Asahi shares mark weekly slide after cyberattack halts production

- Yen tumbles as BOJ's dovishness clashes with Fed tightening, USD/JPY breaks 160 barrier.

- Don't expect a quick reversal - slow BOJ hikes unlikely to dent USD/JPY strength in the near future.

- Key US data this week, but the focus remains on Fed policy and potential rate cuts.

- InvestingPro summer sale is on. Check out our massive discounts on subscription plans!

The Japanese Yen looks set to weaken further, as the USD/JPY currency pair breached the psychologically significant 160 yen per dollar level. This trend is fueled by the stark difference in monetary policies between the Bank of Japan (BOJ) and the US Federal Reserve.

While the Fed has embarked on a tightening path with rising interest rates, the BOJ remains ultra-dovish, keeping rates near zero despite a recent symbolic hike. This policy divergence creates strong selling pressure on the Yen.

Adding to the Yen's woes, remarks from Japanese government officials hinting at potential currency interventions haven't had any effect on the currency. Historically, such intervention attempts have proven ineffective, offering only temporary relief for the Yen.

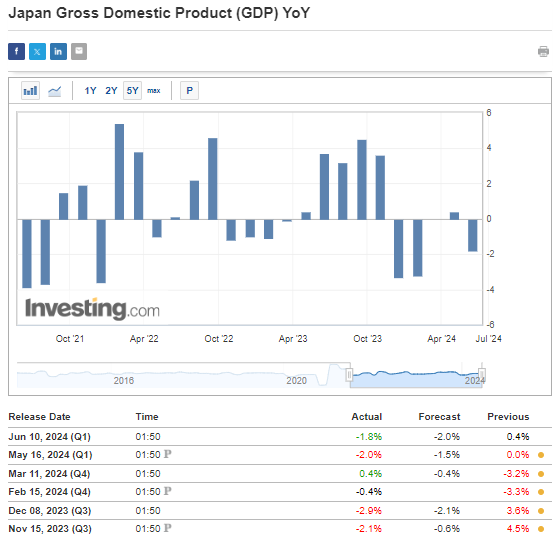

The underlying issue remains Japan's sluggish economy. Stagnant GDP growth hovering around 0% and inflation stuck between 2-3% limit the BOJ's room for maneuvering, pushing the Yen towards further depreciation.

No Strong Case for USD/JPY Declines

Despite hitting the highest levels since 1986 and many indicators showing an overbought market, there's little macroeconomic evidence to support a deeper rebound in the USD/JPY pair. The swap market suggests the Bank of Japan might raise interest rates by 0.1 percentage points at its next meeting in late July.

Even if this forecast comes true, the pace of monetary tightening is too slow to close the interest rate gap between Japan and the US in the short and medium term. This implies that any correction in the USD/JPY pair is more likely to stem from changes in the US dollar, specifically tied to the Federal Reserve's monetary policy.

Currently, the probability of an interest rate cut in September is less than 60%, meaning a definitive move by the Fed is still uncertain. Only if these predictions materialize and the US monetary policy authorities act accordingly will the USD/JPY pair have room for decline.

This Week's Key Macroeconomic Data

Last week's GDP and inflation data from the US aligned closely with consensus expectations, leaving forecasts for the Fed's policy in the coming months largely unchanged amid ongoing uncertainty. This week, investors will focus on the US labor market data, which are also expected to be consistent with recent trends.

USD/JPY: Technical Analysis

Given the current macroeconomic data, the USD/JPY pair is likely to maintain its upward trend. A correction could present a buying opportunity around the previous peaks at 160 yen per dollar, which now serve as a significant support level.

If the 160 yen support level is breached and the upward trend line is broken, the next support level is at 157 yen per dollar. More substantial declines could occur if the Bank of Japan (BOJ) adopts a hawkish stance in its upcoming meeting at the end of the month.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.