Nvidia among investors in xAI’s $20 bln capital raise- Bloomberg

By Investing.com Staff

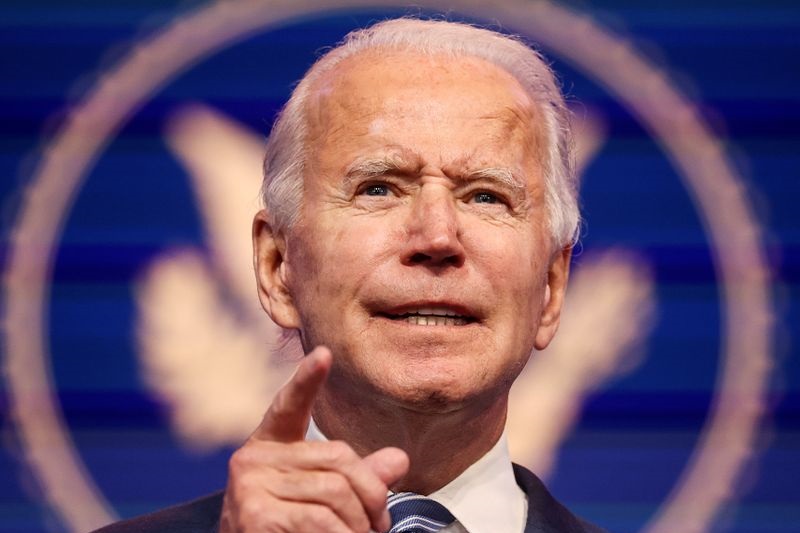

At tonight's State of the Union address, President Biden is expected to call for a 400% hike in the tax on stock buybacks. This could bring the current 1% rate to 4%.

While the announcement is expected to make waves, Cowen analysts don't expect House Republicans to approve a higher buyback tax. However, they add that the probability is not zero, given that the GOP has become populist.

They highlight the news is high impact risk for banks, which are active users of stock repurchases as a way to return capital to shareholders.

"The Federal Reserve in the years after the Financial Crisis pushed banks to favor stock buybacks over dividend increases because evidence from the months leading to the crisis showed banks were quick to cut buybacks but slow to slash dividends," they explain.

The analysts expect bank regulators will privately object to a higher buyback tax as it would encourage banks to raise dividends rather than repurchase shares.