SoFi shares rise as record revenue, member growth drive strong Q3 results

- Japan’s Prime Minister’s resignation weakens USD/JPY; BoJ meetings will guide future actions.

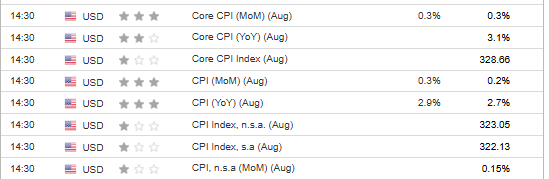

- US inflation expected at 2.9% influences monetary policy outlook for year-end.

- USD/JPY remains in 146.50-149 range, waiting for breakout to determine direction.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

Over the weekend, Japan’s political scene changed significantly when Prime Minister Shiger Ishiba resigned. Initially, this caused the USD/JPY to weaken, but the overall market situation hasn’t shifted much. Investors are still waiting for the Bank of Japan’s possible actions at its meetings in September and October.

The meeting next week probably won’t lead to any changes, but a 0.25% rate increase in October is still possible. In the US, attention is on this week’s inflation reports, which are expected to show a slight increase to 2.9% year-over-year.

Yen Faces Pressure Following Prime Minister’s Resignation

Following the resignation of Japan’s Prime Minister, there’s growing speculation about who might succeed him. Sanae Takaichi is a leading candidate and openly supports Abenomics, which is an ultra-loose monetary policy. As a result, early in the week, currency pairs involving the Japanese yen showed a price gap, suggesting the yen might be overvalued.

However, the Bank of Japan remains crucial in determining the value of the Japanese yen. Recently, BoJ Deputy Governor Ryozo Himino stated that the Bank is open to raising interest rates further, but didn’t specify a timeline. This lack of commitment is seen by the market as a dovish or cautious signal.

Consequently, the likelihood of a 0.25% interest rate cut this year is decreasing, which is causing the yen to weaken. It will be interesting to see how Japan’s monetary authorities respond to growing calls for tighter monetary policy, not only from international figures like Scott Bessent but also from domestic voices such as Takeshi Niinami, the chairman of the Japan Executives Association.

US Inflation Data in Focus

This Thursday, we’ll receive the latest US inflation data. Forecasts suggest a slight increase to 2.9% year-over-year. While this uptick is unlikely to significantly influence the mid-September decision, it will be important for shaping monetary policy expectations for the remainder of the year.

In the event that inflation returns above the 3% y/y level, any dovish surprise in the form of more than two 25bp cuts would most likely be ruled out.

USD/JPY Technical Outlook

The reshuffle on the Japanese political scene has failed to break out of the sideways trend on the USDJPY set between 146.50-149 yen per US dollar.

This is also due to the fact that both the yen and the US dollar are primarily affected by supply forces, which translates into a lack of clear direction. In the event of a possible breakout to the bottom, the way is opened for an attack on the nearest falling support in the area of 145 yen per dollar, while in the corresponding case buyers will already be looking at the maxima in the area of 151 yen per US dollar.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.