InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

- U.S. jobs report, Powell speech, Fed minutes will be in focus this week.

- Tesla is a buy with better-than-feared Q2 deliveries expected.

- Constellation Brands is a sell with underwhelming earnings on deck.

- Looking for more actionable trade ideas? The InvestingPro Summer Sale is live: Subscribe for under $7/month!

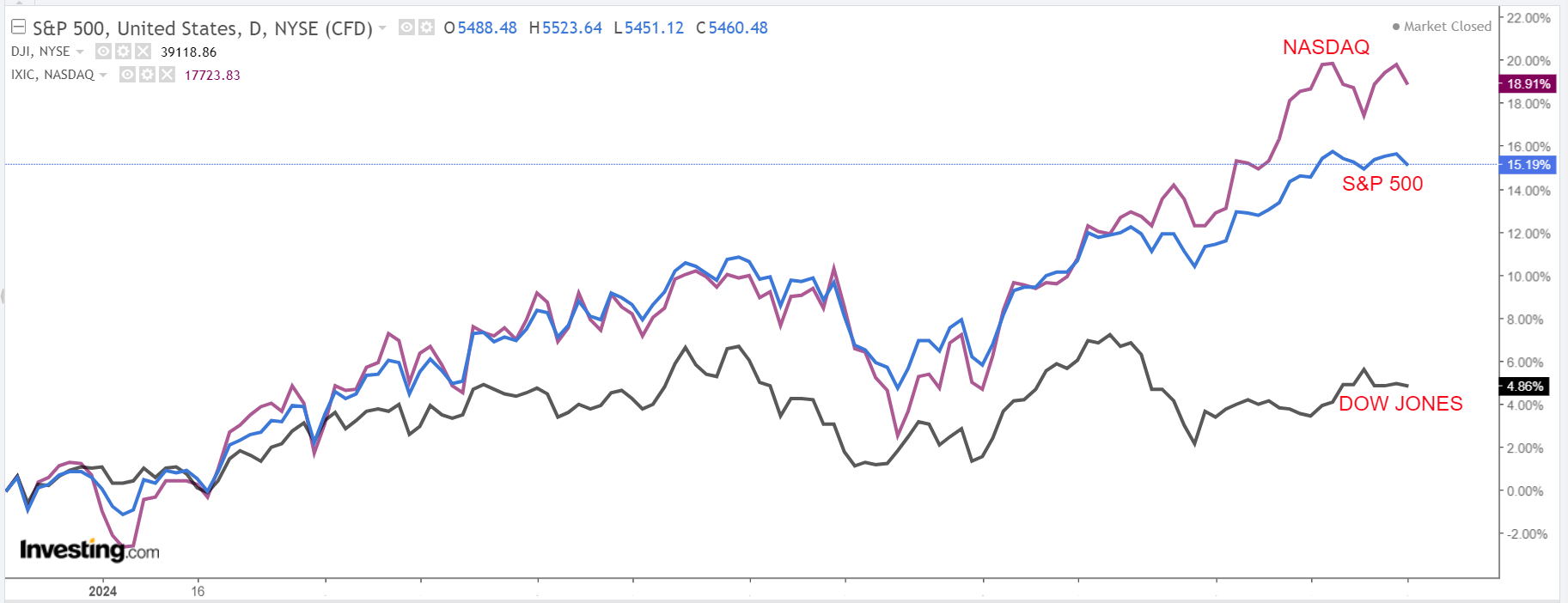

Stocks on Wall Street ended a strong first half of the year on a somewhat downbeat note, with all three major U.S. stock indices closing lower Friday after a higher open.

For the week, the tech-heavy Nasdaq Composite added 0.2%, while the benchmark S&P 500 and the blue-chip Dow Jones Industrial Average declined 0.1%.

Source: Investing.com

All three averages gained ground in June, marking their seventh positive month in eight. The Nasdaq once again led the pack with a month-to-date rally of nearly 6%. The S&P 500 and Dow gained 3.5% and 1.1%, respectively.

Traders also wrapped up a strong first half of 2024. The Nasdaq jumped 18.1% amid the AI-fueled rally. The S&P 500 climbed 14.5%, while the blue-chip Dow lagged with a gain of about 3.8%.

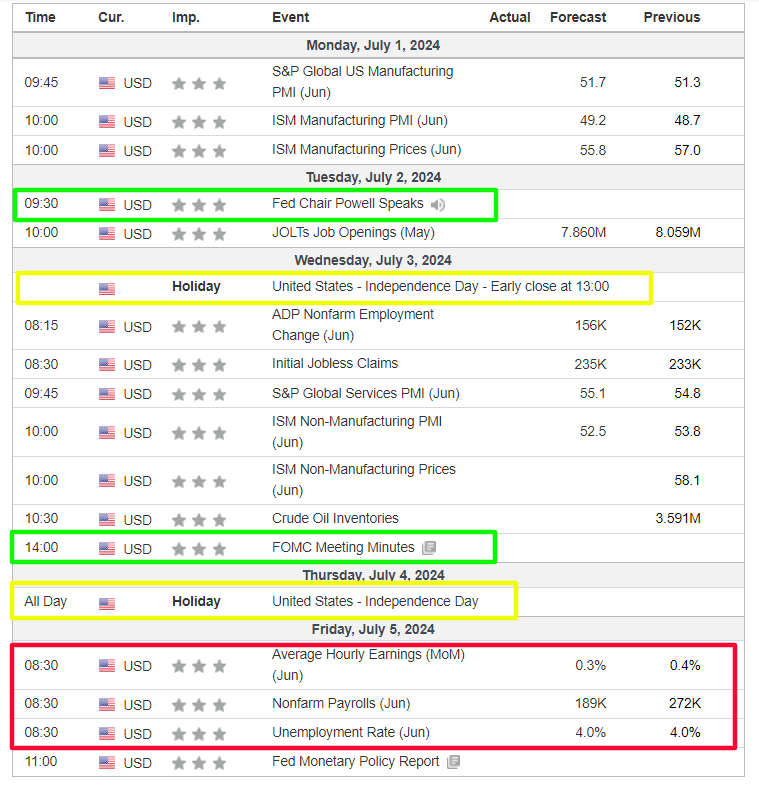

The holiday-shortened week ahead - which will see U.S. stock markets close early at 1:00PM ET on Wednesday and remain shut on Thursday for the Fourth of July Independence Day holiday - will be jam-packed with several market-moving events.

Source: Investing.com

Most important on the economic calendar will be Friday’s U.S. employment report for June, which is forecast to show the economy added 189,000 positions, compared to jobs growth of 272,000 in May. The unemployment rate is seen holding steady at 4.0%.

Also on the agenda will be the minutes of the Federal Reserve’s June FOMC policy meeting, due on Wednesday, while Fed Chair Jerome Powell will participate in a policy panel before the European Central Bank Forum in Sintra, Portugal.

Traders are currently pricing in a 64.1% chance the central bank will lower rates by 25 basis points at its September meeting, according to the Investing.com Fed Monitor Tool.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, July 1 - Friday, July 5.

Stock to Buy: Tesla

Fresh off the heels of one of its biggest weekly gains of 2024, Tesla (NASDAQ:TSLA) shares look set to continue higher in the week ahead as the electric vehicle maker prepares to release important second quarter sales figures.

Tesla will report Q2 deliveries sometime on Tuesday morning and results are expected to get a boost from improving demand in the United States, China, and Europe.

Despite a challenging first half of the year marked by a series of price cuts and softer demand for electric vehicles, there have been indications that a demand turnaround is finally starting to take place as consumers recognize that no more major price discounts are coming.

The Elon Musk-led EV pioneer is expected to have shipped 430,000 vehicles over the three months ending in June, as per consensus estimates. For comparison, Tesla delivered 386,810 vehicles in Q1 and 466,140 vehicles a year ago in Q2.

Tesla produces the Model 3, the Model Y, Model X and Model S, as well as the Semi and Cybertruck. The Model Y crossover accounts for the majority of sales. The Austin, Texas-based company is widely recognized as the global leader in the EV market, holding a dominant market share in the U.S. and China.

Additionally, a significant event is on the horizon with Tesla's high-profile Robotaxi Day scheduled for August 8, which could further influence the company's upward trajectory.

Source: Investing.com

TSLA stock surged 8.2% last week to end Friday’s session at $198 per share. At current levels, Tesla has a market cap of $631 billion, making it the world’s most valuable automaker, bigger than names such as Toyota (NYSE:TM), Volkswagen (ETR:VOWG_p), General Motors (NYSE:GM), and Ford (NYSE:F).

Despite last week’s gains, shares are off by 20% year-to-date and are roughly 52% below their November 2021 all-time high of $414.50.

Source: InvestingPro

It is worth mentioning that Tesla has an above-average ‘Financial Health Score’ of 2.9 out of 5.0, as assessed by InvestingPro's AI-backed models, highlighting its leading market position and long-term growth prospects in energy generation, storage, software, and AI.

Stock to Sell: Constellation Brands

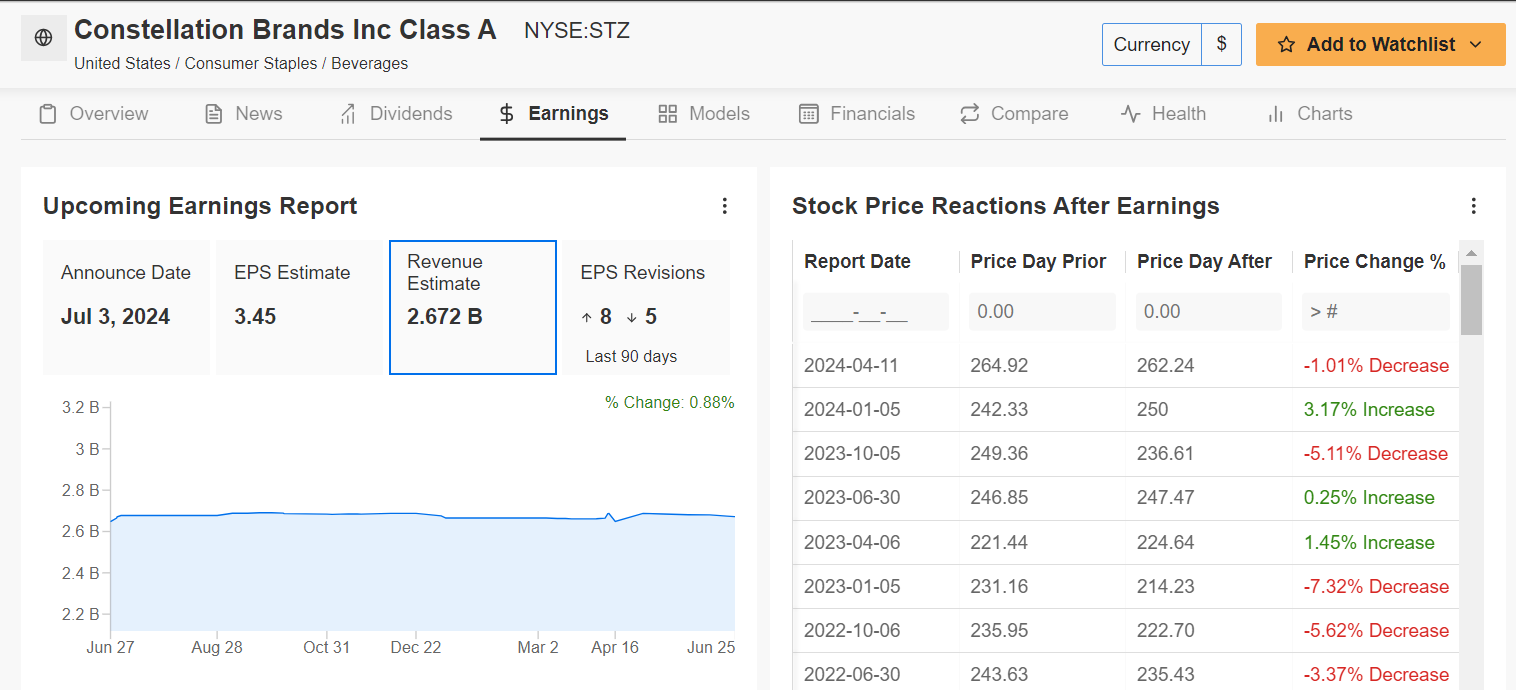

I foresee a disappointing week ahead for Constellation Brands (NYSE:STZ), as the beer, wine, and spirits giant’s earnings and guidance will underwhelm investors due to the challenging macro environment.

Constellation Brands, the owner of Corona and Modelo beer brands, is scheduled to report its fiscal first quarter update before the stock market opens on Wednesday at 7:30AM ET.

Underscoring several near-term headwinds facing the spirits maker, five out of the 13 analysts surveyed by InvestingPro slashed their EPS and sales estimates ahead of the print.

According to the options market, traders are anticipating a swing of around 3.5% in either direction for STZ stock following the release.

Source: InvestingPro

The Rochester, New York-based beverage company, which also makes a number of well-known wine and spirit brands, is seen earning $3.45 per share, increasing 13.5% from EPS of $3.04 in the year-ago period.

Meanwhile, revenue is forecast to inch up 6% year-over-year to $2.67 billion, as strong beer sales outweigh a downbeat performance across its wine and spirits business.

Taking that into account, I believe there is a growing downside risk that the alcoholic beverage company could trim its full-year earnings and sales growth outlook to reflect disappointing wine and spirit sales.

STZ stock closed at $257.28 on Friday, pulling back from its record peak of $274.87 touched on April 11. Shares are up 6.4% year-to-date, underperforming the broader market by a wide margin.

Source: Investing.com

At its current valuation, Constellation Brands has a market cap of $46.9 billion, making it the second largest beverage wineries and distilleries company in the world after Diageo (LON:DGE). Constellation also has sizable investments in medical and recreational cannabis through its association with Canopy Growth (NASDAQ:CGC).

It should be noted that Constellation Brand’s short-term outlook for profitability and free cash flow appears risky, as per InvestingPro, which flag its high revenue valuation multiple as a cause for concern.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Our InvestingPro Summer Sale Is Now Live!

Readers of this article can subscribe to InvestingPro for less than $7 a month as part of our summer sale.

To apply the discount, don't forget to use the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.