Investor caution ahead of Nvidia earnings "understandable," Barclays says

• Fed rate cut, FOMC dot-plot, Powell comments will be in focus this week.

• Micron offers significant upside potential backed by robust earnings growth and strong demand for its AI-related products.

• Nike faces mounting challenges, with declining revenues, a cautious outlook, and soft consumer demand suggesting further downside for its stock price.

• Looking for more actionable trade ideas? Subscribe here for 55% off InvestingPro as part of our Cyber Week Extended sale!

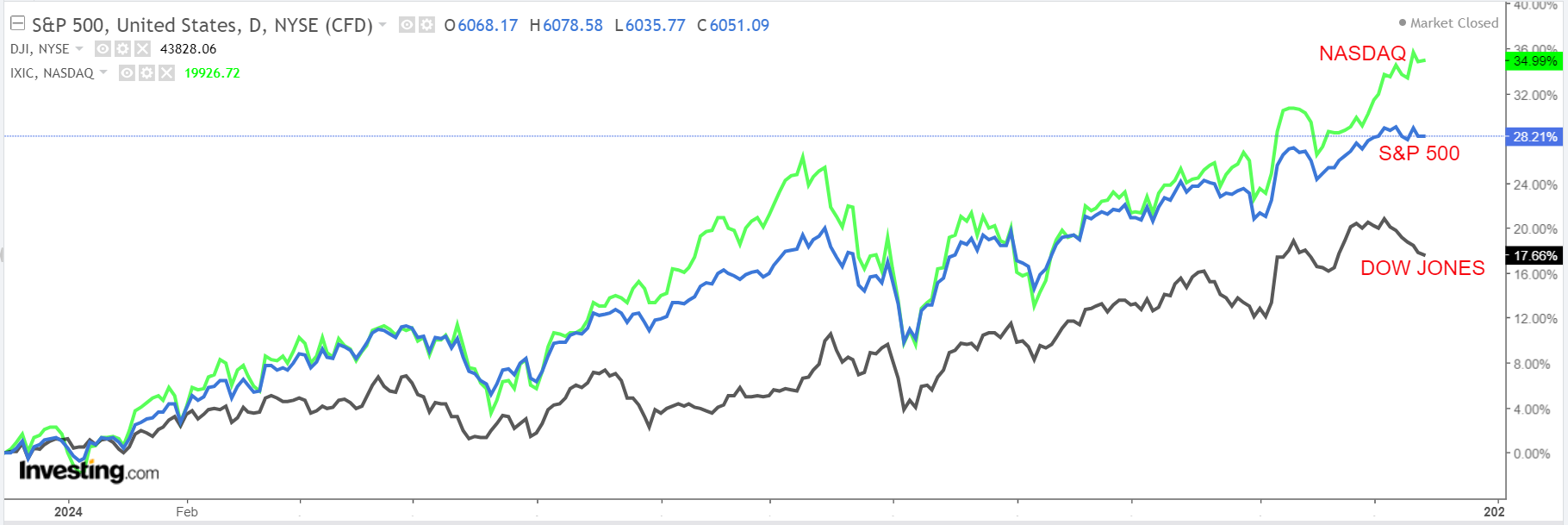

U.S. stocks closed mostly lower on Friday, with the Dow Jones Industrial Average posting its longest run of losses since 2020, as investors priced in the possibility of the Federal Reserve cutting rates more slowly next year.

For the week, the blue-chip Dow fell 1.8%, the S&P 500 dipped about 0.6%, while the tech-heavy Nasdaq Composite tacked on around 0.3% to secure its fourth consecutive week of gains.

Source: Investing.com

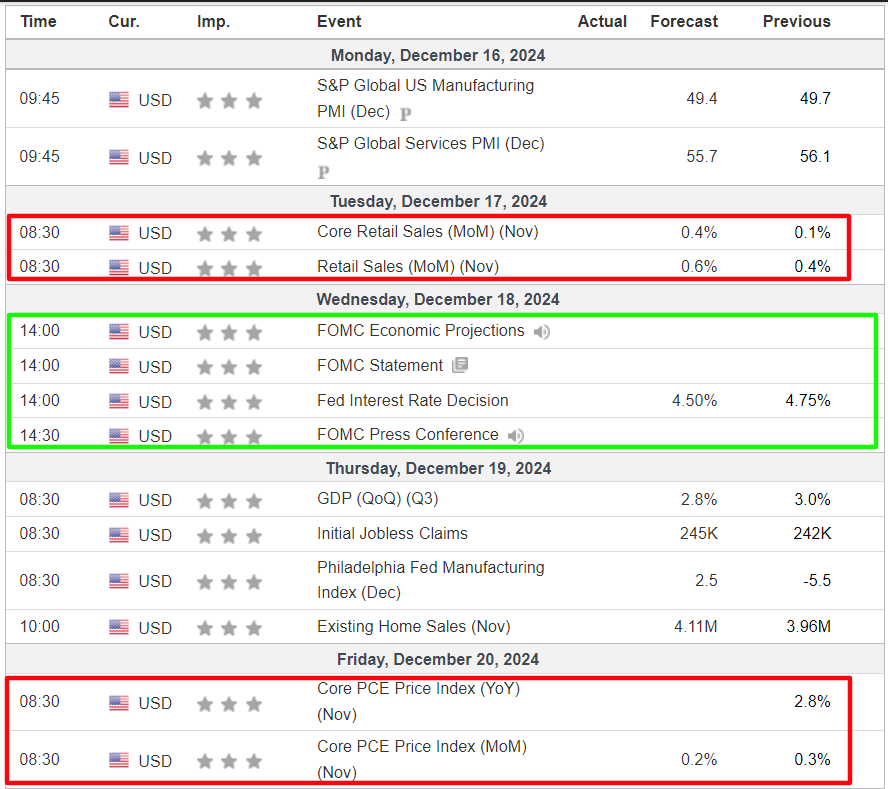

The blockbuster week ahead is expected to be a busy one filled with several market-moving events, including the Fed’s final monetary policy meeting of 2024. An official statement is due at 2:00PM ET on Wednesday. Fed chair Jerome Powell will speak at 2:30PM ET.

With a 25-basis point rate cut assured, investors will focus on the central bank’s guidance on interest rates amid indications Powell could signal a pause in policy easing.

Meanwhile, on the economic calendar, most important will be Tuesday’s U.S. retail sales report, which will shed further light on the health of the economy. The personal consumption expenditures price index reading for November, due Friday, will also be closely watched.

Source: Investing.com

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Nike (NYSE:NKE), FedEx (NYSE:FDX), Micron Technology (NASDAQ:MU), Lennar (NYSE:LEN), General Mills (NYSE:GIS), and Carnival (NYSE:CCL) as Wall Street’s reporting season draws to a close.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, December 16 - Friday, December 20.

Stock to Buy: Micron

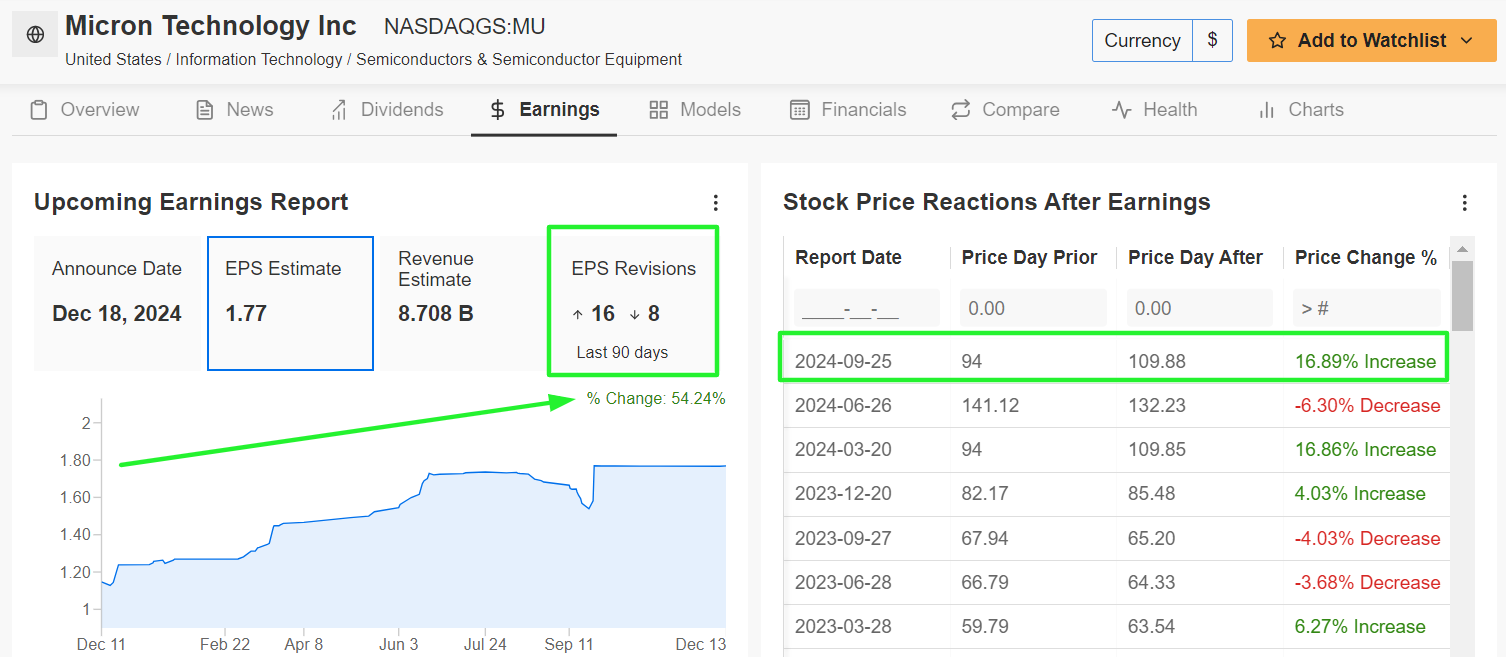

Micron is poised for a solid week as the memory chip maker gears up to report its fiscal first-quarter results on Wednesday at 4:05PM ET. A call with president and chief executive officer Sanjay Mehrotra is set for 5:00PM ET.

Market participants expect a sizable swing in MU stock after the update drops, according to the options market, with a possible implied move of +/-11.7% in either direction. Earnings have been catalysts for outsized swings in shares this year, with MU surging nearly 17% when the company last reported quarterly numbers in September.

Wall Street anticipates strong earnings driven by robust demand for its High-Bandwidth Memory (HBM3E) chips, which are vital for AI and cloud computing applications.

Adding to the bullish sentiment, 16 of the 24 analysts surveyed by InvestingPro have revised their earnings estimates upward over the past three months.

Source: InvestingPro

Micron is seen earning $1.77 a share, reversing a sharp year-ago loss of $0.95 per share, signaling a significant recovery after a challenging period in the memory market. Revenue is forecast to soar 83.9% annually to $8.70 billion, benefiting from sales of high-bandwidth memory devices to data centers running AI applications.

The Boise, Idaho-based company plays a critical role in powering advancements in AI, cloud computing, and 5G connectivity with its innovative DRAM and NAND products.

Looking ahead, I believe Micron’s management will provide solid guidance for the current quarter to reflect robust memory demand from cloud providers as growth prospects in artificial intelligence remain strong. Micron’s groundbreaking HBM3E technology, a key enabler for AI workloads, is expected to be a cornerstone of its growth strategy.

MU stock ended Friday’s session at $102.50. At current levels, Micron has a market valuation of $113.7 billion. Shares, which reached an all-time high of $157.54 on June 18, are up 20.1% in the year-to-date.

Source: Investing.com

It should be noted that Micron stock remains undervalued according to the InvestingPro Fair Value model and could see an increase of 8.5% to $111.22.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and get 55% off and position your portfolio one step ahead of everyone else!

Stock to Sell: Nike

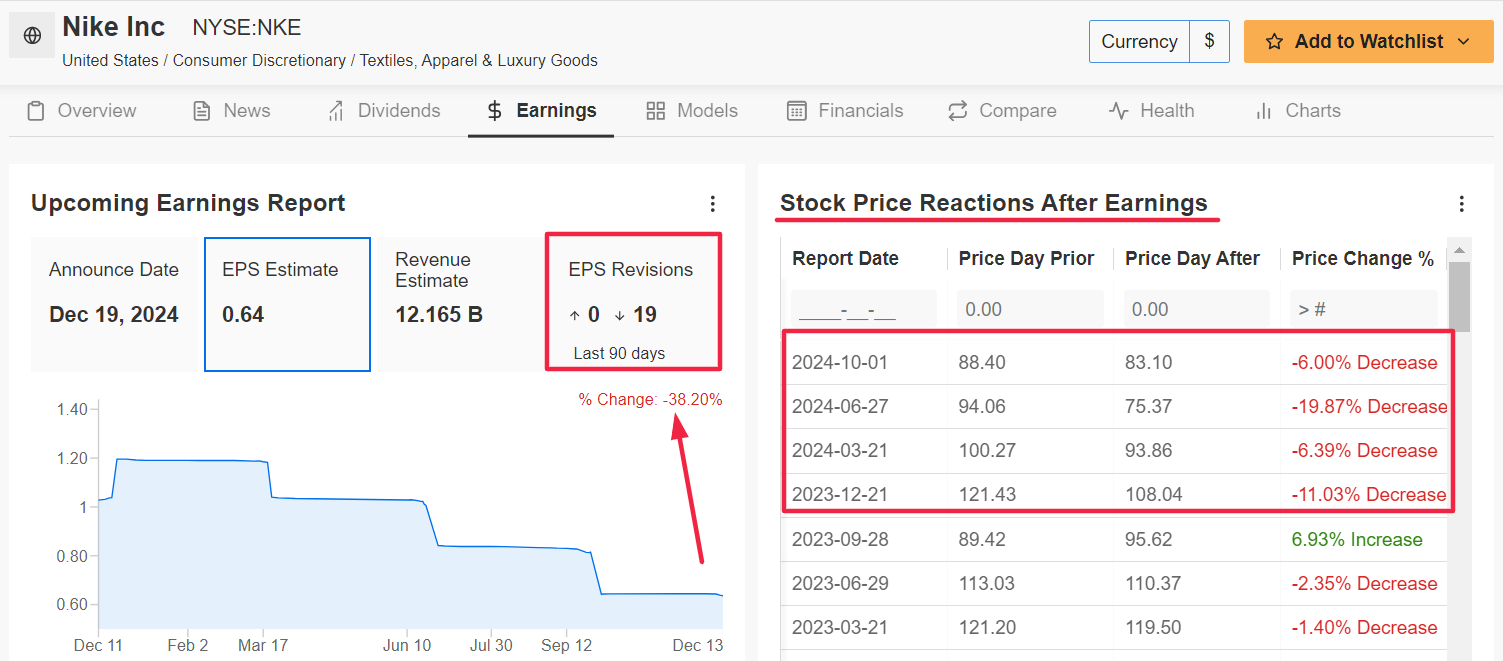

In contrast, Nike, the global athletic apparel giant, faces significant headwinds this week as it prepares to report fiscal second-quarter results on Thursday at 4:15PM ET.

Despite its strong brand recognition, the company is grappling with declining consumer demand for athletic wear and footwear, alongside supply chain challenges.

According to the options market, traders are pricing in a swing of +/-7.7% in either direction for NKE stock following the print. Notably, shares gapped down after earnings in the past four quarters, and continued challenges suggest further downside.

Analysts have slashed their profit estimates amid weakening operating margins and slowing growth in North America and China, two of Nike's largest markets.

Source: InvestingPro

Nike is expected to post a 37.8% drop in adjusted earnings per share to $0.64, with revenue projected to decline by 9.7% from the year-ago period to $12.1 billion.

The sneaker giant has faced mounting challenges in recent quarters, struggling with weakening demand for athletic footwear and apparel amid a softening macroeconomic environment.

The focus will be on newly reappointed CEO Elliott Hill's plans for a turnaround after the company pivoted to a direct-to-consumer model, which has struggled to offset declining wholesale revenues.

NKE stock - which fell to a 2024 low of $70.75 on August 5 - closed at $77.25 on Friday. At its current valuation, the Beaverton, Oregon-based sportswear retailer has a market cap of $115 billion. Shares are down 28.8% in the year-to-date.

Source: Investing.com

It should be noted that Nike has a below average InvestingPro ‘Financial Health’ score of 2.4 out of 5.0 due to ongoing concerns over weakening gross profit margins and spotty sales growth.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get 55% off all Pro plans with our Cyber Week Extended offer and instantly unlock access to several market-beating features, including:

• ProPicks AI: AI-selected stock winners with proven track record.

• InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

• Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

• Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.