Oklo stock tumbles as Financial Times scrutinizes valuation

- Home Depot and Walmart unveiled their Q4 2023 results, with the former reporting sales slightly exceeding expectations and the latter surpassing revenue projections.

- Home Depot's Q4 earnings report showed resilience in the face of challenges, and a positive outlook for 2024.

- However, caution is advised as both companies face potential corrections, according to InvestingPro's fair value analysis.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Retailers Home Depot (NYSE:HD) and Walmart (NYSE:WMT) unveiled their Q4 2023 results today ahead of the opening bell.

Home Depot reported Q4 sales of $34.8 billion, reflecting a 2.9% year-on-year decrease. InvestingPro had anticipated Q4 sales of $34.67 billion, and the actual sales slightly exceeded expectations.

The report highlighted a 3.5% decline in comparable sales, slightly better than the 4% decrease in comparable sales in the US.

Analyzing earnings reports from these retail giants provides crucial insights for assessing consumer demand trends.

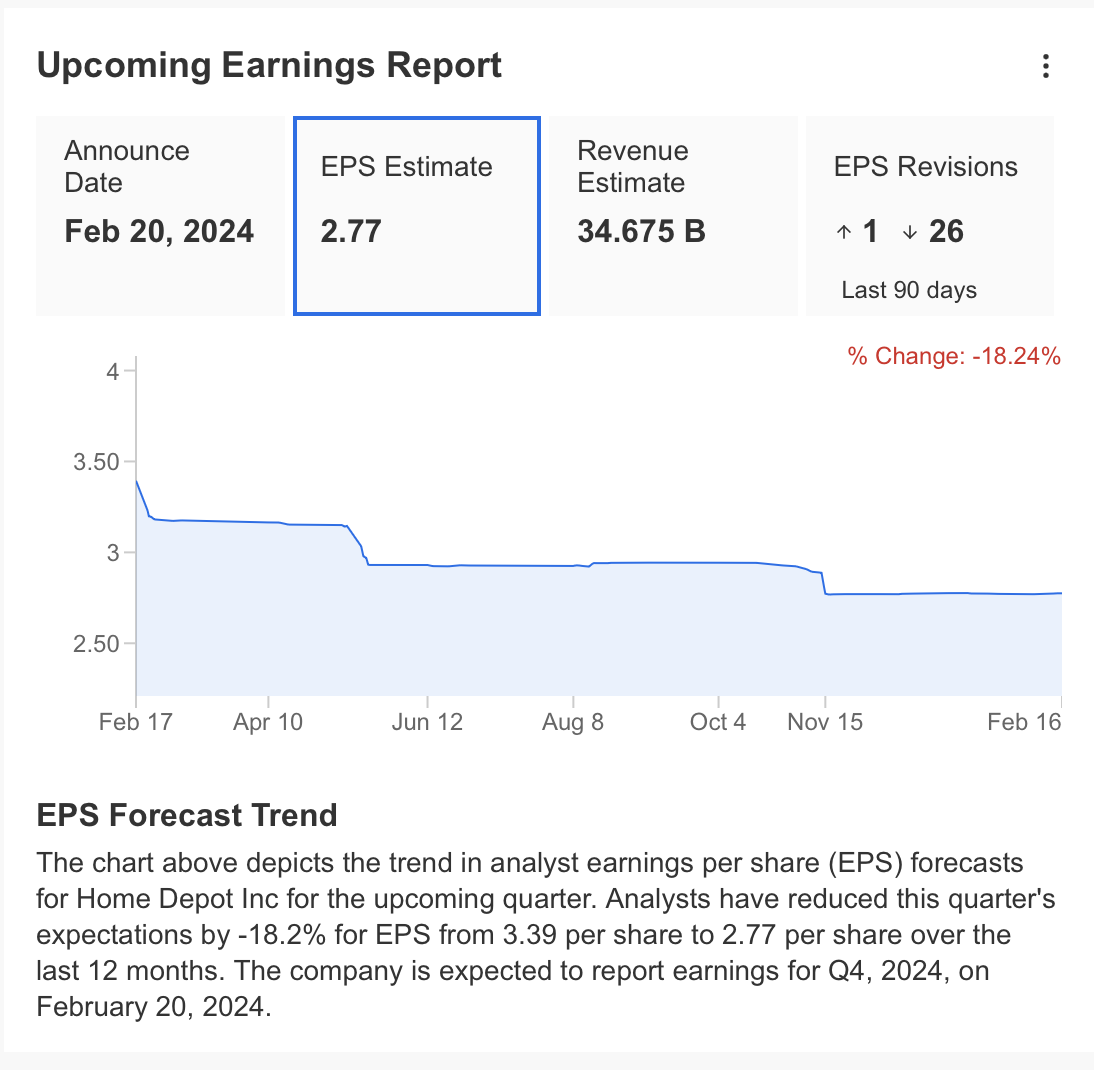

Source: InvestingPro

For the 4th quarter of 2023, net profit was announced as $2.8 billion, while earnings per share came in at $2.82.

This was above the InvestingPro EPS estimate of $2.77. In the same period last year, EPS was $3.3 compared to a profit of $3.4 billion, a 14.5% decrease.

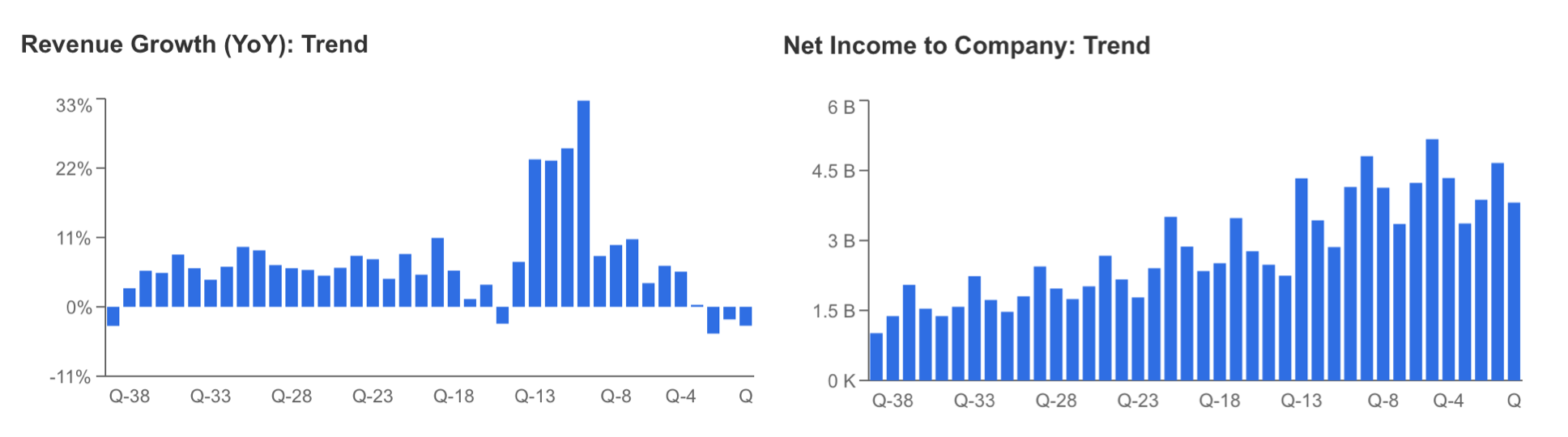

As the Q4 earnings report shows, the negative trend in the company's revenue growth continues. The decline in net earnings was negative in the last quarter, falling below $3 billion for the first time after the first quarter of 2021.

Source: InvestingPro

Following Q4 results, sales for fiscal 2023 were down 3% y-o-y to $152.7 billion. Annual net profit was recorded as $15.1 billion and $15.11 EPS, down 9.5% compared to last year.

Although the company saw declines in its Q4 results, it showed significant resilience in a challenging year for retail with figures above expectations.

Home Depot Looks to Gain Market Share

Home Depot CEO Ted Decker said that the company spent 2023 moderately after a 3-year growth period.

Decker continued his statement by saying that they remained loyal to their strategic investments in 2023 and expressed optimism about growing their market share in the sector.

The company also announced in its earnings report that the quarterly dividend of $2.25 per share was increased by 7.7% and the annual dividend will be 9 dollars.

In the guidance for 2024, Home Depot reported that it aims to increase its total sales by about $2.3 billion.

This showed that the company expects a moderate growth of about 1%. The company expects comparable sales to decline by 1% in 2024.

The company's forecast for 2024 was below the forecast of analysts, who are currently forecasting sub-1.6% annual growth in sales.

Source: InvestingPro

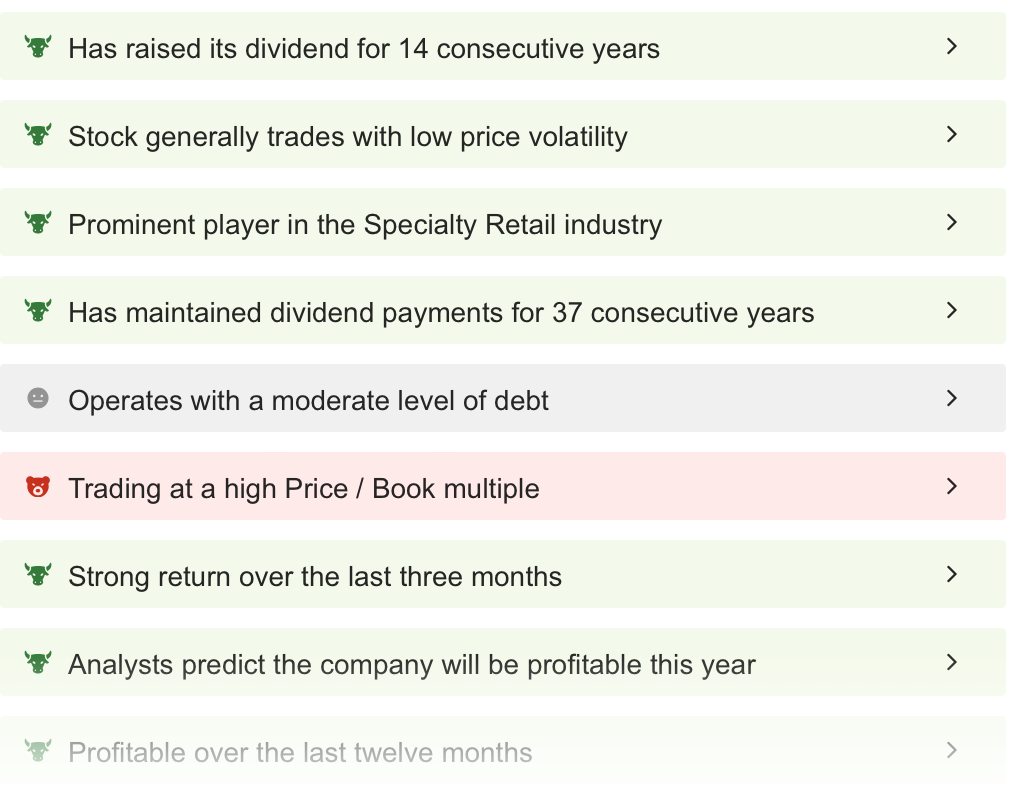

Home Depot: ProTips Summary

With the ProTpis summary on the InvestingPro platform, we can quickly get an overview of the company.

The retailer, which has been paying dividends for 37 years, has increased its dividend payments for 14 consecutive years, which the company decided to increase this year.

The company's continued profitability, albeit in a downward trend, and the strong performance and low volatility of the HD share despite the challenging conditions are listed as strengths.

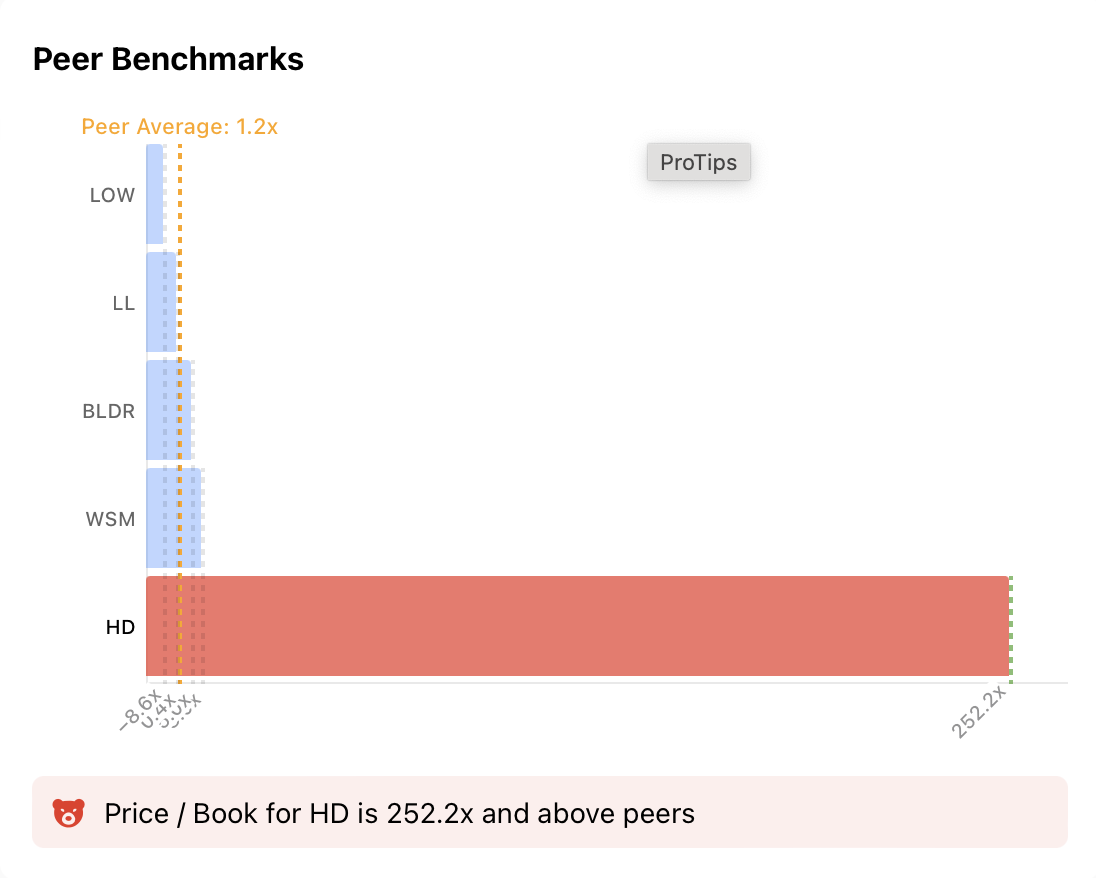

The company's high P/E ratio of 252x is well above the peer average, signaling a possible correction.

Source: InvestingPro

On the other hand, the company's average debt level can be interpreted as a warning sign for the company in a period of high interest rates.

Nevertheless, Home Depot's net debt to capitalization ratio remains at 11.5%, which is low compared to the average net debt to capitalization ratio of 28.9% for peer companies.

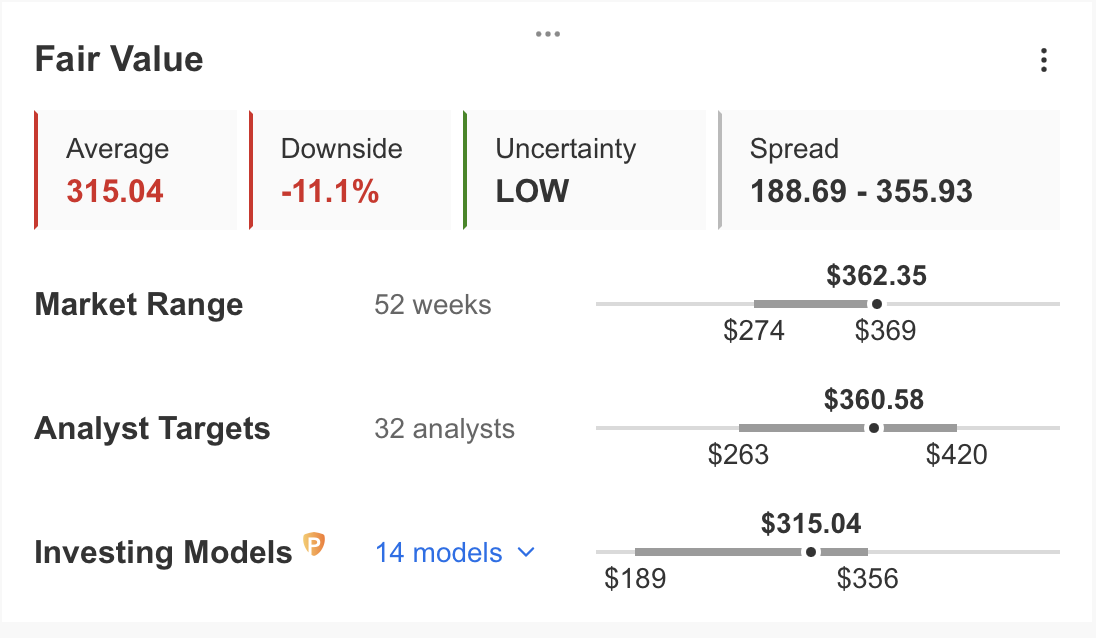

In light of this information, InvestingPro's fair value analysis based on 14 financial models suggests that HD could see a correction up to $315.

Accordingly, the share price could record a correction exceeding 10% during the year.

Source: InvestingPro

Walmart Beats Expectations

Walmart increased its revenue by 5.7% to $173.4 billion in Q4 2023. The earnings report was led by operating income, which jumped 30.4% to $1.7 billion, while adjusted operating income rose 13.4%.

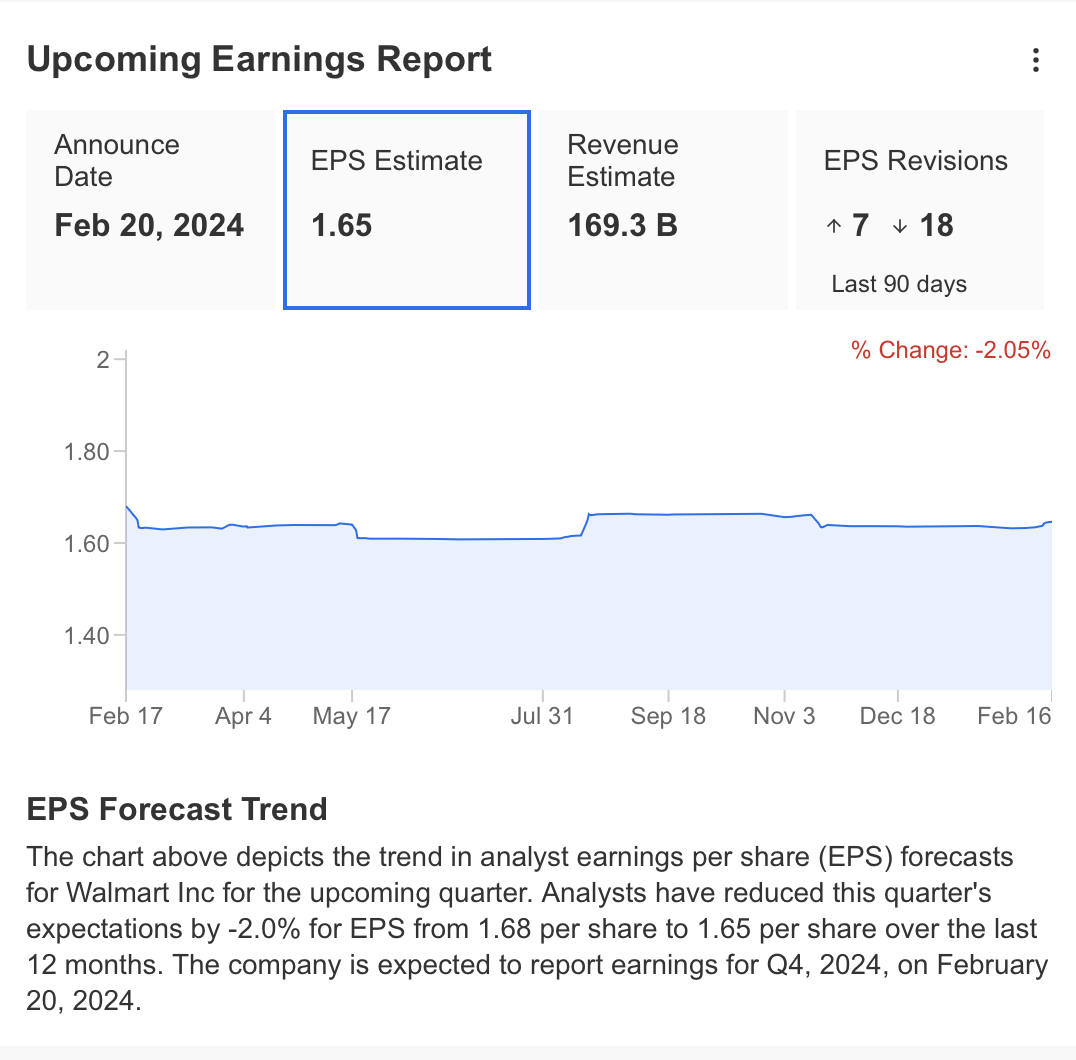

The company's earnings per share also came in above expectations at $1.8. InvestingPro's expectations were for Walmart to announce $169.3 billion in revenue and $1.65 EBIT in the last quarter.

Source: InvestingPro

Walmart also showed that it has successfully managed its digital retailing activities, with e-commerce sales increasing by 23% in the last quarter, exceeding $100 billion.

Source: InvestingPro

Walmart's guidance for the coming quarters was one of the highly anticipated sections among market participants.

While the company adopted an optimistic approach for the coming periods, it was also careful to act cautiously.

Announcing that it increased its annual dividend by 9%, Walmart increased its dividend payment per share to $0.83.

This can be considered a sign that the company's financial health remains solid.

Source: InvestingPro

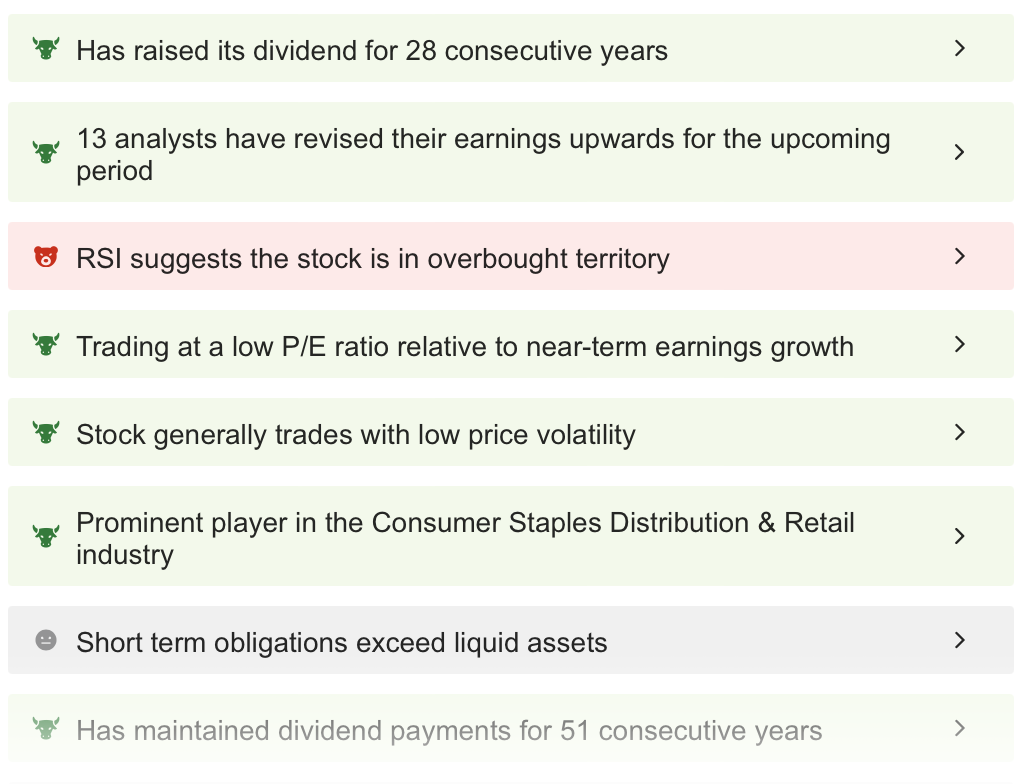

Walmart: ProTips Summary

While the company continues to reassure investors with its regular dividend payment, the fact that it continues with an advantageous P/E ratio compared to short-term profit growth is a positive factor.

With profitability remaining strong, the stock's low volatility is another factor that reassures investors.

Source: InvestingPro

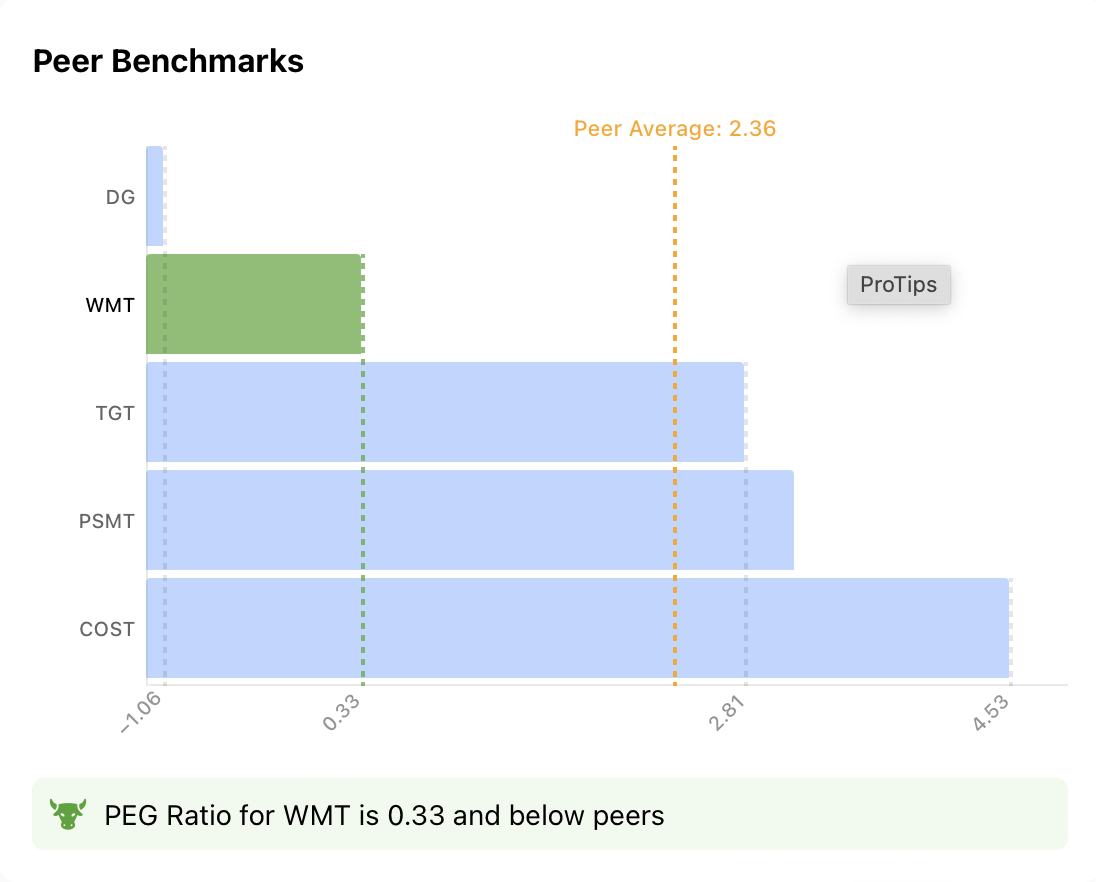

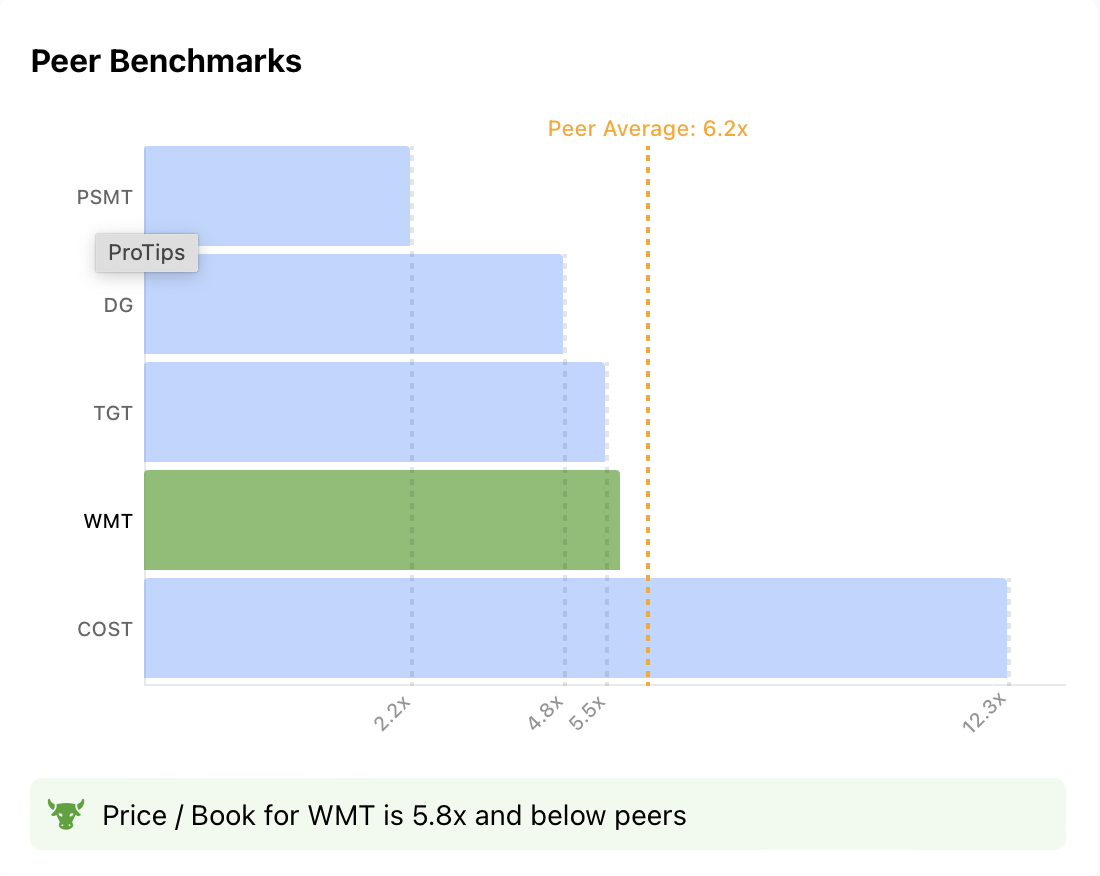

Two cautionary features for the company are that it moves at an average debt level and short-term liabilities remain above liquid assets. In addition, Walmart moves below the peer average with a P/E ratio of 5.5X.

On the other hand, WMT is technically moving in the overbought zone with a high RSI level.

In addition, InvestingPro's fair value analysis predicts that WMT is moving at a 13% premium to its current price of $170 according to 15 financial models and estimates that the share price could see a correction to $152 within the year.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,427.8% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code INVPROGA24 at checkout for a 10% discount on all InvestingPro plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.