Street Calls of the Week

Friday's quadruple witching of options expiration made it difficult to confirm the significance of the day-trading action. Some indexes continue to work with the same areas of support from previous days. Others, not so much.

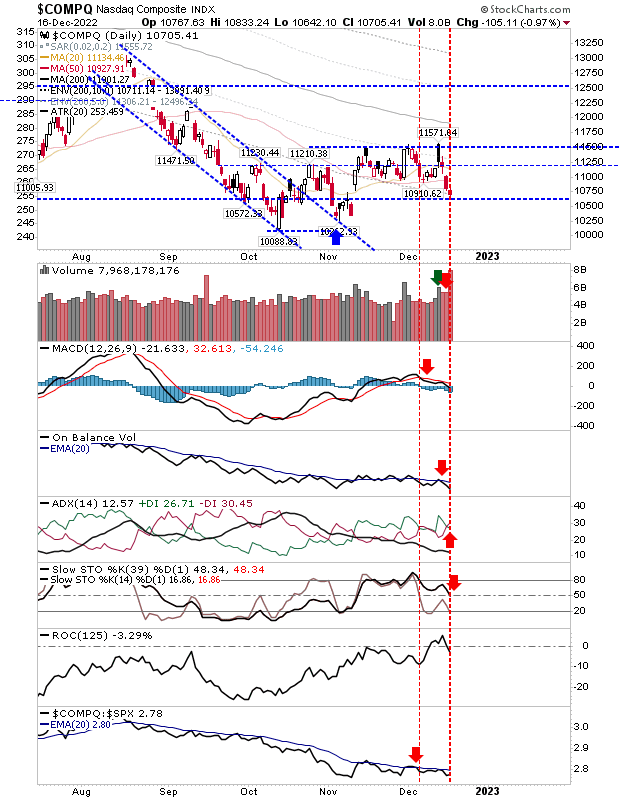

The Nasdaq touched support with a candlestick not typically associated with a reversal - a more neutral 'spinning top' - that leaves things open for today. However, technicals are net bearish, which guides in favor of bears and further losses.

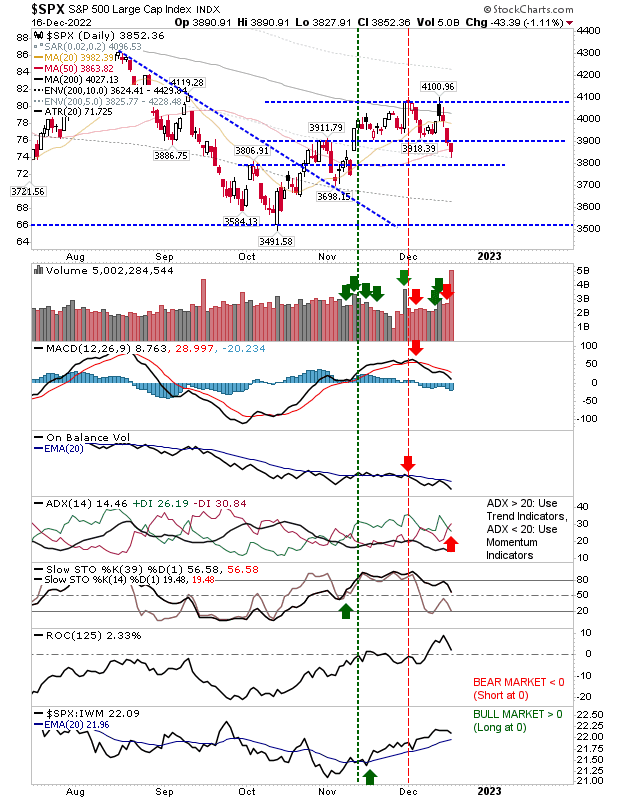

The S&P 500 made a clean cut from what I had defined as possible support without pausing on the way down. It is now looking at the support of its 50-day MA, but as with the Nasdaq, the candlestick is, again, not one associated with a reversal.

Technicals are not net bearish, but there are 'sell' triggers in the MACD, On-Balance-Volume, and ADX. However, the index is outperforming Small Caps, which should attract buyers. However, the index is outperforming the Russel 2000, which should attract buyers.

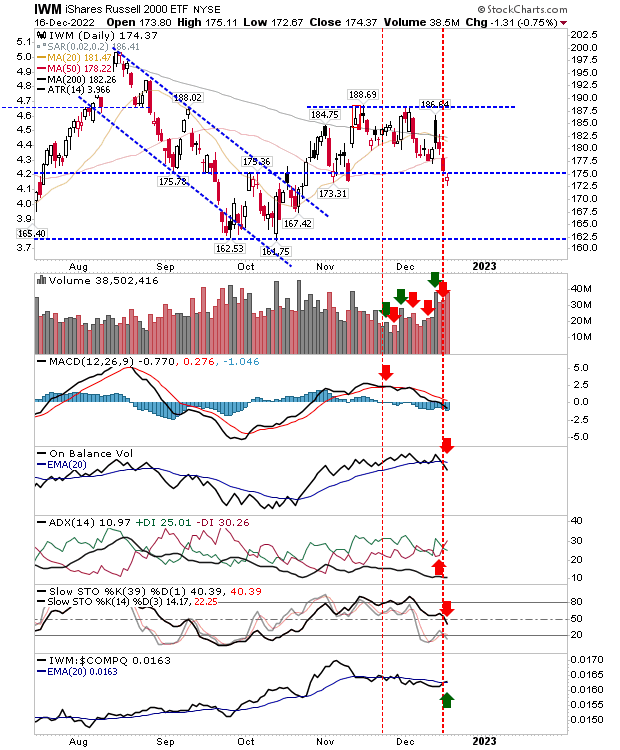

The index feeling the most pressure is the Russell 2000 (IWM). The one support level I thought would hold the three indices got nicked from the open. Adding to the pressure was the net bearish finish to its technicals, although the Russell 2000 is still outperforming the Nasdaq.

Given that the index is staring into the abyss (next support is the October low), buyers could get aggressive at the open and look for a quick return above $175 ($IWM), but if the index can't close above this level on Monday, then $162.50 is a given.

The deadline for a 'Santa rally' is only a few days away, and we could see some bear traps early this week. Watch out for the important levels, as some nice trades should appear along the way.