Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

Investing.com -- Boosted by thin pre-holiday volumes, positive comments from Fed chair Powell on Tuesday, and the impressive Tesla (NASDAQ:TSLA) catchup rally, the stock market started July at the same pace it finished June - that is, pushing higher and higher.

Add to that mixture improving market breadth, and there you have the perfect environment for picking lesser-known names for market-beating results.

Unfortunately, while that may not hold true for most retail investors, it certainly does for our premium users. On July 1, they received a list of market-beating stocks for the month ahead for less than $8 a month - and are already reaping the results.

Not only did our AI add Tesla (NASDAQ:TSLA) to its list, notching an amazing +24.6% gain since on that stock alone, but it also added eight other stocks that have, so far, rallied more than 3% in the month.

Just to give a couple of examples of what we're talking about, on top of the perfect timing in the Tesla pick, our AI also added names such as ON Semiconductor Corporation (NASDAQ:ON) (5.1% so far in July) and Super Micro Computer (NASDAQ:SMCI) (up 4.5% so far in July).

Chosen by state-of-the-art fundamental modeling, these stocks add to the much more extensive list of components of our Beat the S&P 500 strategy, which is up twice the performance of the benchmark S&P 500 this month.

And how do we do it?

By combing the power of AI computing with regular rebalances, our state-of-the-art model secures the freshness of all its picks. Differently from everything else out there, these strategies are forward-looking. No momentum trading; no bag-holding. Just best-in-breed AI-powered financial modeling.

This is the exact methodology that pushed our real-world performance to a solid beat over the S&P 500 since our official launch in October. See the data below (per investment strategy):

- Tech Titans: +78.17%

- Beat the S&P 500: +35.60%

- Top Value Stocks: + 30.09%

- S&P 500: 30.66%

*Numbers as of premarket July 5.

This is no backtest. This is the real-world performance unfolded right in front of our eyes.

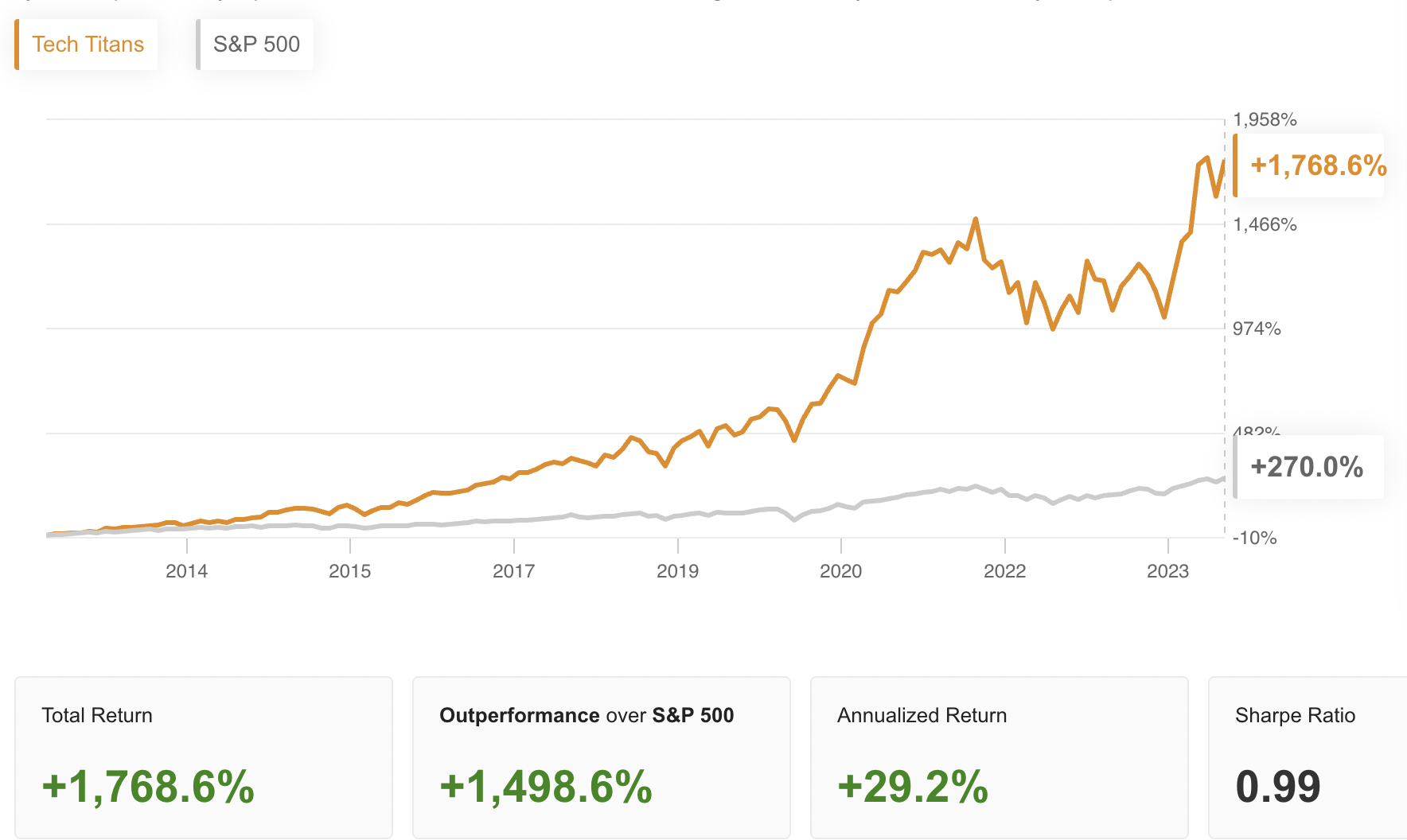

In fact, our backtest suggest that investors who follow the strategies over the long run will get even better results. See below:

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,868,000 by now.

Amazing, right?

Take advantage of our exclusive summer sale and get an insight into the winners now for less than $8 a month!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS2024!