Webull beats Q3 expectations as revenue jumps 55% on strong trading

The recent rally in risk assets has confounded some analysts, but right or wrong, the revival in animal spirits still has momentum, based on several proxies of market behavior via ETF pairs through yesterday’s close.

For context, nearly a month ago, CapitalSpectator.com noted that risk-on signaling had strengthened. Today’s update still finds markets reflecting a bullish profile overall. Markets are hardly flawless so the analysis below should be viewed cautiously. But for the moment, it’s not obvious that the “wisdom” of the crowd has abandoned the recent renewal in bullish expectations.

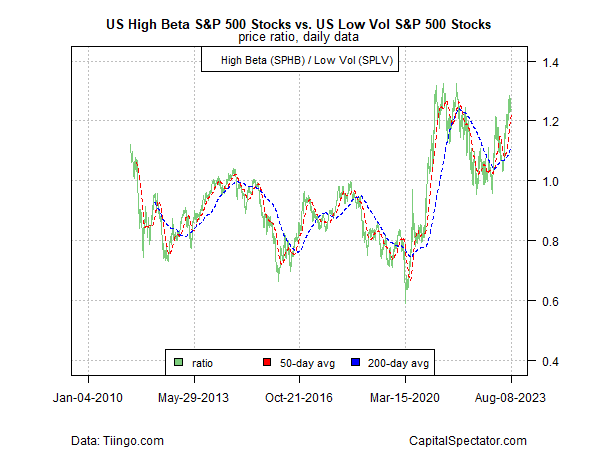

Let’s start with a comparison of so-called high beta (i.e., high-risk) stocks (Invesco S&P 500® High Beta ETF (NYSE:SPHB)) vs. low-volatility (low risk) shares (Invesco S&P 500® Low Volatility ETF (NYSE:SPLV)), a proxy for assessing the appetite for higher/lower risk positioning in US equities.

This ratio has shot higher in recent months and is approaching the previous high in late 2021, just before last year’s sharp correction started. It’s debatable if the recent bull run has run out of road or if the latest pause is a temporary pullback before pushing on to new highs. This much is clear: if and when SPHB:SPLV tumbles, that would be a sign that the bulls are getting cold feet.

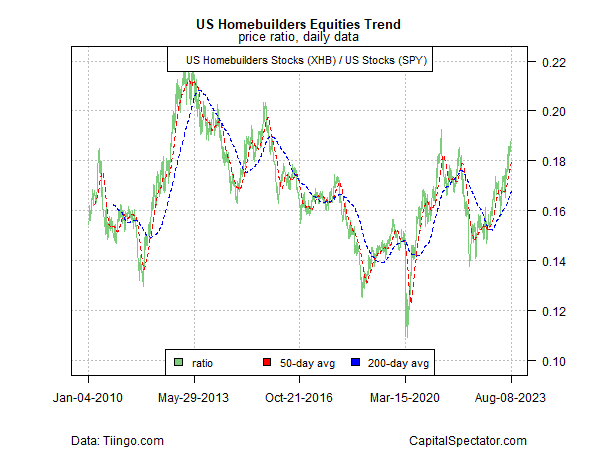

In another encouraging sign for the bulls, the rally in homebuilder stocks (SPDR® S&P Homebuilders ETF (NYSE:XHB)) is still signaling ongoing strength for this cyclically sensitive sector as it recovers in relative terms vs. the broad US stock market (SPDR® S&P 500 (NYSE:SPY)).

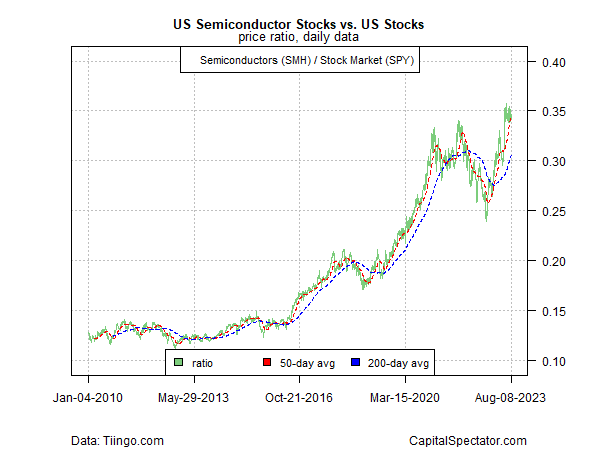

Semiconductor shares (VanEck Semiconductor ETF (NASDAQ:SMH)), widely seen as a proxy for the risk appetite and the business cycle, continue to show strength relative to equities generally (SPY).

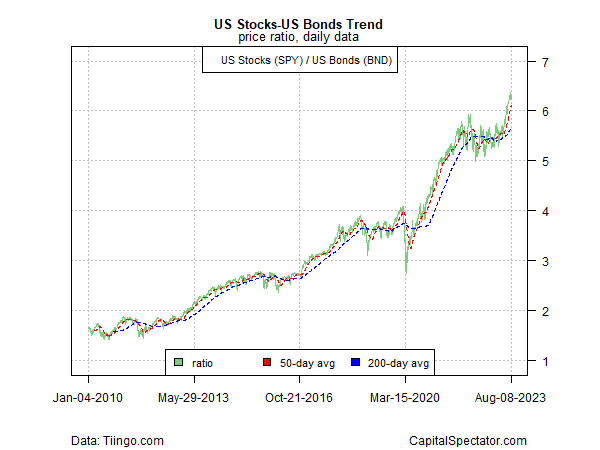

The ratio of stocks (SPY) vs. bonds (Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND)) continues to signal a strong risk-on bias, too.

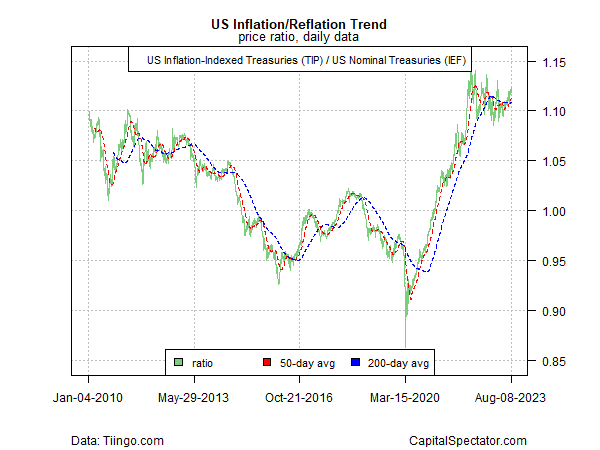

Meanwhile, the reflation/inflation trade remains in a holding pattern based on inflation-indexed Treasuries (iShares TIPS Bond ETF (NYSE:TIP)) vs. conventional Treasuries (iShares 7-10 Year Treasury Bond (NYSE:IEF) ETF (NASDAQ:IEF)). That’s an encouraging sign for the bulls because it suggests that the market continues to anticipate that inflation pressure will continue to ease, which in turn supports the risk-on trade.

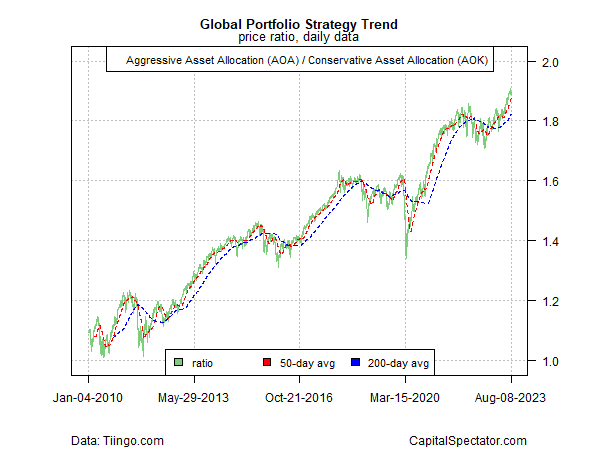

Reviewing the trend for aggressive allocation (iShares Core Aggressive Allocation ETF (NYSE:AOA)) vis-à-vis a conservative strategy for global assets (iShares Core Conservative Allocation ETF (NYSE:AOK)) also indicates an ongoing risk-on bias.

The key question, as always, is whether the recent past is still a prologue for markets. There’s always room for debate, but the lessons of trend behavior in history suggest that it’s reasonable to assume that a directional bias holds until there’s convincing evidence to the contrary.