FTSE 100 today: closes higher as UK inflation surprises; GBP lower, Ithaca report

* Dollar could post worst month v basket since 2011

* Dovish Fed expected, statement due 1800 GMT

* MSCI AxJ stocks up 0.3% led by China

* Asian stock markets: https://tmsnrt.rs/2zpUAr4

By Tom Westbrook and Suzanne Barlyn

SINGAPORE/NEW YORK, July 29 (Reuters) - The U.S. dollar

hovered just above a two-year low on Wednesday, while stocks

struggled, as growing worries about the U.S. economy had

investors cautious and looking to Congress and the Federal

Reserve for a boost.

The Fed is expected to strike a dovish stance at its policy

review later in the day and perhaps open the door to a higher

tolerance for inflation - something dollar bears think could

squash real yields and sink the currency even further.

A $1 trillion U.S. fiscal rescue package is also at an

impasse as a Friday deadline to extend unemployment benefits

looms. MSCI's broadest index of Asia-Pacific shares outside Japan

.MIAPJ0000PUS rose 0.1% as gains in China offset small losses

elsewhere. Japan's Nikkei .N225 was down 0.8% on a rising yen

and weak start to corporate earnings season. .T

Against a basket of currencies =USD the dollar wallowed

just 0.3% above a two-year low hit a day ago. It has lost 3.7%

in July so far and is headed for its worst month in nine years.

Gold XAU= steadied around $1,960 an ounce, pulling back

from a $1,980 high on Tuesday but still having gained nearly

$150 in eight sessions. GOL/ S&P 500 futures ESc1 were flat.

The Fed's forward guidance probably determines the next move

and the extension of several emergency lending facilities on

Tuesday fuelled anticipation of a particularly dovish tone.

"Some pockets of the market are looking for the forward

guidance to be a bit bolder in a dovish direction," said Imre

Speizer, currency analyst at Westpac in Auckland. "If we don't

get that, you may well get a small rebound in the dollar."

The Fed publishes its interest rate decision, which is not

expected to change, at 1800 GMT and Chair Jerome Powell holds a

press conference half an hour later.

The bond market was also in a cautious mood ahead of the

meeting, having retraced a selloff on Tuesday to leave benchmark

U.S. 10-year yields US10YT=RR at 0.5823%. US/

SHOW ME THE MONEY

Besides the Fed, the other focus is on political wrangling

over the next U.S. fiscal package, which weighed on Wall Street

overnight where the S&P 500 .SPX fell 0.6%. .N

Republicans' $1 trillion proposal includes cutting a weekly

$600 unemployment benefit, which expires on Friday, to $200 just

as cracks emerge in the economic rebound.

U.S. consumer confidence fell by more than expected this

month, as COVID-19 infections flared. The Democrats are pressing for a larger spending commitment,

while President Donald Trump also said he didn't like elements

of the Republican plan, adding to the sense of confusion.

"This is a big deal - there's 30 million people unemployed

and so much of U.S. GDP is consumer spending," said Chris

Brankin, CEO of brokerage TD Ameritrade Singapore.

"Markets are hopeful that some type of extension gets

done...even if it's reduced - if you just cut if off wholly

you'd see significant volatility in the markets."

Elsewhere in currencies, the Australian dollar AUD=D3

eased to $0.7164 after second quarter consumer prices fell by

the most on record, cementing views interest rates would stay

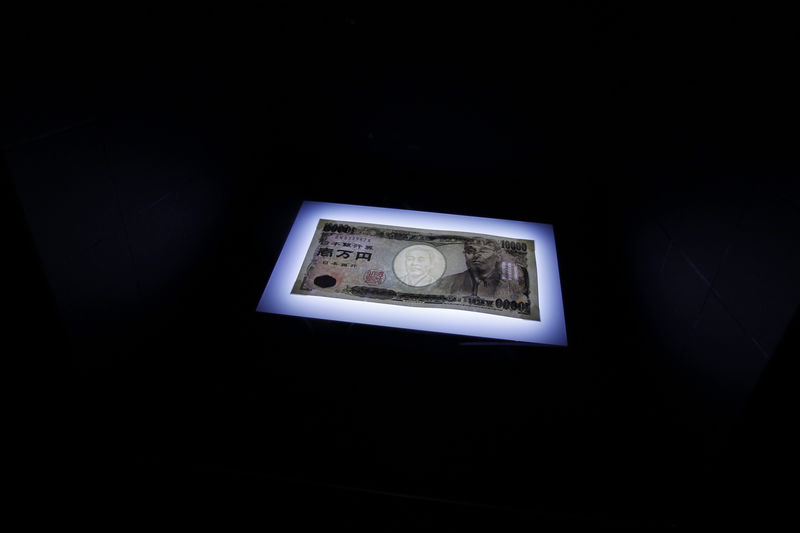

low for a long time to come. The euro EUR=EBS was steady at $1.1723 while the yen

JPY= was testing a new four-month top at 105.09 per dollar.

Copper prices climbed back towards a two-year high hit two

weeks ago, on hopes that global stimulus would help industrial

demand. MET/L

Oil prices steadied after a surprise drop in U.S.

inventories pointed to energy demand, even as virus infections

surge. O/R

Brent crude futures LCOc1 were last up 0.2% at $43.29 per

barrel and U.S. crude was flat at $41.03 a barrel.