Eos Energy stock falls after Fuzzy Panda issues short report

- The US dollar index rebounded after Powell’s cautious remarks, but the broader bearish trend remains intact.

- USD/JPY consolidates, signaling potential directional move as Fed cuts clash with BoJ hikes.

- Key USD resistance lies between 97.60 and 97.80, with confirmation needed for sustained upward momentum.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The US dollar rebounded after Powell’s latest remarks raised some uncertainty about the interest rates outlook, although with the Fed pivoting, it remains to be seen whether the greenback will kick on from here.

I have my own doubts and still expect the US dollar index to resume lower, although we will probably need to see continued weakness in employment for the Fed to deliver those two rate cuts that the market is eying before the end of 2025.

Among the US dollar pairs, the USD/JPY is one to keep an eye on, given that it hasn’t really moved much compared to all the other majors, implying that a big move could be on the way soon. With the BoJ likely to hike rates further, we could potentially see a breakdown in the USD/JPY soon, although so far there have been no technical signs of that.

Powell Reiterates No Risk-Free Path Warning

Following the Fed’s rate cut last week, the US dollar index rebounded after Powell raised doubts over the FOMC’s rate cut projections. He was at it again late in the day on Tuesday, offering no new hints on whether he might support a rate cut at the Fed’s next meeting, in October. He said:

“Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation. Two-sided risks mean that there is no risk-free path.”

FedSpeak will continue to make headlines. San Francisco Fed President Mary Daly will be speaking later today. It is an otherwise light day for the economic calendar. Weekly jobless claims will be released tomorrow and core PCE on Friday.

Before looking at the USD/JPY chart, let’s first quickly discuss levels on the US dollar Index chart, which remains entrenched in a bearish trend, despite the latest bounce.

US Dollar Index Testing Trend Line

The US dollar index staged a bounce following last week’s FOMC rate decision, but the rally now finds itself pressing against resistance at around the 97.60-80 area. Here, the 21-day exponential moving average meets prior support and the underside of a bearish trend line. Given the confluence of these important technical factors here, this makes it a key resistance area to watch. A clean breakout above here would appease the US dollar bulls, at least in the near-term.

However, the broader picture still reflects a sequence of lower highs and lower lows, consistent with a corrective trend. The recovery we saw began after the index dipped beneath the July trough of 96.37, sweeping out liquidity before staging a rebound.

Whether this proves to be a durable low, perhaps a double bottom, or even a false breakdown, remains to be seen. For the moment, the market requires stronger bullish confirmation to convince traders that this is anything more than a short-term reprieve. I’m not persuaded just yet, so it’s a case of watching how the week develops.

Keep an Eye on USD/JPY

After a rather quiet few months, the USD/JPY chart is shaping up to be rather intriguing. The Bank of Japan struck a marginally hawkish note last week, hinting that further rate rises could be on the horizon. That comes right when the Federal Reserve is now cutting rates again, a divergence that should, in theory, place downward pressure on the {{|0USD/JPY}} pair. Yet, price action hasn’t quite reflected this. Not yet, anyway. But is that about to change?

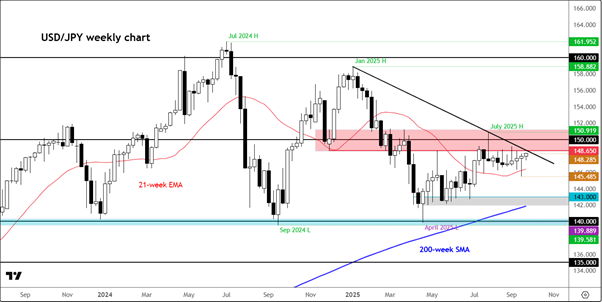

Turning our gaze to the USD/JPY charts now, and on the weekly, we can see the pair has produced a string of indecisive doji-style candles over recent weeks — a classic signal that the market is coiling before a larger directional move.

What will be the fundamental trigger of that remains to be seen, but with the US dollar being among the weakest of major currencies in recent months, it could simply be a case of rotations into the yen ahead of a possible rate hike or two from the BoJ in the coming months.

USD/JPY Levels to Watch

The USD/JPY continues to grapple with a major resistance band between 148.65 and 150.00. This zone, once a strong base in December and again earlier this year, has been retested multiple times since it broke down. So far, we haven’t had a convincing break back above it to tip the balance in the bull’s favor again.

So, the sellers are still technically in charge, and this group of traders was encouraged by the appearance of an inverted hammer candle at those highs that was formed at the end of July. Yet, frustratingly for the bears, the follow-through has been conspicuously absent. Prices have merely drifted sideways.

The question now is whether the Fed’s dovish tilt can finally tip the balance lower. If so, the UJ bears could initially target liquidity resting beneath last week’s low of 145.48, with the pair currently testing waters above the high of last week’s range at 148.28.

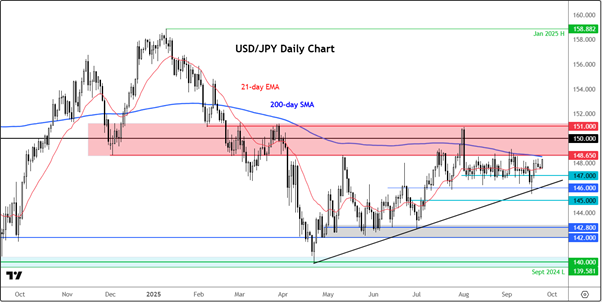

On the daily chart, we can see that the 200-day moving average is doing a fine job of capping rallies, reinforcing the importance of that 148.65–150 resistance corridor we discussed when looking at the weekly time frame. With this long-term moving average pointing lower, the broader trend is starting to lean bearish.

However, conviction will only come if the market can break below some important support levels now. The first one is at 147.00. Beneath there, a descending trendline offers support at around 146.00, and if that were to give way, 145.00 becomes the logical next target.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.