TSX tick higher after index ends prior session near two-week high

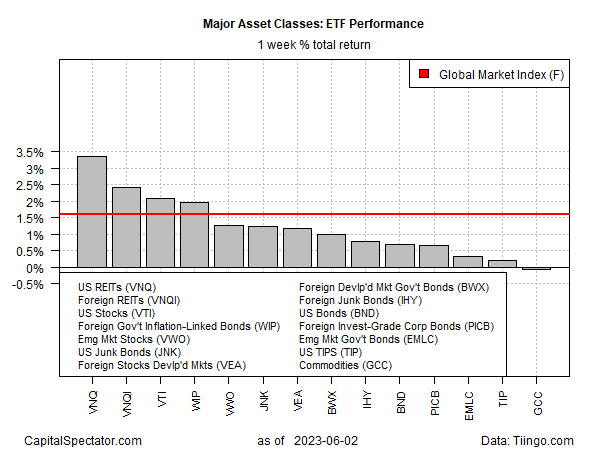

Based on a set of ETFs, widespread gains lifted nearly all the major asset classes for trading in the week through Friday’s close (June 2). The downside outlier: commodities, which slipped fractionally.

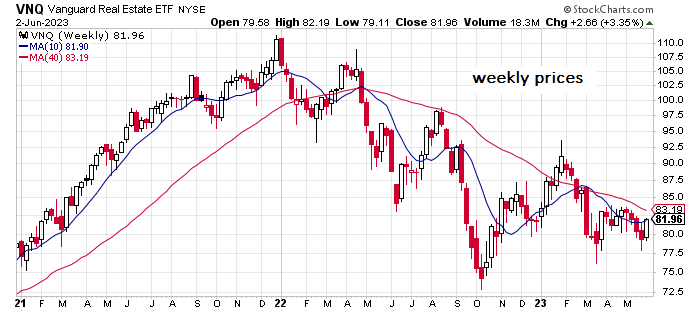

Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) jumped 3.4% last week. The rise marks the first weekly increase for the ETF in more than a month. Despite last week’s pop, VNQ’s trend still looks bearish as commercial property markets struggle with the headwinds of higher interest rates, which compete with yield-sensitive REITs. The rise of remote work also weighs on the industry by keeping the vacancy rate relatively high.

Broadly defined commodities posted the only loss for the major asset classes last week. WisdomTree Continuous Commodity Index Fund (NYSE:GCC) slipped fractionally, posting its sixth straight weekly decline, leaving the ETF near its lowest price since early 2022.

A critical factor in sliding commodities prices is weak manufacturing activity this year. Notably, China, a leading consumer of metals and energy, has had a sluggish rebound this year after reopening from the pandemic. Based on survey data, manufacturing activity continues to contract in the US.

The Global Market Index (GMI.F) rebounded last week, rising 1.6%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

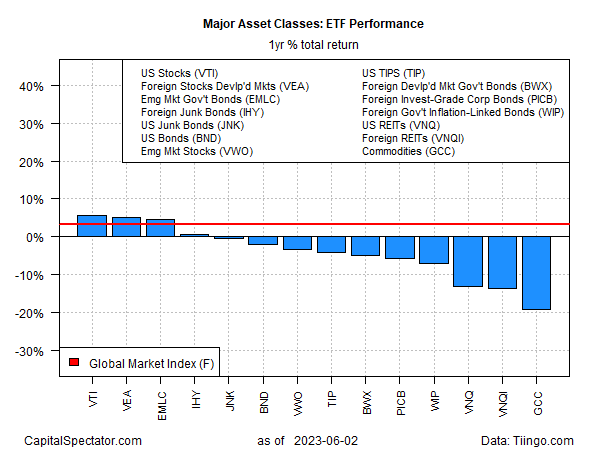

The major asset classes post mixed results for the one-year window, with most ETF proxies reporting a loss over this period. The performance leader over the past year: US stocks (NYSE:VTI) via a 5.6% increase. Commodities, by contrast, are down a steep 19.2% for the past 12 months.

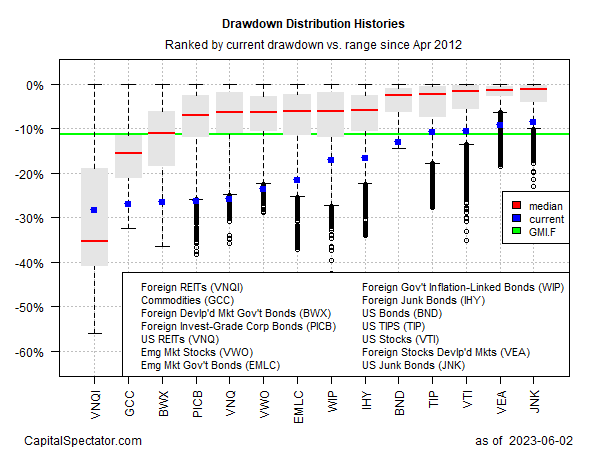

Most of the major asset classes are still posting relatively deep drawdowns. The deepest: foreign real estate shares (VNQI), which ended last week with a near-30% peak-to-trough decline.