Webull beats Q3 expectations as revenue jumps 55% on strong trading

The current lineup of US GDP nowcasts for the third quarter continue to indicate a softer but still solid growth rate. Wall Street is wondering if the upcoming payrolls report for August will change the calculus.

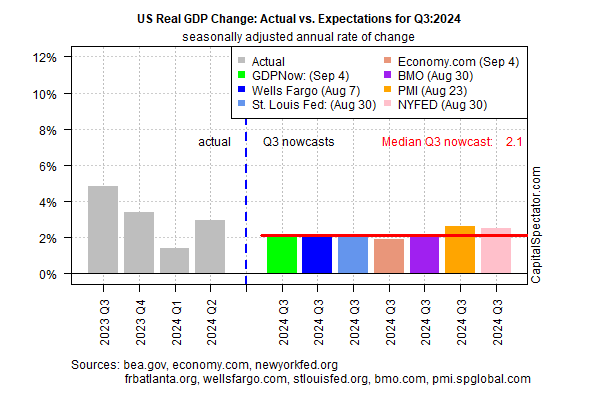

Let’s start with the current nowcast for Q3 GDP. The median estimate, based on a set of projections compiled by CapitalSpectator.com, is 2.1%.

That marks a slowdown from the strong 3.0% rise in Q2, but a 2% increase – if correct – is still strong enough to dismiss concerns that an NBER-defined recession has started.

Nowcasts, of course, are best guesses using the available data, and so all the standard caveats apply. But it’s encouraging that the current Q3 nowcast remains relatively steady at/near the 2% mark.

The current 2.1% nowcast is slightly above the previous median 2.0% estimate (Aug. 27).

The question is whether Friday’s update on August payrolls will paint a different outlook. Recent data for the labor market shows an ongoing slowdown in hiring and a moderate rise in the unemployment rate.

Analysts are still debating the implications, but by some accounts, the tide has turned for the economy and recession risk is rising. Markets will be keenly watching the upcoming jobs data for reassessing the outlook, for good or ill.

“We do not seek or welcome further cooling in labor market conditions,” Fed Chairman Powell said in a speech in Jackson Hole, Wyoming, in late-August.

Nomura Securities predicts a stronger pace of hiring in Friday’s report. “We expect the employment report to show a reassuring rebound in job gains and a downtick in the unemployment rate,” the firm wrote in a research note on Friday.

“The labor market is cooling, but in our view, the weakness in July was overstated.”

Economists generally agree, based on the median point forecast via Econoday.com. Total nonfarm payrolls are projected to rise 160,000 in August, up from a weak 114,000 increase in the previous month.