Street Calls of the Week

Investing.com — While the market maintains an absolute focus on NVIDIA Corporation (NASDAQ:NVDA), several other stocks are rallying unnoticed, notching solid results under the radar of the major news outlets.

Such is the case of Vistra Energy Corp (NYSE:VST), up a hefty 38% month to date. In fact, VST has been on our AI's list since March, yielding a fantastic 94% return to our users who followed our strategies.

But while such results sound great to any investor looking to ride the bull market trend, spotting such winners can be the tricky part.

Not for our premium users, though. In fact, for less than $9 a month using this link, our users had a scoop on eight 20%+ gainers before they rallied in May. Just to name a few:

- Perficient (NASDAQ:PRFT): Up 56% in May.

- Louisiana-Pacific Corporation (NYSE:LPX)

- Marathon Digital Holdings (NASDAQ:MARA)

- NAPCO Security Technologies (NASDAQ:NSSC)

Next Monday our AI will rebalance again, providing users with fresh picks for June. Join now for less than $9 and have an insight into next month's winners before they take off!

But how does our AI keep on picking winners?

Simple; by compiling the history of the stock market in data, ProPicks' state-of-the-art AI models update you with the best stock selection in the market at the start of every month.

Differently from everything else out there, our AI-powered stock picks stocks before they become too expensive, thus not just following a "momentum" model.

That's how we managed to crush the market by a very wide margin since the launch in October last year. In fact, these are the gains you would have notched since October by following our AI picks (numbers as of premarket today):

- Beat the S&P 500: +31.69%

- Dominate the Dow: +17.40%

- Tech Titans: +71.76%

- Top Value Stocks: +33.77%

- Mid-cap Movers: +18.47%

That's against the following gains from the benchmark indexes during the same period:

- S&P 500: +15.48%

- Dow Jones Industrial Average: +7.19%

- Nasdaq Composite: +18.98%

This is not a backtest; this is real-world performance, unfolded in real time to our users. In fact, our backtest suggests that going for the long run will give you even heftier gains.

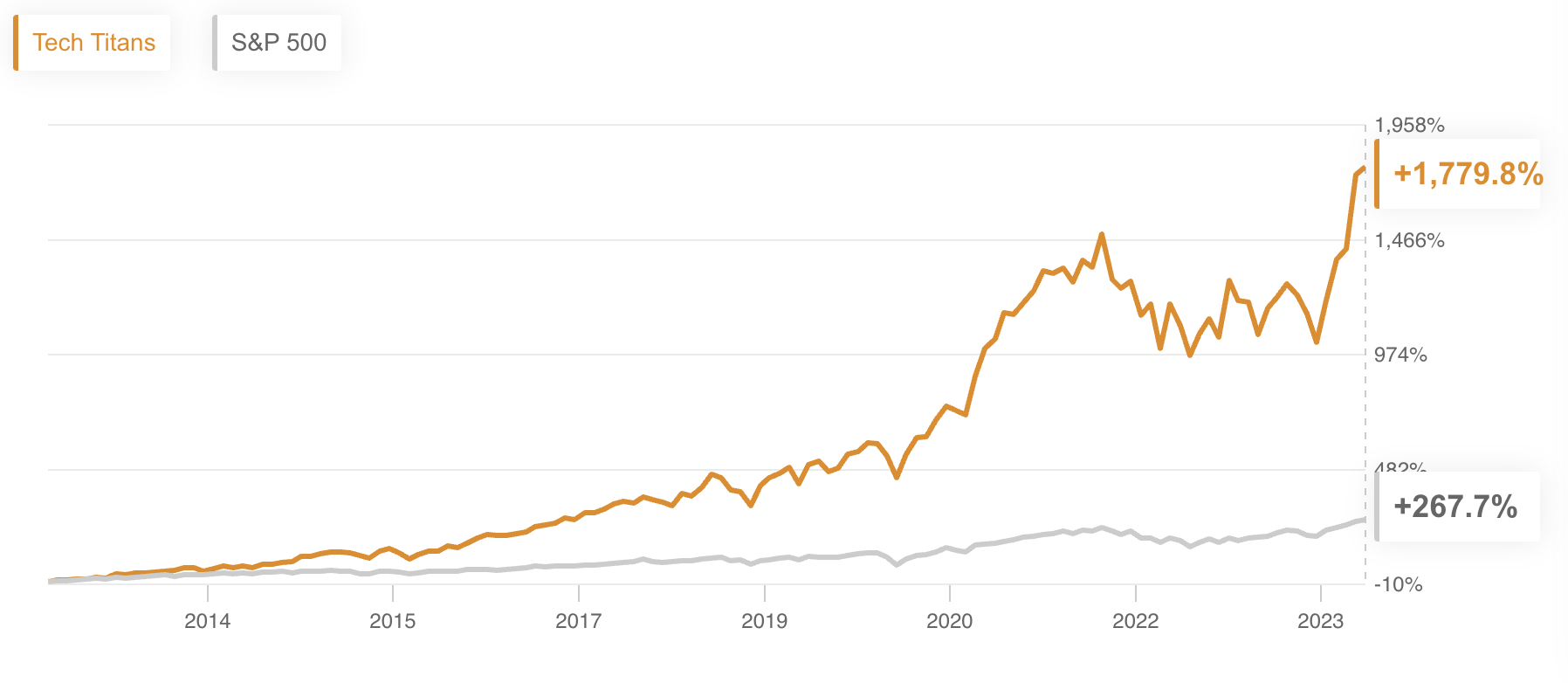

In fact, the aforementioned methodology has led our flagship Tech Titans strategy to garnish an eye-popping 1,779% return in our backtest over the last decade.

Do not miss out on the next winner; subscribe now for less than $9 a month, and never miss another bull market again by not knowing which stocks to buy!

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,879,800K by now.

So, will you keep on guessing or have an insight into the winners?

For less than $9 a month, that decision has never been easier.

Join now and never miss another bull market again!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS20242!