China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

- Every move Cathie Wood makes is closely followed by the market.

- In this piece, we'll take a look at what the investor has been up to recently.

- Also, we'll focus on her three biggest bets in the market going ahead.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Famed investor Cathie Wood has built her reputation by aggressively investing in disruptive innovation. She gained widespread recognition in 2020 when her ARK Innovation ETF (NYSE:ARKK) delivered a remarkable 150% return.

After facing headwinds in 2021 and 2022, her fund staged a comeback and delivered a 68% return in 2023, capitalizing on the tech boom. Going ahead, she promises investors an average annual gain of 15% over the next five years.

Cathie Wood's Readjustments to Deliver the Promised Returns

Wood's latest moves emphasize her continued focus on areas like biotechnology, artificial intelligence, and electric vehicles. Notably, she purchased 185,155 shares of Intellia Therapeutics (NASDAQ:NTLA) and 423,487 shares of Recursion Pharmaceuticals (NASDAQ:RXRX), reflecting her growing confidence in these companies.

She also acquired significant stakes in Pacific Biosciences (NASDAQ:PACB), Blade Air Mobility (NASDAQ:BLDE), 10X Genomics (NASDAQ:TXG), Tempus AI (NASDAQ:TEM), and Veracyte (NASDAQ:VCYT).

Conversely, Wood sold 27,886 shares of Incyte Corporation (NASDAQ:INCY), 3,084 shares of AeroVironment (NASDAQ:AVAV), 12,900 shares of Verve Therapeutics (NASDAQ:VERV), and 109,487 shares of Zoom Video Communications (NASDAQ:ZM), continuing her trend of divestments in these firms.

One of her biggest bets remains Tesla (NASDAQ:TSLA). Wood believes that the company's upcoming Robotaxi fleet will drive the next bull run for the stock.

In light of these moves, this article will spotlight three stocks that the investor is betting big on.

1. Tesla

In July, Tesla (NASDAQ:TSLA)'s sales of electric vehicles produced in China rose 15.3% year-over-year to 74,117 vehicles. After this data came out, Elon Musk expressed confidence in further sales growth in China this year.

Cathie Wood recently stated that if she had to recommend only one stock to benefit from artificial intelligence, it would undoubtedly be Tesla. Besides its leadership in electric vehicles, Tesla is also advancing in artificial intelligence and plans to introduce robotaxis.

Tesla stands as the largest holding in Cathie Wood’s Ark Innovation ETF, representing 14% of the fund's assets. The 20% decline in Tesla shares this year has contributed to Ark Innovation's underperformance, marking its third lagging year against the market in the past four.

Wood views the recent decline in Tesla shares as a good buying opportunity for medium-term investors. Tesla's high beta indicates that its stock is significantly more volatile than the S&P 500, leading to more intense price movements.

Fundamentally, Tesla's fair value is estimated at $243.26 by market analysts.

2. Pacific Biosciences

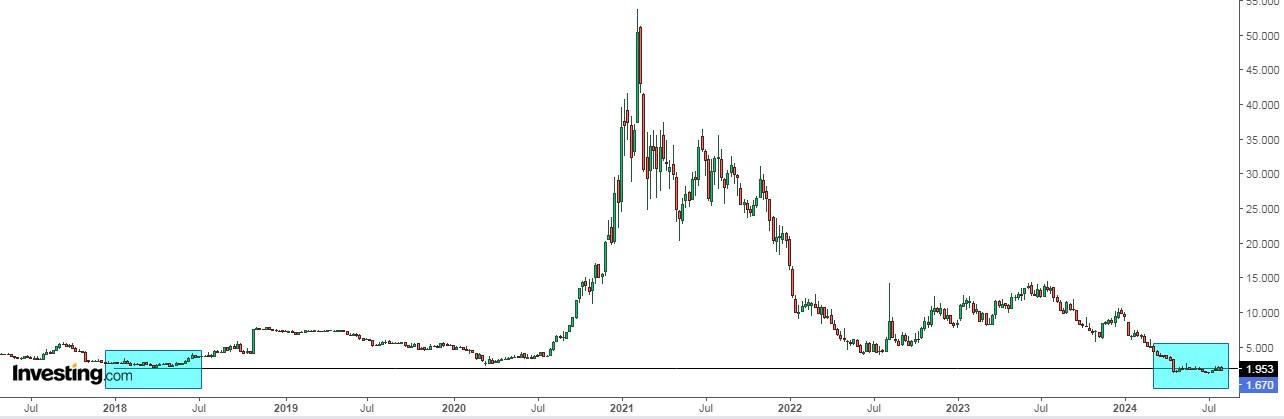

Founded in 2004 and based in California, Pacific Biosciences specializes in DNA sequencing. The company will report its earnings today, with expectations for a 22.5% increase in EPS for the year.

Cathie Wood likened Pacific Biosciences to Amazon's (NASDAQ: NASDAQ:AMZN) early days in 2003, noting that the company is aggressively investing in technology to dominate its sector.

Market consensus values the stock at $4 to $4.25, reflecting its significant growth potential.

3. Crispr Therapeutics

Crispr Therapeutics (NASDAQ:CRSP), a Swiss-American biotech firm founded in 2013 and headquartered in Zug, Switzerland, aims to develop cures for diseases like diabetes.

Currently, the company boasts more cash than debt and has liquid assets exceeding short-term liabilities, offering it financial flexibility.

Crispr Therapeutics has made notable strides in its product portfolio, including the approval of Casgevy.

While this approval represents a significant milestone in genetics, its immediate revenue impact may be modest, with market penetration expected to be gradual.

Cathie Wood views Crispr Therapeutics as potentially more disruptive than major tech companies and sees substantial upside potential for its shares.

The company's fair value is estimated to be 15% above its current share price, with the market potential estimated at $86.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.