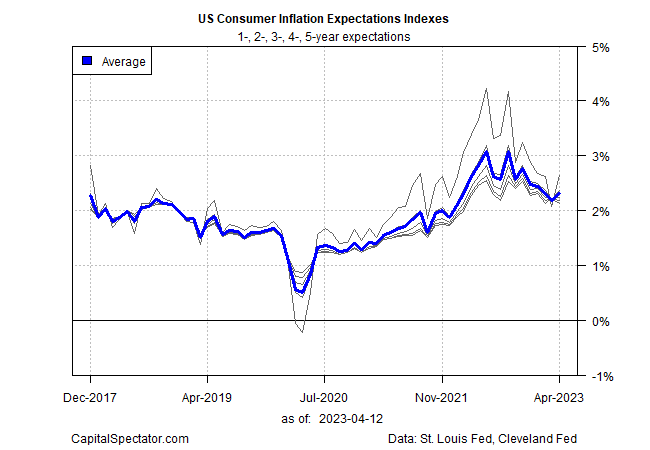

One pushback to the lower inflation forecast is the recent upturn in consumer expectations, based on a model developed by the Cleveland Fed. According to these numbers, the recent slide in the public’s expectations for prices has rebounded moderately. It’s premature to say if this is noise or an extended shift to the upside. But if these numbers, along with survey data for consumers’ outlook, push higher in the months ahead, the change will likely strengthen the Fed’s resolve to err on the side of hawkish policy decisions.