Robinhood shares gain on Q2 beat, as user and crypto growth accelerate

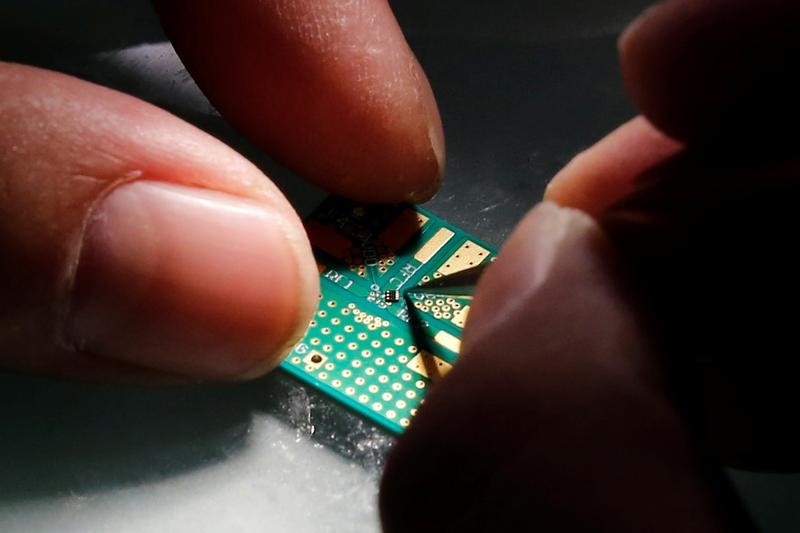

In the booming semiconductor sector, ASML NV (NASDAQ: ASML) and Aehr Test Systems (NASDAQ: AEHR) have demonstrated strong performance over the past year. Both companies offer different investment opportunities within the industry, with ASML being the world's largest producer of lithography systems and Aehr Test Systems being a smaller firm specializing in testing equipment for semiconductors.

ASML, also the sole producer of high-end extreme ultraviolet (EUV) lithography systems, has seen its stock rally nearly 30% over the past 12 months. These EUV systems are crucial for manufacturing the world's most intricate, transistor-dense chips. Despite experiencing a slowdown in revenue growth in 2022 due to declining PC sales, slow smartphone sales, and other macroeconomic headwinds, analysts predict a growth of 23% in revenue and 30% in earnings for ASML in 2023.

ASML's long-term forecast presented during its investor day presentation in November suggests an annual revenue between $47 billion and $64 billion by 2030. This implies a compound annual growth rate of 12% from 2022 to 2030. The company also expects its annual gross margin to expand to between 56% and 60% by 2030.

However, potential challenges lie ahead for ASML as escalating trade and military tensions between Taiwan, China, and the U.S. could impact its top market - Taiwan - which accounted for 38% of its revenue in 2022. Additionally, potential restrictions by U.S. and European regulators on sales of lithography systems to chipmakers in mainland China could pose risks.

On the other hand, Aehr Test Systems has established an early-mover advantage in testing equipment for silicon carbide chips, which can operate at higher voltages, temperatures, and frequencies than traditional silicon chips. The company's stock has more than tripled over the past 12 months.

The demand for silicon carbide chips has surged in recent years due to their resilience, making them ideal for applications such as short-length LEDs, lasers, 5G base stations, military radars, and electric vehicles. This growth has led to a significant increase in Aehr's sales of silicon carbide testing and burn-in systems over the past two years.

Despite macroeconomic headwinds and supply chain constraints affecting the production of new electric vehicles, Aehr expects its revenue to rise "over 50%" in fiscal 2024 as the electric vehicle market recovers. The company also became profitable on both a GAAP and non-GAAP basis in fiscal 2022.

However, Aehr faces challenges including customer concentration issues, potential competition from larger semiconductor equipment makers, and high stock valuations. The company generated 79% of its revenue from a single customer in fiscal 2023.

Despite these challenges, the strong performance of both ASML and Aehr Test Systems highlights the growth potential within the semiconductor sector.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.