Fiserv earnings missed by $0.61, revenue fell short of estimates

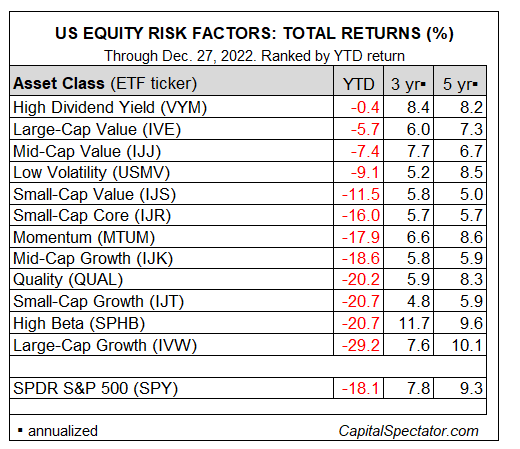

Investing in US stocks by way of risk factors has been a humbling experience this year. Short of a miraculous rally between now and Friday’s close, this realm of financial engineering is on track to dispense black eyes all around, based on a set of proxy ETFs.

The widespread losses aren’t surprising, given the slide in US stocks generally, based on SPDR® S&P 500 (NYSE:SPY), which has tumbled more than 18% year to date through Tuesday’s close (Dec. 27). Broadly defined market beta is usually the strongest wind blowing, for good or ill.

SPY’s loss, although relatively steep, is a middling performance relative to the range of factor results year to date. Notably, large-cap growth (iShares S&P 500 Growth ETF (NYSE:IVW) is posting the deepest setback in 2022, declining more than 29%.

By contrast, the best-performing factor on our list: high-dividend yield (as represented by Vanguard High Dividend Yield Index Fund ETF Shares (NYSE:VYM)), which has shed a mere 40 basis points.

Judging by the gains for the trailing 3- and 5-year windows for all the factor funds, there’s a case for seeing 2022 as a downside outlier. If so, the red ink reflects opportunity for a round of factor rebalancing. Large-cap growth, in particular, has taken a severe beating this year, which implies that its expected return tops the list.

Timing, of course, is uncertain as always. All the more so these days when several macro factors continue to cast a long shadow: the war in Ukraine, ongoing interest-rate hikes by the Federal Reserve, and the rising risk of recession in the US and around the world. In sum, the case for staying defensive will probably resonate well beyond the hangovers of January 1.