AI bubble? Four Differences Today vs. 2000

A shock Swiss CPI print has markets dusting off negative-rate scenarios for the SNB, just as widening U.S.–Swiss yield spreads propel USD/CHF higher.

- Swiss CPI fell 0.3% in September, annual rate slowed to 0.1%.

- Risk of negative rates from the SNB remains.

- USD/CHF rally tracks widening yield differentials.

- Bullish break opens path to 0.8150 and beyond.

An icy inflation report has revived speculation about the Swiss National Bank (SNB) having to cut interest rates into negative territory, combining with higher U.S. Treasury yields to spark a powerful bullish breakout in USD/CHF. Given recent price and momentum signals, the path of least resistance appears higher in the near term.

An Icy Swiss Inflation Report

Swiss inflationary pressures mirrored the weather outside in September, plunging 0.3% for the month, leaving the annual rate just above zero at 0.1%. Markets had expected a smaller 0.1% drop for the month, an outcome that would have pushed the annual rate up from 0.2% to 0.3%. Instead, the undershoot helped resurrect the prior disinflationary trend, keeping the prospect alive for the SNB to cut rates into negative territory next year.

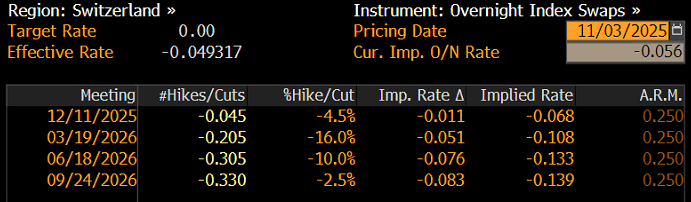

Even though SNB officials have made it clear that the hurdle for negative rates is high, swaps markets continue to price around a one-in-three chance of a reduction to -0.25% by Q3 next year.

Source: Bloomberg

Widening Yield Differentials Drive USD/CHF Higher

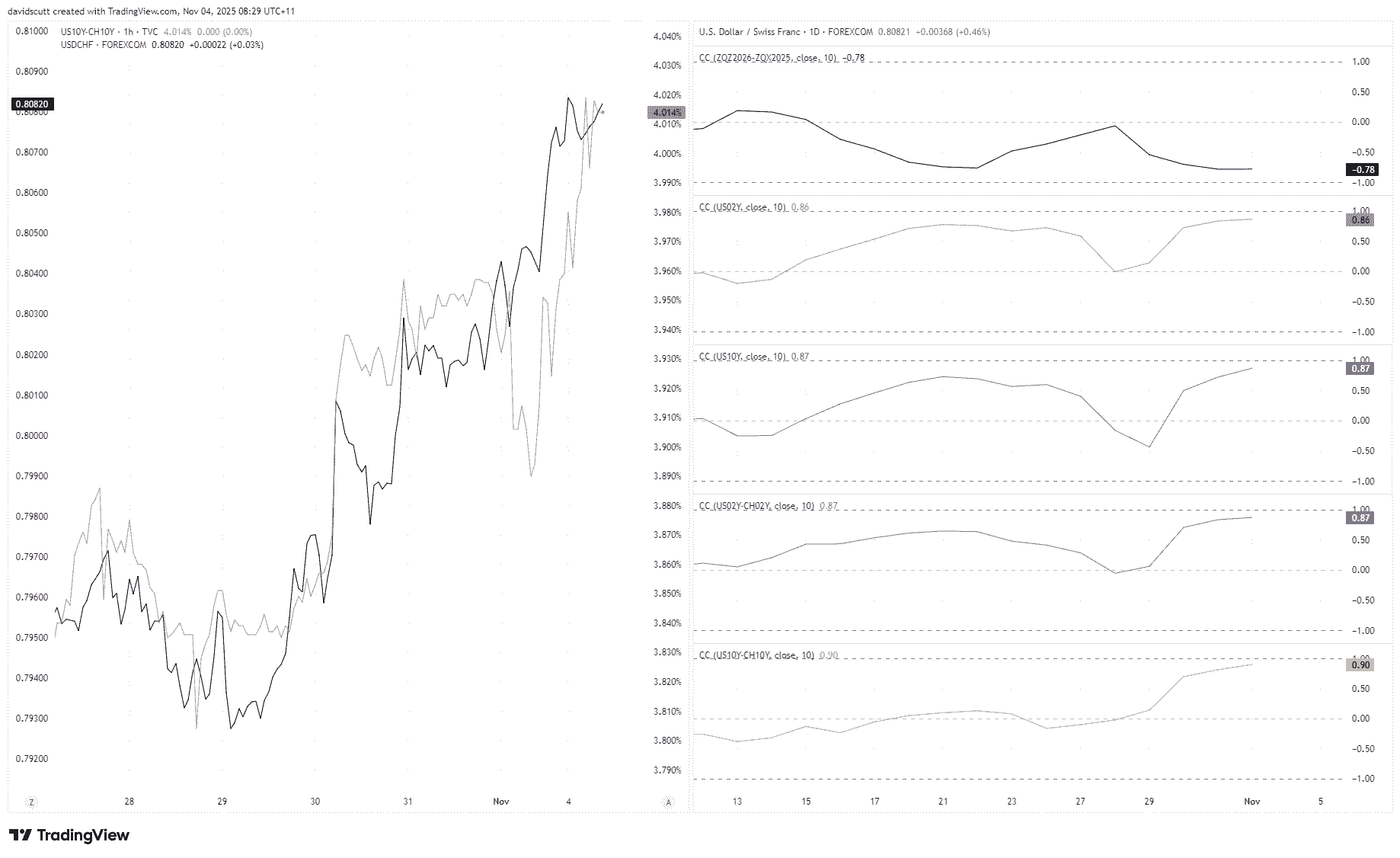

What happens with interest rates is important for USD/CHF given its historic relationship with yield differentials, especially when it comes to the U.S. side of the ledger. That point is reinforced in the chart below revealing the tight relationship the pair has seen with rates over the past two weeks.

Source: TradingView

From top to bottom, we have implied Fed rate cut pricing by the end of 2026, according to futures, with 2-year and 10-year US Treasury yields after that. They’re followed by 2-year and 10-year yield differentials between the U.S. and Switzerland. None of the correlation coefficients has seen a reading lower than +/-0.78 over the past fortnight, pointing to a strong link between the two variables.

You can see the relationship visually in the left-hand pane, with USD/CHF in black overlaid with U.S.–Swiss 10-year yield differentials. Both have essentially moved in lockstep recently, with widening rate differentials assisting the move higher in USD/CHF.

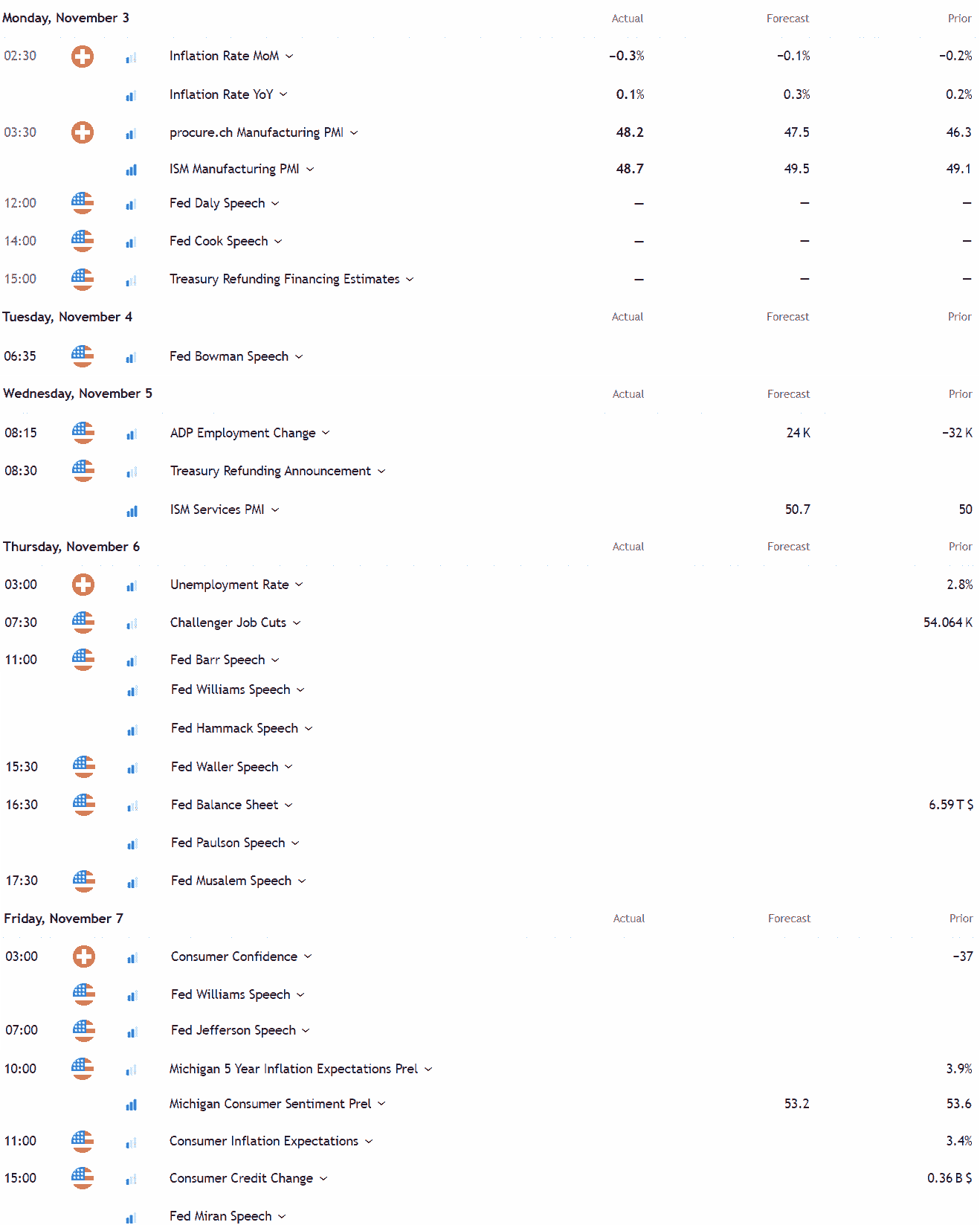

Fedspeak, Refunding, ISM, and ADP in Focus

Source: TradingView (U.S. ET)

While the Swiss CPI report and U.S. ISM manufacturing PMI were the focus for USD/CHF traders to start the week, over the coming days, a wave of speeches from Fed officials, details on U.S. Treasury issuance over the next two quarters, along with private-sector surveys, will likely set the tone for US rates and USD/CHF given the absence of official data due to the U.S. government shutdown.

If you want more granular detail on what to look out for in these events, they were covered more comprehensively in a note released over the weekend.

USD/CHF Delivers Powerful Bullish Move

You can see the powerful bullish move in USD/CHF since the FOMC interest rate decision on the charts, with the key reversal candle of that day proving to be an accurate guide as to what was coming next. The pair smashed through the 50-day moving average before backtesting and bouncing from the level a day later, taking out resistance at 0.8000 before breaking downtrend resistance that had capped the pair on several occasions earlier this year.

On Monday, the pair backtested and bounced from the downtrend, eventually pushing above 0.8071, another level that had capped gains since the middle of August.

Source: TradingView

The close above 0.8071 provides a level where bullish setups can be built around, allowing for longs to be established above it with a stop beneath for protection. The preference would be to see the price retest the level and bounce before entering the trade, especially as we’ve seen the price do that frequently earlier in the bullish move. 0.8150, 0.8200, and 0.8250 saw plenty of action in 2025, providing obvious targets to consider.

Above, 0.8333 is another level to keep on the radar. On the downside, a reversal back below 0.8071 would put former downtrend resistance (0.8035), 0.8000, and the 50-day moving average in play for short setups.

The momentum picture is increasingly bullish for USD/CHF, with RSI (14) trending higher but not yet overbought, pointing to strengthening upside pressure. MACD has also crossed over the signal line from below and now sits in positive territory, confirming the bullish message. As such, long setups screen as more likely to succeed than shorts in these conditions.