Trump administration authorizes CIA for covert action in Venezuela - Bloomberg

This Chart Says Stocks Could Hit All-Time Highs

Despite ongoing concerns about inflation, labor market stability, and consumer spending, stocks have erased their early 2025 losses and are now up for the year. While many fear for a slowdown, one specific chart from suggests we could be heading for new all-time highs—and soon.

The Weekly Gap-Up That Changes Everything

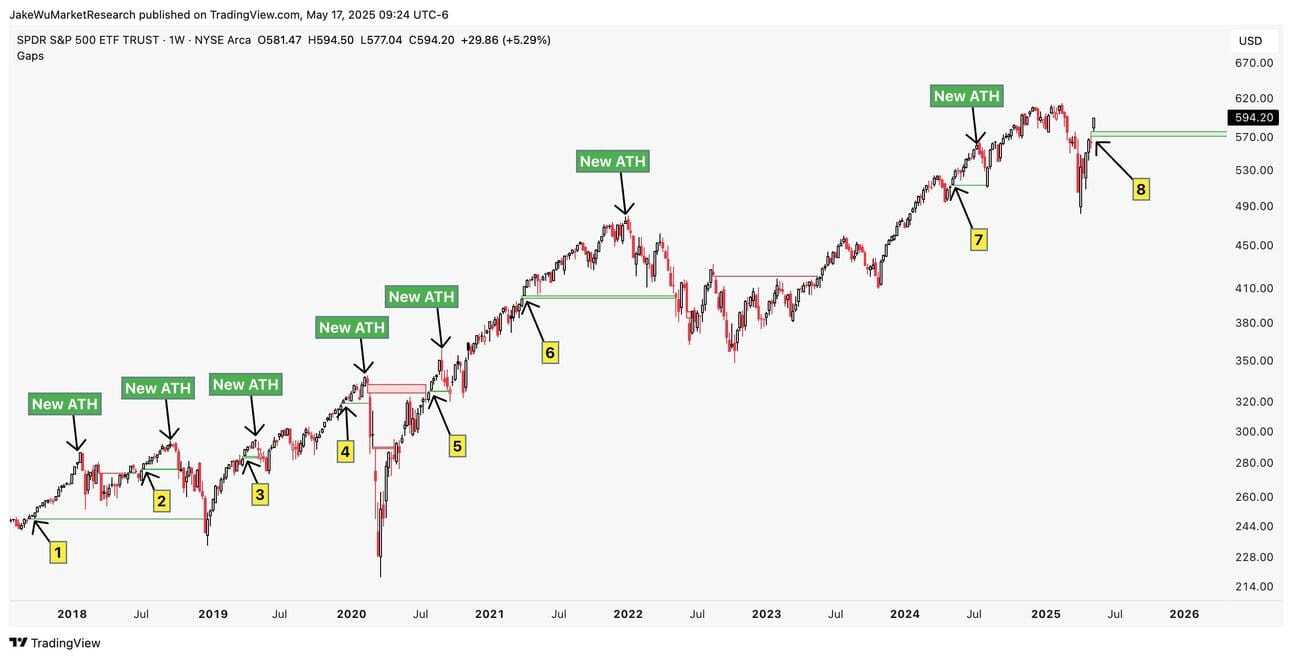

I found this very informative chart from Jake Wujastyk, who points out a unique market phenomenon: the weekly gap-up. For those unfamiliar, a gap-up occurs when the opening price of a new trading week is significantly higher than the previous week’s close, leaving a "gap" on the chart. What makes this particularly interesting is what happens next. Since 2018, there have been eight significant weekly gap-ups. Seven of these have already played out, and the results are undeniable:

- All seven previous weekly gap-ups led to new all-time highs (New ATH) before the gap was ever filled.

- The market didn’t just rally—it continued upward to set new records before any meaningful pullback occurred.

The eighth gap-up just occurred and it hasn’t filled yet. If history is any guide, this suggests that we are on track for another run to all-time highs, potentially before any substantial correction.

Why This Time Could Be No Different

Skeptics will argue that economic headwinds are too strong this time. But the truth is, markets often operate on a different wavelength than economic data. Market sentiment, liquidity, and technical signals frequently drive prices beyond what fundamentals would suggest. Wujastyk’s chart is a testament to how momentum and liquidity can override bearish narratives.

The consistency of this gap-up phenomenon is what makes it so compelling. In each of the seven prior instances, there was ample reason to doubt the rally: trade wars, rate hikes, political turmoil, and even a pandemic. Yet, the market climbed higher. The May 2025 gap-up marks the eighth occurrence, and unless something fundamentally disrupts the cycle, it sets the stage for new highs—potentially as early as late June.

A Historic Setup Worth Watching

The chart tells a story of momentum that defies the typical doom-and-gloom expectations. While many are bracing for a downturn, this weekly gap-up setup suggests otherwise. The critical factor to watch is whether the gap fills. If it doesn’t, it would reinforce the weekly gap-up’s 100% accuracy rate. Traders and investors alike should keep a close watch on this gap because, as history suggests, ignoring it could mean missing out on a massive technical signal.