Buy tech sell-off, Wedbush’s Ives says: ’this is a 1996 moment, not 1999’

Stocks gave back all of Monday's gains and a bit more, with the S&P 500 finishing yesterday lower just over 1%.

Of course, today at 2 PM ET, we get the FOMC meeting decision, the Summary of Economic Projections, and then the Powell presser. That leaves the USD/JPY in the crosshairs, and really, the path for the USD/JPY couldn’t be more two-way. You can flip a coin at this point to call the direction.

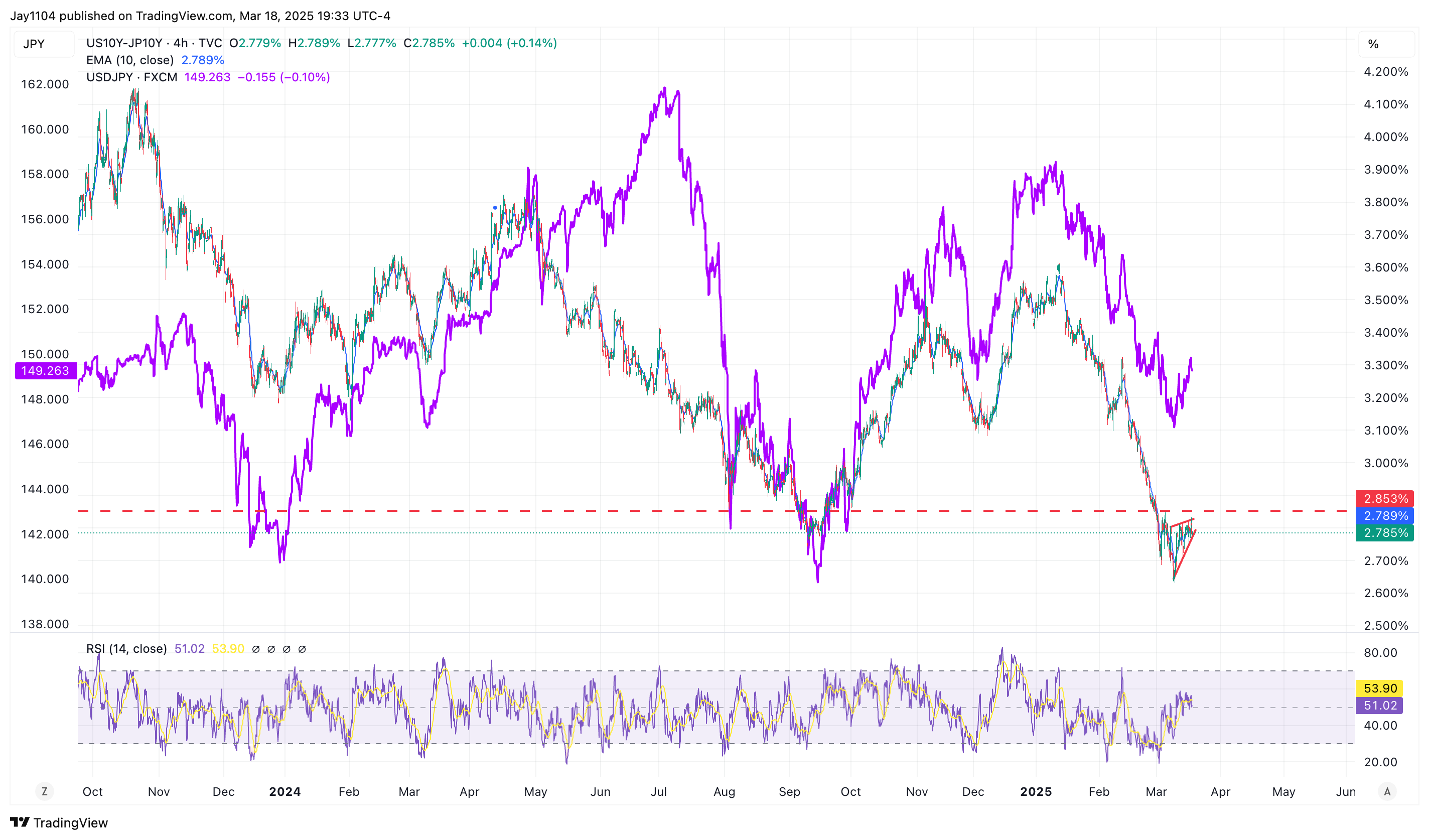

However, when looking at the spread between the US 10-year and the 10-year JGB, the bias appears to suggest that the spread continues to narrow; it certainly looks like some kind of bear pennant has formed in the chart.

If the spread narrows further, it would suggest that the USD/JPY falls, meaning that the Yen strengthens since the two track each other almost perfectly.

The BoJ has had plenty of opportunities to counter the rising Japan 10-Year JGB yield recently, but it has opted not to counter the higher yields.

So we go back to the USD/JPY, and if material strengthening occurs, then I think it will mean that the carry trade continues to unwind.

Of course, we won’t know the actual outcomes until Wednesday evening, after the Fed’s meeting, because we must wait and see what Powell & Co. has to say. So, being patient may be the best bet until outcomes become clear.